2013 Update on Lifetime Social Security and Medicare Benefits and Taxes

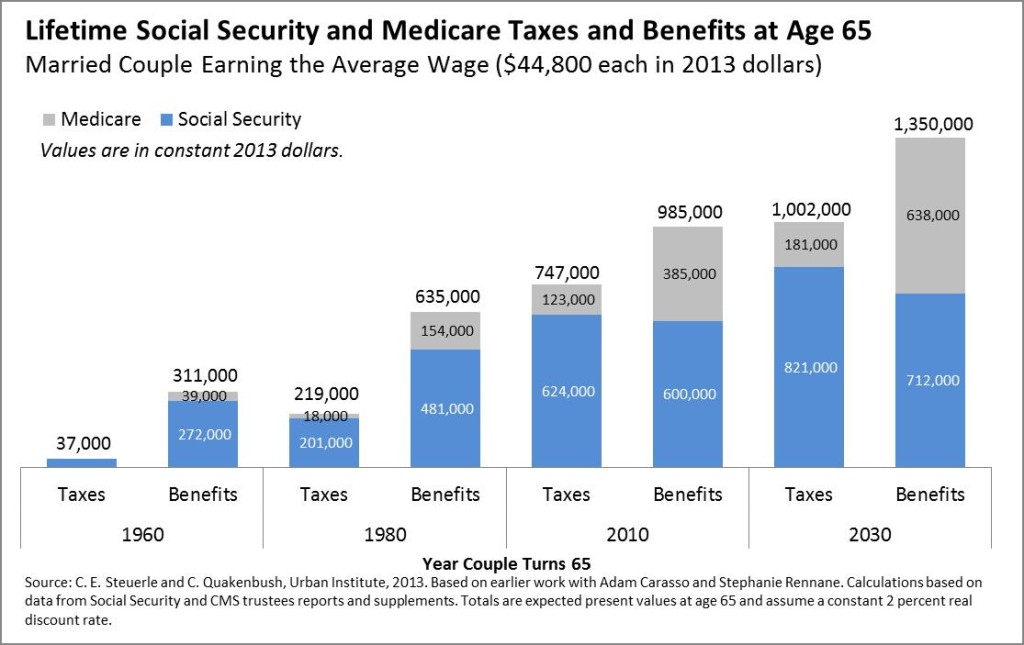

Posted: November 12, 2013 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts, Taxes and Budget 3 Comments »Our updated numbers for lifetime Social Security and Medicare benefits and taxes are now available, based on the latest projections from the Social Security and CMS actuaries for the 2013 trustees’ reports for OASDI and Medicare. Couples retiring today, with roughly the average earnings of workers in general, as well as average life expectancies, still receive about $1 million in lifetime benefits. This number is scheduled to increase significantly for future retirees and is higher for those with above-average incomes and longer life expectancies.

Little has changed on the Social Security side from our previous estimates, as the program has undergone no significant reform in recent years. Our estimates of present values of Medicare benefits for future retirees have decreased slightly from last year as slower health care cost growth has made its way into projections. By 2030, Medicare benefits (net of any premiums paid) are about 90 percent of last year’s estimates, still a significant multiple of Medicare taxes paid. (As in 2012, our numbers incorporate a Medicare cost scenario that assumes the “doc fix” and other adjustments will be extended, not the “current law” scenario in the trustees report.)

We have been publishing these numbers for a long time—and not without controversy over our intent. Our hope is simply that better and more complete information will help elected officials decide whether Social Security and Medicare are distributing taxes and benefits in the fairest and most efficient way possible, a decision we do not believe possible by looking only at annual numbers or how current, not future, retirees and taxpayers might fare. Therefore, we are delighted that in its most recent Long-Term Budget Outlook, the Congressional Budget Office for the first time also published estimates for lifetime Medicare benefits and taxes, as well as Medicare and Social Security combined. Using a slightly different methodology, CBO produces very complementary results. Differences derive from it using median-wage (rather than average-wage) workers, a 3 percent (rather than a 2 percent) real discount rate, and an assumption of Social Security claiming at 62 (rather than 65). As CBO also notes, expected benefits (and taxes, to a more limited extent) have grown over time for a number of reasons, including longer life expectancies, higher incomes, and rising health spending per person.

