Piketty, Poverty, Political Pooh

Posted: July 14, 2014 Filed under: Columns, Income and Wealth, Taxes and Budget 1 Comment »The 50th anniversary of President Johnson’s War on Poverty has led to a flurry of articles and debates about whether that war succeeded. That debate has been reenergized by Thomas Piketty’s best-selling book, Capital in the Twenty First Century, which argues that inequality is rising because returns to capital have risen relative to average economic growth. A solution to this inexorable force, Piketty claims, lies in some form of worldwide wealth tax.

In both cases, I find the political debate largely unproductive. Many conservatives and liberals pick at pieces of data and history to support their own forgone conclusions. Rather than seek practical margins for making progress, much of the discussion turns to thumbs up/thumbs down rhetoric or totally impractical solutions.

Here’s how the data play out. Since the late 1970s, market-based measures of poverty and the distribution of income (that is, measures of income before taking account of government redistribution through taxes and transfers) improved very little in the first case and got worse in the second. Both did much better a few decades earlier, including up to the mid-1970s. PIketty bases his broad historical conclusions about growing inequality largely on market measures. In turn, researchers ranging from Gary Burtless at Brookings to Tim Smeeding at Wisconsin to Richard Burkhauser at Cornell to Diana Furchgott-Roth and Scott Winship at the Manhattan Institute have shown greater reductions in poverty and less growth in inequality of income or consumption when market-based income is adjusted for government taxes and transfers.

These two different ways of looking at the data make for strange bedfellows as the debate turns political. Conservative critics of the War on Poverty combine with liberal world-always-getting-worse warriors, who like to cite Piketty, to form conclusions based largely on the before-tax, before-transfer measures. They unite to attack the status quo, with one suggesting fewer transfers (the war failed) and the other higher taxes on the rich (the tax system failed). Liberal defenders of social welfare programs and conservative opponents of higher tax rates, in turn, conclude that on an after-tax, after-transfer basis the world is a lot better off than the other side asserts. They defend the status quo.

Here are the statistics that I ponder. In real terms, social welfare spending averaged about $7,500 per household at the time the War on Poverty was declared. By the time that Ronald Reagan was inaugurated in 1981, spending per household had grown to $15,000. And today it has doubled again from the start of the Reagan administration to about $32,000. (These figures do not even include tax expenditures for social welfare, such as pension, housing, and wage subsidies, which averaged about $7,000 per household in 2013.) Meanwhile, GDP per household grew from about $70,000 in 1964 to nearly $140,000 today.

Over this same 50 years the official thresholds for measuring who is in poverty have not grown one dollar in real terms. These measures, adjusted only for inflation, in a sense, are based on absolute poverty, unadjusted for the new goods and services a growing economy provides or, said another way, for whether a household’s income keeps up with average or median income in the economy. For a family of four, for instance, the nonfarm poverty threshold is crossed when a household’s income falls below roughly $23,550 today, essentially the same level as in 1964. For a single person, the poverty threshold equals $11,490

“Wait a second,” you may think. The government spends far more on social welfare than would be required to give every household support above poverty levels. And in almost every year there have been substantial real increases in the amount of transfers made. Why, then, has the poverty rate not fallen more?

There is no single answer. Here are four pieces of the puzzle:

Huge gains at the top. Inequality in market-based income DID grow substantially since the late 1970s, the period when progress against poverty slowed. The ability of high-income individuals at the top of a winner-take-all economy to capture much of the extra rewards that derive from monopoly or oligopoly settings does help explain some of the stagnation in earnings growth for those with average or low earnings.

It doesn’t explain why the public supports, which have continued to grow, haven’t made greater headway in improving the skills of the population enough that their market incomes would rise more. That brings us to the next three pieces of the puzzle: the extent to which the public money has been spent to help providers, help the middle class, and pay for health care.

Providers. Beneficiaries include providers who have captured large portions of government, not just private market, money. Before you start looking elsewhere, just remember that providers include, among others, doctors, drug manufacturers, social workers, lawyers, lenders, other financial intermediaries, builders, housing officials, software developers, tax preparers, government contractors, and, for that matter, researchers like myself.

