State Pension Reform: Is There a Better Way?

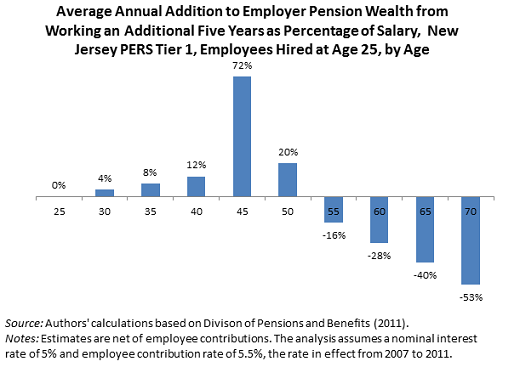

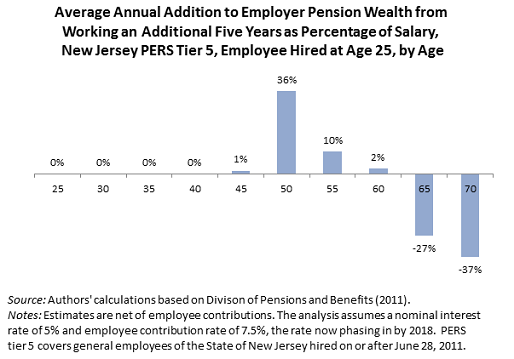

Posted: July 26, 2012 Filed under: Aging, Income and Wealth, Race, Ethnicity, and Gender, Shorts 1 Comment »Are the benefits of state pension plans allocated efficiently and fairly, and do they attract the best workers for the amount of money spent? Consider the graphs below for the state of New Jersey, which are somewhat typical of state pension plans in many other states. They show the annual pension wealth increments provided by the state for working for the state for five additional year for typical tier-1 (pre-reform) and tier 5 (post-reform) employees hired at age 25. Younger workers used to get very little, now they get nothing. Middle age workers get locked into the employment, regardless of how well it fits their skills or the needs of the state at that point. And older workers get very negative benefits, though at later ages than in the pre-reform era. For further details, see a paper (and two briefs) I published with Richard W. Johnson and Caleb Quakenbush, entitled “Are Pension Reforms Helping States Attract and Retain the Best Workers?”

It is very interesting to see this analysis in a bar chart form, but the basic concept is also well understood in the civil service.

Case 1. My father was a civilian employee of the Navy who retired with 40 years service (including credit for 4 years in uniform during WWII). I remember that in the last few years before he retired, he used to talk about how he was “working for 2%”, meaning the 2% increment in his pension for one more year of service.

Case 2. After I graduated from law school, I worked for the federal government for four years. I remember one of my supervisors (age about 45 or 50 with 20+/- years of service) saying he was “trapped” by the pension plan and couldn’t afford to leave until he had the right to an immediate annuity.

Case 3. When I left federal service at 27 after my four years, I elected to cash in my pension credits even though all I got back my own 7% annual contributions without interest and without any federal contribution. Even so, that lump sum was much more valuable than the prospect of a tiny annuity after 38 more years.