How Much Should the Young Pay for Yesterday’s Underfunded Pension Plans?

Posted: August 22, 2013 Filed under: Aging, Columns, Income and Wealth, Taxes and Budget 2 Comments »Recent stories about Chicago’s pension crisis represent only the latest in a long series of announcements about poorly funded state and local pension plans. Detroit’s declaration of bankruptcy shows one possible consequence of such neglect, with many of the city’s retirees fearing drastically reduced pension payments. This isn’t the first time that retirees and workers have found their financial stability threatened, either: many private pension plans have failed in such industries as steel production and airlines.

While there’s often no easy or right answer for who should pay for these uncovered burdens, as a society we’ve pretty much decided that in this arena, as in so many others, the young should get the shaft.

Often poorly funded or badly designed to deal with risk, many pension plans need only some catalytic economic change, whether from greater competition or an economic downturn, to start sinking rapidly. A promise for the future, underfunded from the past, shifts liabilities forward in time, where they get passed around like a hot potato. No one—employer, worker, or taxpayer—wants to get burned with the cost of past mistakes, or even part of it. But the money that should have been set aside has long been spent, so someone at some time must cover the shortfall.

Consider why government or private employers underfund a plan in the first place. In a private plan, underfunding allows higher wages to current workers, bonuses to top managers, and cash withdrawals to partners and dividend recipients. In a public plan, elected officials can give higher current compensation to workers or more services to the population while letting taxpayers off the hook–temporarily, of course.

When people see this inadequately supported edifice begin to crumble, they make a run on the bank. Given the increased threats to future wages, job security, and dividend payments, everyone has an incentive to get what they can while the getting is good. Keep wages up as long as possible, even if that means further weakening pension plans. Increase those bonuses to top managers, who suggest their skills are needed now more than ever to dampen the firm’s or agency’s fall. Lobby Congress and state legislators to allow employers to defer better funding of their pension plans so these other cash outflows can continue. And maintain pension payments for current and near-retirees regardless of the hit on those not yet retired.

Traditional actuarial calculations—the formulas by which actuaries determine whether employers adequately fund their plans—make matters worse. These formulas often allow employers to play Wall Street with their pensions. A firm or government borrows at low interest rates on one side of the ledger, then invests in riskier assets with higher expected returns on the other side. Even dodging the question of when such practices generally make sense, employers often push their actuaries to use outrageous assumptions about rates of return on those risky assets.

For instance, many state and local governments today assume a return of around 8 percent on a mixed portfolio of bonds and stocks in a world where interest-bearing bonds often yield only 3 or 4 percent at best and the earnings-to-price ratio (the effective rate of return earned by corporations relative to the price of their stock) is about 6 percent in real terms. If these employers want to play the markets with their pension plans, then the plans should be overfunded enough to handle the risk. Alternatively, governments and firms should make their projections assuming a less risky but lower rate of return. If the risk-taking strategy works, then future (not current) funding payments can be lowered.

When the firm or government declares bankruptcy, many bondholders, pensioners, and remaining workers deserve sympathy. Certainly the retiree who might have to rely on less than expected, the bondholder who accepted a lower rate of return in exchange for what she thought was a less risky investment, and the taxpayer who often gets caught covering everyone else’s problems. Sometimes these are the same people who benefited from the excessive payments (made possible, first, when inadequate funds were put into the pension plan, and then, during the delay between recognizing the problem and taking some later action such as bankruptcy). But often they are not.

While these claimants may battle each other, they almost always collude against the young. The use of unreasonable actuarial assumptions establishes this pattern by forcing future workers and taxpayers to cover shortfalls. In addition to covering some of those losses, new workers for the state or the firm, if it survives, will be granted far fewer pension or retirement plan benefits than even current workers, not merely those already retired.

Unequal pay for equal work becomes the new standard. Age discrimination against the old is illegal, but not the young. State pension plans now typically provide tiered benefits, with successively lower benefits for newer workers. In fact, states are now starting to provide negative employer benefits to the young by giving them back less in benefits than their contributions plus some modest rate of return.

The same holds in different ways in private industry. We are all familiar with the higher cash and pension benefits being paid to older airline pilots and automobile workers, among others. Almost no one addresses the consequences for wealth-building, including retirement adequacy, for today’s young. That’s tomorrow’s problem.