The Middle Class. The middle class rather than the poor has also captured very large portions of the social welfare budget, largely in ways that have for decades encouraged them to retire and work less for greater portions of their lives. Early growth in Social Security benefits, for instance, did a good deal to reduce poverty, but in more recent decades has made less progress because growth—the marginal increase in payments—has been concentrated preponderantly on more years of support and higher levels of benefits for everyone, from rich to poor alike. Remember that a program can on average be successful in meeting some objectives, yet still target its incremental budget poorly. Incremental spending in our public retirement programs in the modern age increasingly operates to decrease the market incomes of the middle class and, despite billions of additional dollars spent each and every year, only modestly increases the transfers received by the poor.

Health Care. A large share of the growth in the income of almost everyone but the rich has come not in cash but in the form of government and employer-provided health care and insurance. One-third of per capita income growth in our economy from 1990 to 2010, for instance, went simply to pay for real increases in health care, as average annual health care spending per household from all sources ballooned to approximately $24,000. Measures of both market income (e.g., Piketty) and most measures of after-transfer income (e.g., the official poverty measure) fail altogether to count this major source of income. Yet for many, particularly those below median income, that item has dominated the way their income has grown for perhaps three decades. The CBO has tried very recently to count health insurance received as income in some of their work, but its efforts are an exception to the rule.

These four pieces interlock in various ways. For instance, more years and money in Social Security support, particularly as people live longer, has encouraged the average worker to retire for more than a decade longer than in 1940, when benefits were first paid, thus reducing their market income. Because many of the government’s expenditures on health care have been captured by providers, the public’s gain in benefits comes out to only a fraction of each additional $1 the government spends, while in the private sector cash compensation stagnates to pay for higher costs of health insurance.

In sum, the debate over poverty and inequality deserves renewed attention. However, it provides a quandary to many in both major political parties, who are largely mired in mid-20th century debates and fighting the thumbs-up, thumbs-down battles that blocks improvement from either side. The times beg for a 21st century agenda (an issue I try to address in my new book, Dead Men Ruling).

Finding an Opportune Way to Expand the Earned Income Tax Credit

Posted: January 30, 2014 Filed under: Columns, Income and Wealth, Job Market and Labor Force, Taxes and Budget 5 Comments »President Obama announced only one major new proposal during last night’s State of the Union address. Here’s what he said:

I agree with Republicans like Senator Rubio that it [the EITC] doesn’t do enough for single workers who don’t have kids. So let’s work together to strengthen the credit, reward work, and help more Americans get ahead.

Having worked on the EITC and other wage subsidies for a long time (and having introduced them at a crucial stage of tax reform efforts in the 1980s), I say it’s about time they were back on the table. Particularly since the onset of the Great Recession, policy discussions around helping those with lower incomes have focused on unemployment insurance, food stamps, and government-subsidized health insurance. Employment needs to move toward the front of our public policy agenda.

As necessary as these other social safety net programs might be—and am not trying to assess their merit here—they generally do not encourage people to stay in the workforce. Like the welfare of old, before the onset of reform of what then was Aid to Families with Dependent Children (AFDC), they provide the greatest benefit to those who do not work at all. While it’s debatable whether a simple EITC expansion increases total labor supply, there is almost no doubt that per dollar of cost it increases employment more than many other social welfare provisions.

Employment has been a vexing and growing challenge for the American economy. The share of all adults who work—also called the employment rate— was declining even before the Great Recession, particularly among the young and the near-elderly. Indeed, a declining employment rate represents a far bigger and longer-term issue than unemployment, since the NON-employment rate includes both those who are unemployed and those who drop out of or never join the labor force.

Concern over employment makes wage subsidies fertile ground for bipartisan consensus, if—and this is a big “if” in these partisan times—both sides can claim victory from the deal.

Consider the history the EITC. Almost every president since Richard Nixon has signed legislation establishing the EITC, expanding it, or making some provisions permanent. And it’s been bipartisan. The initial enactment and the largest increases all occurred under Republicans—Ford, Reagan, and George H.W. Bush, while the expansion during the Democratic Clinton administration was also quite significant.

Many who backed these legislative changes did not view the credit in isolation. They often favored it over some alternative—welfare for Senator Russell Long (the EITC’s first champion) and a minimum wage increase for President George H.W. Bush. Or they accepted the EITC as part of a broader tax or budget package. The EITC was never the subject of stand-alone legislative action.

That leads us to today, and what compromises might be supported by both political parties. I suggest two possibilities.

One, following our historical pattern, is to expand the EITC as an alternative to other efforts. At some point, recession-led unemployment insurance expansions will end. A bill to increase the minimum wage might go nowhere. Might an expanded wage subsidy be a compromise? A broader tax or budget bill always presents possibilities. The EITC offers one way to mitigate the net impact on lower-income populations, whether offsetting losses from new deficit reduction efforts, or ongoing cutbacks due to sequestration or dwindling appropriations.

