The California Secure Choice Retirement Savings Program: Why pension reform turns inefficiently to the states

Posted: December 5, 2016 Filed under: Economic Growth and Productivity, Taxes and Budget 2 Comments »This post originally appeared on TaxVox.

By: C. Eugene Steuerle and Pamela Perun

Starting as soon as it can be made operational, perhaps in 2018, as many as 7 million private-sector California workers who currently have no access to a job-based retirement plan will be automatically enrolled in a state-managed savings program. The California Secure Choice Retirement Savings program will start with employee contributions of 3 percent of earnings, though the state board managing the initiative could increase the contribution rate to as much as 8 percent. While workers will be auto-enrolled, they can opt out of the plan.

The new law is an important step toward securing better retirement coverage for those who require it most. Too many people reach old age with far too little saving to meet their long-term needs.

While an interesting idea ,the plan, however, faces limits that would be better served through federal reform. For instance, companies that operate across state borders don’t want to be bogged down with 50 different sets of state regulations. In addition, federal law currently grants employee deposits fewer tax breaks than are enjoyed by employer contributions. Only federal law changes can deal with those challenges.

However, changes to federal law that reduce tax revenues may be blocked by the constraints of the federal budget process.

Here’s the rub. At the federal level, any pension reform that might succeed in securing significantly more retirement saving will be scored as losing revenue to the federal government. Big revenues. And no major tax reform or tax cut in recent years, as well as President-elect Donald Trump’s campaign tax plan, has made pension reform a priority.

Suppose, for instance, that a national reform increases net contributions to traditional retirement plans by $80 billion, or one percent of the $8 trillion of wages and salaries that workers earned in 2016. If those savers reduce their tax on new deposits by 15 percent, revenues would decline by $12 billion in the first year and by more than $100 billion over a decade, even after accounting for taxable withdrawals.

Even if we see big new tax cuts in a Donald Trump presidency, that’s a lot of money. However, state legislators do not face the same budget process constraints as federal lawmakers. They are indifferent to the effects of state law on federal revenues, and the impact of a big tax-advantaged savings plan on state revenues are relatively modest given lower state income tax rates. Hence, for now, all incentives point toward the states acting independently, inconsistently, and inefficiently in tackling our nation’s larger retirement security problems.

There are alternatives. We have proposed an alternative strategy through a federal plan that would greatly simplify current law while broadly encouraging both employer and employee contributions.

Of course, it makes some sense to let states operate as laboratories of democracy. However, the more successful this California effort and similar ones being considered in Illinois, Oregon, and Connecticut, the greater the need for the type of coordination that only the federal government can provide. Until we get our federal budget into some sort of order, however, federal reform likely will continue to be stifled. Catch 22, once again.

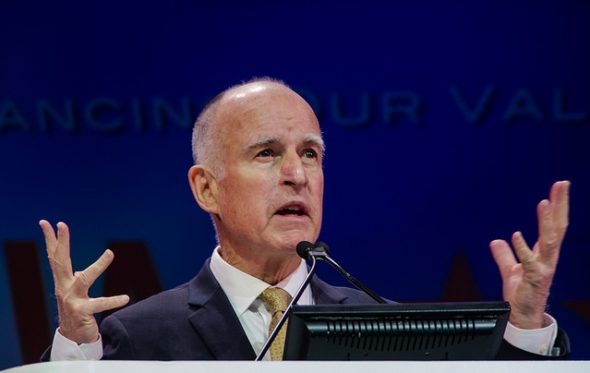

Photo courtesy of Randy Bayne/via Flickr Creative Commons.

I would rather see laboratories of socialism and worker democracy to yet more trust fund socialism where management gets a freer hand in operating the business without shareholder constraint. Outside savings is the enemy, save for an investment insurance fund that pays off if the employer is mismanaged into bankruptcy. Trust fund capitalism is so 20th century – its time to be done with it.

Mr. Bindner, your comment is incomprehensible.