Or is it? Seems like we’ve heard that claim before.

Reforming Social Security Benefits

Posted: May 23, 2013 Filed under: Aging, Columns, Income and Wealth 18 Comments »Excerpt from “Reforming Social Security Benefits,” Testimony Before the House Ways and Means Subcommittee on Social Security.

In this testimony, I would like to focus on the need for Social Security benefit reform regardless of the current imbalances in the system or the taxes raised to support the system.

Why? Despite Social Security’s great success, its growth in lifetime benefits over time has been decreasingly targeted at its major goals. Even while programs for children and working families are being cut, combined lifetime benefits for couples turning 65 rise by an average of about $20,000 every year, so that couples in their mid-40s today are scheduled to get about $1.4 million in lifetime benefits, of which $700,000 is in Social Security.

Social Security has morphed into a middle-age retirement system. Typical couples are receiving close to three decades of benefits. Smaller and smaller shares of Social Security benefits are being devoted to people in their last years of life.

If people were to retire for the same number of years as they did when benefits were first paid in 1940, a person would on average retire at age 76 today rather than 64. Soon close to a third of adults will be on Social Security, retiring on average for a third of their adult lives.

While Social Security did a good job reducing poverty in its early years, it has made only modest progress recently, despite spending hundreds of billions of dollars more. The program discourages work among older Americans at the very time they have become a highly underused source of human capital in the economy.

The failure to provide equal justice permeates the system. It discriminates against single heads of household, spouses with relatively equal earnings, those who bear their children before age 40, long-term workers, and many others. At the same time, private retirement policy leaves most elderly households quite vulnerable.

Unfortunately, the Social Security debate has largely proceeded on the basis of being “for the box” or “against the box.” The contents themselves deserve scrutiny.

How might one break through the stalemate and find areas of mutual agreement? While I applaud the efforts of the Simpson/Bowles Commission and the Bipartisan Policy Commission I believe we can go much further to address the problems I just raised. How? We should start with a basic set of principles and see where they lead us.

Consider. Inevitably balance will be paid for mainly through benefit cuts or tax increases on higher income individuals who have most of the resources. That debate need not derail other needed reforms. I suggest proceeding in the following order:

First, consider reforms aimed at meeting Social Security’s primary purposes:

- providing greater protections for those truly old or with limited resources;

- supporting the work and saving base that undergird the system; and

- providing more equal justice for those suffering needless discrimination in the system, like single heads of household and longer-term workers.

Some of those fixes cost money, and some raise money; we don’t have to address trust fund and distributional consequences in each and every change.

Second, further adjust minimum benefits and the rate schedule and indexing of that schedule over time to achieve final cost and distributional goals. The extent of these adjustments will also depend upon the tax rate and base structure agreed upon.

My testimony provides a fairly detailed way to engage this type of reform process. It largely follows the logic I applied to taxation when serving as the economic coordinator of the Treasury effort that led to the bipartisan-supported Tax Reform Act of 1986, and in my testimony before the Simpson/Bowles Commission.

On Dementia, Cost-of-Living Adjustments, and the Right Way to Reform Programs for the Elderly

Posted: April 16, 2013 Filed under: Aging, Columns, Economic Growth and Productivity, Health and Health Policy, Income and Wealth, Taxes and Budget 4 Comments »While the increase in dementia among the elderly and the president’s proposal to change the index used to provide cost-of-living adjustments (or COLAs) to Social Security recipients have both received prominent headlines recently, the discussions have largely been independent of one another. Yet any principled attempt to reform our elderly programs, including Social Security, Medicare, and Medicaid long-term care, should consider them together.

A well-designed reform of elderly programs could and should accommodate some of the cost problems associated with dementia by back-loading a larger share of benefits in Social Security to older ages when these and other needs of old age increase. COLA adjustments, whatever their other merits, front-load the system by cutting back on benefits for the oldest the most and those in late middle age or their 60s hardly at all. That the president and Congress have limited ability to engage in these types of discussions and tackle multiple goals at the same time is yet one more example of how our political processes increasingly block us from fixing what ails us.