The other is to tweak the EITC so it interacts better with other policy goals, such as reductions in marriage penalties—a cause often advocated by Republicans. The childless single workers identified by the president are not the only ones left out of any significant wage support. So also are many low-income married workers. Despite recent changes, the EITC still creates marriage penalties, particularly if a low-wage worker marries into a household already receiving the maximum credit. Such a low-wage worker often fares worse than a single person who gets nothing or almost nothing: once added to the household, the additional worker’s income can phase out his partner’s’ EITC benefits and reduce or eliminate any previous eligibility for other public benefits. Current government policy announces that it is more advantageous to stay unmarried.

Simply expand the current, very small, credit for childless single people, and marriage penalties would multiply in spades. I suggest including in any expansion low-wage workers who decide to marry or stay married, not only those single persons left out. Such an expansion would proceed largely along the same lines as the president’s, but also reduce marriage penalties .

In sum, the president’s best path to bipartisan support for the EITC is to stress more policies that favor employment, offer the expansion as a compromise from other efforts less favored by his opposition, and reduce marriage penalties.

What Should We Require From Large Businesses?

Posted: December 6, 2013 Filed under: Columns, Income and Wealth, Taxes and Budget 3 Comments »If we want successful companies to contribute to the economy fairly, what should we be asking them for? More corporate income tax? A higher minimum wage? Health insurance for employees? More profit-sharing for employees? Restricted-stock payments of highly paid executives, so they can’t succeed individually when they fail their workers and shareholders?

We’ve tried all these approaches, but at different times and in a discombobulated way.

The corporate income tax, which once raised far more revenue than the individual income tax, now applies mainly to multinational companies, which find ways to hide their income in low-tax countries. Domestic firms often avoid the tax altogether through partnerships or similar organizational structures.

The minimum wage has been allowed to erode substantially. I earned $1.25 an hour while in high school in the mid-1960s; if that amount had grown at the same rate as per capita personal income, high school kids and others would now be earning $20 instead of $7.25.

Health insurance mandates for many employers is our new form of minimum wage. The ACA’s $2,000-per-employee penalty for larger employers that do not provide insurance is essentially an additional “minimum wage” requirement of at least $10 an hour, either in the form of a penalty or health insurance.

Profit sharing was at one time touted as the way to instill better work habits and allow employees to share in a firm’s success. Many employees, however, put all their savings in that one investment and got stuck with huge losses when their firms declined.

A 1993 Tax Act limited to $1 million annually the amount of cash and similar compensation that could be paid to top executives and still get a corporate tax deduction. Post-reform, stock options flourished, as did a more uneven distribution of income within firms.

More recent proposals to reform the corporate income tax set minimum taxes on multinational companies, regardless of the country in which the income was earned; increase the minimum wage on all firms; bump up or reducing the mandate on larger employers to provide health insurance (by adjusting either what services the insurance must provide or the size of the penalty for not providing insurance); regulate companies to disclose how unequal their compensation packages are; and require executives, particularly in financial companies, to invest more in the stocks and bonds that couldn’t be sold immediately and would fall in value should their companies falter.

What drives all these proposals, I think, is the notion that large organizations only become that way by being successful and that they owe the public something in return for this success. At some point, almost all companies achieve their size by generating above-average profits and sales growth. The Wal-Marts and Apples and Mercks of today, the General Motors and U.S. Steels and Pennsylvania Railroads of yesterday, have or had more power and money than most. Did they get there only through the hard work and ingenuity of a few people who deserve most of the rewards? Or were they also lucky? The first out of the block? The beneficiaries of scale economies, where only a few companies would survive or the winner would take all? Did they get government help along the way, perhaps taking advantage of the basic research that served as a prelude to their development? Or the protections of a developed legal system, along with a bankruptcy law that limited their losses? If so, doesn’t that legitimize the discussion of how their gains might be shared, either with their own employees or the public?

If we truly want to create a 21st century agenda, I wonder if we could come up with better, more efficient, and fairer policies by asking the broader question than by piecemeal approaches. The corporate income tax, for instance, has been put forward by the chairs of the congressional tax-writing committees, as well as the president, as a ripe candidate for reform. Yet, however much I might favor such reform as a pure tax issue, it’s only a piece of these broader redistributional questions. Might it be better, for instance, to abandon the attempt to assess any extra layer of corporate income tax, and instead ask larger firms to take a greater role in accepting apprentices, hiring workers during a downturn, sharing profits with workers, providing minimum levels of compensation but not necessarily all in health insurance, and restricting the ability of their higher-paid managers to walk away with bundles even while their firms fail?

Obviously, the devil is in the details. But we should at least have the conversation.

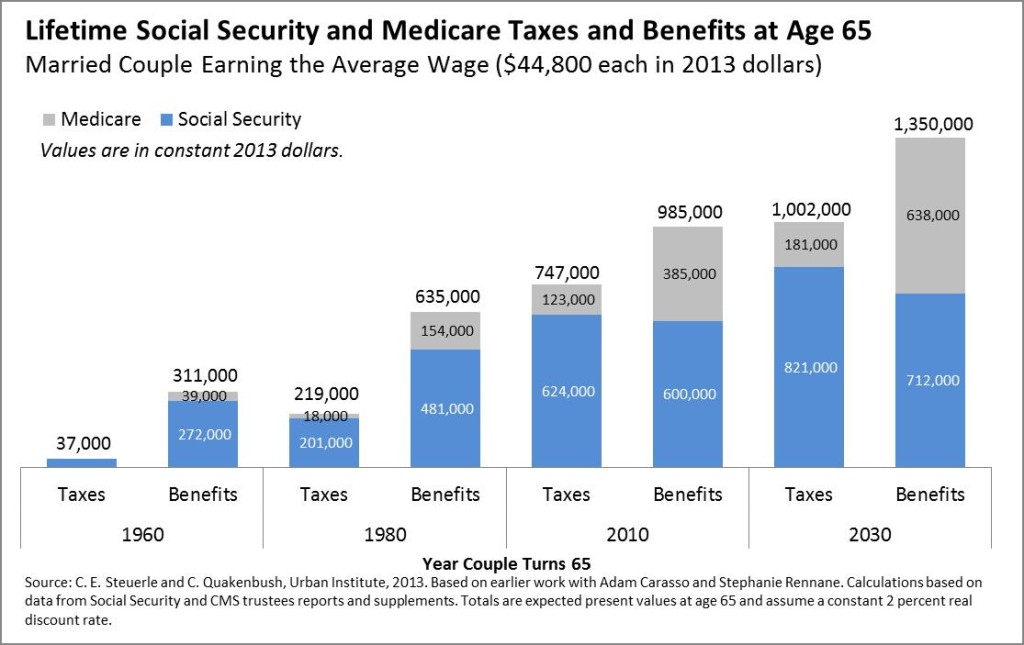

2013 Update on Lifetime Social Security and Medicare Benefits and Taxes

Posted: November 12, 2013 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts, Taxes and Budget 3 Comments »Our updated numbers for lifetime Social Security and Medicare benefits and taxes are now available, based on the latest projections from the Social Security and CMS actuaries for the 2013 trustees’ reports for OASDI and Medicare. Couples retiring today, with roughly the average earnings of workers in general, as well as average life expectancies, still receive about $1 million in lifetime benefits. This number is scheduled to increase significantly for future retirees and is higher for those with above-average incomes and longer life expectancies.

Little has changed on the Social Security side from our previous estimates, as the program has undergone no significant reform in recent years. Our estimates of present values of Medicare benefits for future retirees have decreased slightly from last year as slower health care cost growth has made its way into projections. By 2030, Medicare benefits (net of any premiums paid) are about 90 percent of last year’s estimates, still a significant multiple of Medicare taxes paid. (As in 2012, our numbers incorporate a Medicare cost scenario that assumes the “doc fix” and other adjustments will be extended, not the “current law” scenario in the trustees report.)

We have been publishing these numbers for a long time—and not without controversy over our intent. Our hope is simply that better and more complete information will help elected officials decide whether Social Security and Medicare are distributing taxes and benefits in the fairest and most efficient way possible, a decision we do not believe possible by looking only at annual numbers or how current, not future, retirees and taxpayers might fare. Therefore, we are delighted that in its most recent Long-Term Budget Outlook, the Congressional Budget Office for the first time also published estimates for lifetime Medicare benefits and taxes, as well as Medicare and Social Security combined. Using a slightly different methodology, CBO produces very complementary results. Differences derive from it using median-wage (rather than average-wage) workers, a 3 percent (rather than a 2 percent) real discount rate, and an assumption of Social Security claiming at 62 (rather than 65). As CBO also notes, expected benefits (and taxes, to a more limited extent) have grown over time for a number of reasons, including longer life expectancies, higher incomes, and rising health spending per person.