In a well-cited RAND study, Michael Hurd and his coauthors estimate that dementia-related care purchased in the marketplace will cost somewhere close to $0.25 trillion in 2040 (in 2010 dollars). That sounds like and is a lot of money, but Social Security and Medicare are expected to rise to cost over $3.5 trillion in that same year. Although I am greatly simplifying by ignoring such factors as how much of the $0.25 trillion would be covered by individuals and not the government or the effect of entitlement reform on costs, the raw comparison speaks for itself.

Simply put, some of the private and public budget problems associated with dementia, Alzheimer’s, and other growing problems for the older among the elderly could be addressed by providing higher cash benefits in older ages. Whatever the aggregate size of Social Security in general, one could pay for this reform by cutting back on benefits in younger ages of Social Security “old age insurance” receipt. This would not solve all the associated problems of dementia, but it would be a simple, effective, easy-to-administer step in the right direction. And, by concentrating benefits more in older ages, it would encourage working longer at a time when employment rates for the population as a whole are scheduled to decline.

But this is not the discussion we’re having. Instead, the president and many budget reformers put forward a proposal to adapt what many believe is a better measure of cost-of-living or price changes and apply it to almost all government programs, including Social Security. As a technical matter, a COLA adjustment doesn’t affect the growth in initial Social Security benefits for those who retire, only the inflation adjustment they get after they retire. At that point, they get a small annual cut—e.g. 3/10 of 1% the first year, 6/10 of 1% the second year, and so forth—that compounds every year in retirement, so that by the time beneficiaries are in their late 80s or 90s, some 25 or 30 years of lower COLAs add up to a cut in benefits of as much as 10 percent.

Social Security has never adjusted upward the earliest retirement age for increases in life expectancy. Instead, it reduced the earliest age from 65 to 62 in 1959 and 1962. As a consequence, the share of benefits going to those with 15 or more remaining years of expected receipt has risen dramatically over time, and the share to those with, say, less than 10 years of remaining life expectancy has declined. The COLA proposal, even with some very old age adjustments suggested by the president, would add to this long-term trend of making the program ever less available in relative terms for those in truly old age.

This is not to say that the COLA proposal should not be adopted. Who can oppose trying to measure something better? But attempts to fix systems like Social Security and other elderly programs one parameter or adjustment at a time cannot easily meet multiple worthwhile objectives. Similarly, efforts to back-load the system to meet the needs of true old age, as suggested here, should be coordinated with further adjustments—say, in minimum benefits—to avoid discriminating against those with shorter life expectancies.

With or without a better COLA, therefore, reform of Social Security and other elderly programs requires a more comprehensive approach if we are to meet the needs of old age as they evolve over time. Shouldn’t dementia be a higher priority than early retirement? If we’re going to spend $3 trillion or more annually on Social Security and Medicare by 2040, do we really think that the allocation of those funds be determined by formulas set in years like 1935 or 1965 or 1977, when much of the current system was cobbled together?

Getting the Facts Straight on Retirement Age

Posted: March 12, 2013 Filed under: Aging, Columns, Economic Growth and Productivity, Income and Wealth, Race, Ethnicity, and Gender 16 Comments »On the front page of the Washington Post on March 11, 2013, Michael Fletcher connects the different life expectancies of the poor and rich to the debate over whether Social Security should provide more years of retirement support as people live longer. He mistakenly leaves the impression that adjusting the retirement age for increases in life expectancy hurts the poor the most. In fact, such adjustments take more away from the rich. Let me explain how.

Suppose I designed a government redistribution policy that increases lifetime Social Security benefits by $200,000 for every couple with above-average income that lives to age 62. For every couple with below-average income that reaches age 62, my program would increase benefits by $100,000.

Does this sound like a good policy? Well, that’s exactly what Social Security has done by providing all of us with increasing years of retirement support. People retiring today get many, many more years of Social Security benefits than those retiring when the system was first created. And, the primary beneficiaries are the richer, not the poorer, among us. Throwing money off the roofs of tall buildings would be a more progressive policy, since the poor would likely end up with a more equal share.