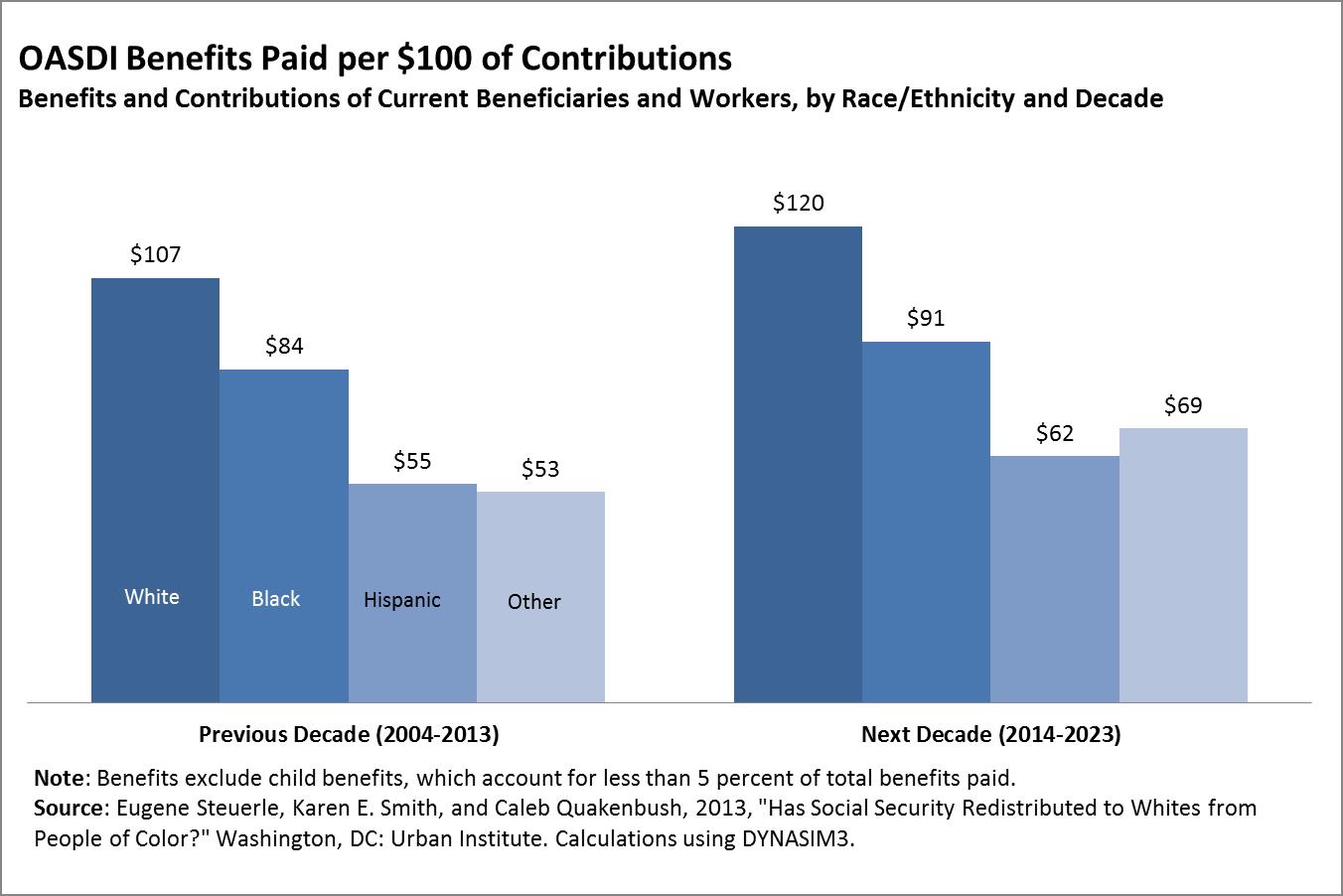

Has Social Security Redistributed to Whites from People of Color?

Posted: November 8, 2013 Filed under: Columns, Income and Wealth, Race, Ethnicity, and Gender 6 Comments »In a new brief, my colleagues and I examine how many features of Social Security combine to redistribute money among racial and ethnic groups over long periods of time, combining together generations. We find that the program as a whole, and especially its retirement portion, has likely redistributed from blacks, Hispanics, and other racial minorities to whites.

The major cause? When taxes are compared to benefits for each generation, the early generations of retirees got large windfalls, those retiring today come closer to breaking even, and tomorrow’s retirees on average will get back less than they pay in, assuming some modest interest rate could have been earned on their contributions or taxes. This phenomenon by itself wouldn’t cause interracial redistribution, but whites disproportionately occupy the high-return generations, while Hispanics, more recently immigrated groups, and blacks increasingly occupy the lower return generations.

The immigration part of the story is easy to understand. Hispanics and other recent immigrants weren’t around to receive the windfalls that came about as the system expanded over its early decades. Whenever Congress increased lifetime benefits for retirees and near-retirees, younger workers would be required to contribute for decades to support those higher benefits. Older workers would get those higher benefits with fewer years of additional contributions or, at times, none at all.

As for the redistribution from blacks, they disproportionately occupy the lower-return generations because of their larger family sizes. A simple analogy might be made with a two-family world where one couple has three kids and the second has one, but the kids all contribute the same $1,000 each to support the four parents, who all get the same benefit of $1,000 each. The larger family contributes $3,000 and gets back $2,000. The effect will be permanent unless some other redistributions over time offset this windfall gain for the smaller family.

Of course, these simple stories ignore Social Security’s other moving parts. Its progressive benefit formula, which I consider in many ways brilliant because it is based on lifetime rather than annual earnings, redistributes to those with lower lifetime earnings. At the same time, Social Security contains many regressive features. For instance, as a protection for old age it appropriately requires that payments be made in the form of annuities, but that ends up redistributing to those with higher incomes because they have higher-than-average life expectancies. Also, unlike private pensions where it would be illegal, single heads of household, often lower-income women, are required to contribute for spousal and survivor benefits they can’t receive.

Because of these various offsetting features, the retirement or old-age part of the system exhibits little net progressivity even before adding on this new multigenerational consequence of making each successive generation pay more for each dollar of benefit it receives.

When disability insurance is considered, it adds to significantly to progressivity in the sense of redistributing to those with lower incomes. From a broader perspective, of course, one can hardly consider it a plus that some racial and ethnic groups incur higher levels of disability, along with the huge losses of private income that Social Security does not replace.

The study does not contain policy prescriptions, though my own separate work has for very long time suggested the merits of substantively (not just symbolically) higher levels of minimum benefits and other progressive adjustments. Nor does the study contradict the success of Social Security in reducing poverty dramatically among the elderly, particularly in its early decades. It does suggest that as reform is being considered, we give serious attention to whether the system achieves its stated objectives, including the extent to which it really provides better protection for those individuals and classes who are less well off.

Both the left and right, I think it fair to say, have presumed that the system is far more progressive than it turns out to be—a more recent literature finding to which this study adds. Unfortunately, the Social Security debate, like so many we have today, tends to be argued on a thumbs-up or thumbs-down basis, rather than on how it might be better designed to meet society’s objectives.

Read more on Economix and Wonkblog.

Is it Unfair to Exclude the Poor from Government Subsidies?

Posted: September 20, 2013 Filed under: Columns, Income and Wealth 13 Comments »Advocates for many social policies—health care insurance, asset development for the poor, charitable deductions for those currently ineligible, child care subsidies, and countless others—often base their arguments on distributional grounds. Typically, lower-income households cannot avail themselves of these benefits or subsidies, and advocates deride the unfairness of it all.

We must be very careful when framing the issue this way. True, many incentives apply disproportionately and inappropriately to higher-income individuals. However, extending these incentives to those with lower incomes does not, by itself, create better policy or even increase fairness.

Put simply, if Congress grants additional incentives to low- and moderate-income households, it decides simultaneously to distribute more to them and to distribute it through a particular subsidy or incentive—and, in the case of incentives, that the benefit should go only to those who opt to use it. Each of these choices, not just any one of them, must be justified in its own right.

Take health insurance under the Affordable Care Act. This legislation offers some lower-income households subsidies of nearly $20,000 and some middle-income households subsidies of $10,000. These households must, however, use this subsidy to buy health insurance, not more education or food or transportation. Those who don’t buy health insurance get none of this subsidy, even if they are poor.