Why, then, do some Social Security advocates oppose increasing the retirement age? Because the $100,000 in my example could mean proportionately more money for the poor. For instance, it might add one-tenth to their lifetime earnings (of, say, $25,000 a year for 40 years of work, or $1 million over a lifetime), while the $200,000 to rich individuals might add only one-fifteenth to their lifetime earnings. As it turns out, even this assumption isn’t correct, but let’s assume for the moment it is.

Why would we want to redistribute that way? Following that logic, we should have protected the jobs of all the Wall Street bankers after the recent crash because their wages represented a smaller share of their income than the wages of poorer workers providing support services. Or perhaps we should provide $5,000 of food stamps to those making more than $50,000 and $3,000 of food stamps to those making $20,000; after all, the latter would still get proportionately more.

As it turns out, however, more years of retirement benefits don’t benefit the poor proportionately more than the rich. Yes, the poor have lower life expectancies, but other elements of Social Security offset this factor. A greater share of the poor doesn’t make it to age 62, so a smaller share of them benefit from expansions in years of retirement support. More importantly, those who are poorer are more likely to receive disability payments that aren’t affected one way or the other by the retirement age; hence, again, a significantly smaller share of them benefit from more retirement years. Other regressive elements such as spousal and survivor benefits also come into play for reasons I won’t further explain here. Empirically, these various factors add up in such a way that increases in years of benefits help those who are richer and those who are poorer in ways roughly proportionate to their lifetime incomes.

Setting these disputes aside, the higher mortality rate of the poor at each age does raise many legitimate policy issues. Recipients who stopped smoking a couple of decades ago, for instance, have been rewarded with more and more years of retirement benefits. This, along with many other features of Social Security, such as the design of spousal benefits already noted, does mean that the system is a lot less progressive than most believe.

The more fundamental issue, then, is whether we should better protect those with low-to-average wages during their lives. I believe we should but through better-targeted mechanisms, such as minimum benefits, progressive adjustments to the benefit formula, wage supplements to low-wage workers, and other devices that don’t spend most of the program’s funds on ever more years of retirement for those who are richer.

Yet another reason to worry about the retirement age is that the failure to adjust over time—a couple retiring today at 62 can now expect about 27 years of benefits—has meant larger shares of payments go to those closer to middle age, in terms of remaining life expectancy. Almost every year, a smaller share of payments goes to those who are truly old and more likely to need assistance.

In sum, the recent widening gap in life expectancy, likely due to such factors as differential rates of cigarette smoking, deserves serious attention. But let’s not pretend that throwing money off the roof, or providing more years of retirement support to the non-disabled who make it to age 62, addresses the core issue. There are better ways to compensate than converting a system originally designed to protect the old into one offering middle-age retirement to everyone.

What the Public Doesn’t Understand About Social Security and Medicare

Posted: January 30, 2013 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts, Taxes and Budget 6 Comments »An earlier short highlighted my research with Caleb Quakenbush into how much people pay in Social Security and Medicare taxes over a lifetime, and how much they receive in benefits. For instance, we found that a two-earner couple making an average wage who turned 65 in 2010 would have paid $722,000 in Social Security and Medicare taxes over their lifetimes, but would receive $966,000 in benefits.

These types of numbers often generate outraged debate over how much seniors are “owed” based on what they “paid in” to Social Security and Medicare.

But there is another, more philosophical, issue that these numbers cannot address. Americans do not pay their taxes into a personal account that they can take out, plus interest, when they retire. The money paid into Social Security and Medicare has always been chiefly paid out immediately to older generations. The only exception has been some trust funds which have always been modest in size and are shrinking. Thus, Social Security is effectively a transfer system from young to old, and always has been.

We may feel that because we transferred money to our parents, our kids, in turn, owe us. But we must take into account also how much they can or should afford for this task as opposed to their own current needs for themselves and their children. Think of a one-family society, where three kids support their parents, but then those three kids have no children of their own (or only one or two children). What those three kids gave their parents informs us only slightly on what they can or should get from their own children if there are none or fewer of them. Likewise, when demographics change and there are fewer workers to support an aging population, society has to make adjustments, regardless of what some may otherwise think is “fair” or what they think is their entitlement.

For articles inspired by this research, see a recent PolitiFact.