Another aspect of this legislation imposes a minimum burden on many employers who do not purchase health insurance of $2,000 per full-time worker. That’s equivalent to increasing the minimum wage by about $1.25 an hour for someone who works 1,600 hours a year. But, the mandate is to pay the government that money or give employees health insurance. The mandate cannot be met by bumping up the employee’s cash earnings by an equivalent amount.

In effect, we must distinguish between the distribution of benefits or taxes and their allocation or efficiency. Even if we conclude that it would be fairer to give more benefits to those with lower incomes, it does not follow that any benefit they receive is the best use of that money. If a housing ownership subsidy, a housing rental subsidy, and handing out money have the same overall distributional consequence and cost, we still need to decide which, if any, of these options is most effective use of that money.

To give another example, over many years Congress increased the standard deduction in the tax system in order to help lower- and middle-income taxpayers. The standard deduction was higher than what most households would get if they itemized available deductions—in 2013, a $12,200 standard deduction for a couple is far more valuable than $6,000 in mortgage interest and charitable deductions. Increasing the standard deduction increased progressivity, even while it reduced the share of homeownership and charitable deduction benefits received by those with lower incomes. One can hardly say these increases were “unfair.”

Proposals to provide various benefits or incentives to lower-income households, as opposed to simply giving them more money or providing other benefits, must rest on some grounds other than progressivity. Some work and saving policies that give a “hand up” rather than a “hand out” might provide better incentives for work and saving, with side benefits to the rest of society. More asset-development incentives at lower income levels might create more democratic ownership of wealth, enhance retirement security more optimally, or grant extra benefits to society when homeowners take better care of their living quarters than renters. Requirements to spend subsidies on health insurance may reduce the number of people able to game the system by seeking free care when they get sick and avoid any contribution to the cost of their health care. Many of these choices are not easily assessed quantitatively, but they are primarily efficiency arguments, not fairness arguments.

At the same time, we still want to look at the distribution of any benefit to see just who receives it and how any program allocates its monies. For instance, if homeownership creates positive gains for society, might it not be better to spend the same amount of money to encourage homeownership among all income classes than to spend disproportionate amounts on those buying second homes or McMansions? Looking at distributional results helps us make such judgments by assessing the actual rather than intended impact of the policy.

Civil Rights and Economic Mobility

Posted: September 5, 2013 Filed under: Columns, Economic Growth and Productivity, Income and Wealth, Race, Ethnicity, and Gender 1 Comment »The 50th anniversary of “the March on Washington”—so famous and, in many ways, so successful that “the” is sufficient to define it—brought forth a gusto of stories about what had been achieved since then, including some very interesting blog posts by my colleagues. Several turned to data on the distribution of wealth, including some studies in which I participated, noting the lack of gains—especially in the past few decades—in the wealth and income of blacks and Hispanics relative to whites.

Those aggregate, raw figures on wealth and income act as a form of performance test on one aspect of government policy. They state rather emphatically that, whatever its merits, such policy was not sufficient to move the needle on wealth mobility across and among racial and other classes. Some simply draw the conclusion that we must redouble our efforts on programs that they have favored for a long time. Spend more on Medicare or Medicaid or cut tax rates or whatever. But what if that focus is wrong? What if the dominant liberal and conservative agendas over the past 50 years, at least when it came to social policy and taxes, never really had much to with mobility? What if the data compel us to adopt more dynamic, yet realistic, policies that put mobility and opportunity more at the forefront of policy in the 21st century?

Over these past few decades, liberal agendas have focused largely on the positive effects of ensuring that people had adequate income, food, health care, and so on—that is, consumption. Conservative agendas have focused largely on the negative effects of high income tax rates, particularly at the top of the income distribution. Often raising legitimate concerns about poverty or incentives, respectively, in many ways, each side has won its battle. Redistributive and other social welfare policies now dominate the $55,000 in federal, state and local spending, including tax subsidies, now spent on average per household, while tax rates at the top tend to be about half what they were from World War II to the early 1960s.

Relative to 50 years ago, fewer people are without food or food assistance, people can now retire on Social Security for many more years, health care has become far more life-sustaining, more people go to college, and, while economic growth hasn’t been great lately, we’re still about three times richer than we were. So the record isn’t all that bad, despite current travails. But, once again, those successes largely did not carry over to mobility among and across classes.

Here are just a few examples of how policies have given limited attention to mobility:

- Current welfare policy helps feed and house people, but it often discourages work by imposing very high costs on moderate-income households with children, as they can lose hundreds of dollars of benefits for each $1,000 they earn.