Retired Couples Receiving More Years of Support under Social Security

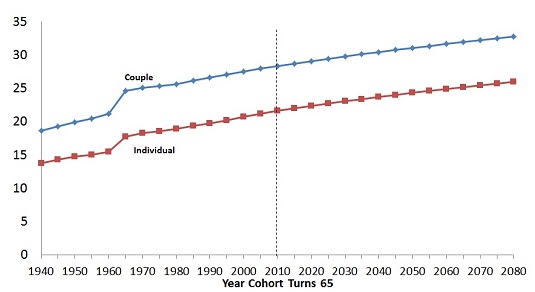

Posted: January 18, 2013 Filed under: Aging, Income and Wealth, Shorts, Taxes and Budget 3 Comments »Increased time spent in retirement is a driving factor behind rising Social Security and Medicare costs. A couple that stopped working at the earliest Social Security retirement age in 1940 would expect to receive 19 years of retirement benefits; a similar couple in 2010 would expect 28 years of benefits. By 2080, couples could be receiving retirement support for 33 years.

This calculation assumes both partners are the same age and will have average life spans. Partners of different ages and those (often higher-income) couples who expect to live longer, such as nonsmokers, receive even more years of support.

As it turns out, these many years in retirement affect more than Social Security balances. Retiring longer also reduces the share of Social Security benefits spent on recipients in their last (e.g., ten) years of life and the income tax revenues to support other government functions.

Expected Years of Retirement Benefits, Earliest Year of Retirement

C. E. Steuerle and S. Rennane, Urban Institute 2010. Calculations based on mortality data from the 2010 OASDI Trustees’ Report.

Assumption: in a couple, at least one partner is still living. ERA was set at 62 for women in 1956 and men in 1961.

For more on this topic, see Correcting Labor Supply Projections for Older Workers Could Help Social Security and Economic Reform.

Social Security & Medicare Lifetime Benefits

Posted: November 5, 2012 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts 6 Comments »How much will you pay in Social Security and Medicare taxes over your lifetime? And how much can you expect to get back in benefits? It depends on whether you’re married, when you retire, and how much you’ve earned over a lifetime.

I recently published with Caleb Quakenbush “Social Security and Medicare Taxes and Benefits Over a Lifetime: 2012 Update” which updates previous estimates of the lifetime value of Social Security and Medicare benefits and taxes for typical workers in different generations at various earning levels based on new estimates of the Social Security Actuary. The “lifetime value of taxes” is based upon the value of accumulated taxes, as if those taxes were put into an account that earned a 2 percent real rate of return (that is, 2 percent plus inflation). The “lifetime value of benefits” represents the amount needed in an account (also earning a 2 percent real interest rate) to pay for those benefits. Values assume a 2 percent real discount rate and all amounts are presented in constant 2012 dollars.

While no major changes in Social Security or Medicare law have occurred since the last update, these estimates reflect alternative assumptions provided by the Center for Medicare and Medicaid Services (CMS) actuaries that lawmakers will cancel a draconian scheduled cut in Medicare payment rates to physicians and other scheduled spending reductions. The result is significantly higher projected lifetime Medicare benefits than current law assumptions would indicate.

Below is a sample table from the brief, for a two-earner couple both earning Social Security’s average wage measure. This set of calculations assumes that workers retire at age 65.

| Two-Earner Couple: Average Wage ($44,600 each in 2012 dollars) | |||||||

| Year cohort turns 65 | Annual Social Security benefits | Lifetime Social Security benefits | Lifetime Medicare benefits | Total lifetime benefits | Lifetime Social Security taxes | Lifetime Medicare taxes | Total lifetime taxes |

| 1960 | 19,000 | 264,000 | 41,000 | 305,000 | 36,000 | 0 | 36,000 |

| 1980 | 30,800 | 461,000 | 151,000 | 612,000 | 196,000 | 17,000 | 213,000 |

| 2010 | 35,800 | 579,000 | 387,000 | 966,000 | 600,000 | 122,000 | 722,000 |

| 2020 | 37,800 | 632,000 | 427,000 | 1,059,000 | 700,000 | 153,000 | 853,000 |

| 2030 | 41,200 | 703,000 | 664,000 | 1,367,000 | 808,000 | 180,000 | 988,000 |

More background information on these calculations can be found at: http://www.urban.org/socialsecurity/lifetimebenefits.cfm.