- Even while single parenthood remains a major source of poverty for many, that same welfare policy now penalizes—on the order of hundreds of billions of dollars—low-income couples with children who decide to get or remain married.

- Although investing in quality early childhood education appears to have a high payoff, the means testing of Head Start and other programs re-segregates our schools, with poorer kids often clustered together in classrooms separate from middle-class kids.

- Housing rental subsidies help people live in decent housing, but they also discourage home-buying and paying off a mortgage along the way, keeping lower-income families away from that classic and, for large segments of the population, most important mechanism for saving.

- Our retirement policies help most Americans live their later years in some comfort. But by encouraging early retirement, Social Security and other programs lead to an increased wealth gap among the elderly as richer classes retire later—hence, work and save longer—than poorer classes.

- Low tax rates may encourage entrepreneurship, but when they don’t raise enough revenue to pay our bills, they add to interest costs on the debt, gradually eroding support for investments in people, education, and similar efforts.

It’s not that liberals and conservatives advocating these older agendas don’t care about mobility. They’ll tell you that people with more sustenance will be able to work and study harder and entrepreneurs facing lower tax rates will create more jobs. But they try to claim too much for agendas that, though successful on some fronts, did not improve mobility in recent decades. The proof is in the pudding.

Raising these issues threatens those who fear that acknowledging failure on any front merely empowers those who advocate for the opposing agenda. And in today’s chaos that passes for policymaking, that is probably true. I don’t even know in what galaxy to place debates over previously nonpartisan issues like extending the debt ceiling so Congress can pay off its bills.

For me, it isn’t about abandoning the past. It’s simply about moving on.

How Much Should the Young Pay for Yesterday’s Underfunded Pension Plans?

Posted: August 22, 2013 Filed under: Aging, Columns, Income and Wealth, Taxes and Budget 2 Comments »Recent stories about Chicago’s pension crisis represent only the latest in a long series of announcements about poorly funded state and local pension plans. Detroit’s declaration of bankruptcy shows one possible consequence of such neglect, with many of the city’s retirees fearing drastically reduced pension payments. This isn’t the first time that retirees and workers have found their financial stability threatened, either: many private pension plans have failed in such industries as steel production and airlines.

While there’s often no easy or right answer for who should pay for these uncovered burdens, as a society we’ve pretty much decided that in this arena, as in so many others, the young should get the shaft.

Often poorly funded or badly designed to deal with risk, many pension plans need only some catalytic economic change, whether from greater competition or an economic downturn, to start sinking rapidly. A promise for the future, underfunded from the past, shifts liabilities forward in time, where they get passed around like a hot potato. No one—employer, worker, or taxpayer—wants to get burned with the cost of past mistakes, or even part of it. But the money that should have been set aside has long been spent, so someone at some time must cover the shortfall.

Consider why government or private employers underfund a plan in the first place. In a private plan, underfunding allows higher wages to current workers, bonuses to top managers, and cash withdrawals to partners and dividend recipients. In a public plan, elected officials can give higher current compensation to workers or more services to the population while letting taxpayers off the hook–temporarily, of course.

When people see this inadequately supported edifice begin to crumble, they make a run on the bank. Given the increased threats to future wages, job security, and dividend payments, everyone has an incentive to get what they can while the getting is good. Keep wages up as long as possible, even if that means further weakening pension plans. Increase those bonuses to top managers, who suggest their skills are needed now more than ever to dampen the firm’s or agency’s fall. Lobby Congress and state legislators to allow employers to defer better funding of their pension plans so these other cash outflows can continue. And maintain pension payments for current and near-retirees regardless of the hit on those not yet retired.

Traditional actuarial calculations—the formulas by which actuaries determine whether employers adequately fund their plans—make matters worse. These formulas often allow employers to play Wall Street with their pensions. A firm or government borrows at low interest rates on one side of the ledger, then invests in riskier assets with higher expected returns on the other side. Even dodging the question of when such practices generally make sense, employers often push their actuaries to use outrageous assumptions about rates of return on those risky assets.

For instance, many state and local governments today assume a return of around 8 percent on a mixed portfolio of bonds and stocks in a world where interest-bearing bonds often yield only 3 or 4 percent at best and the earnings-to-price ratio (the effective rate of return earned by corporations relative to the price of their stock) is about 6 percent in real terms. If these employers want to play the markets with their pension plans, then the plans should be overfunded enough to handle the risk. Alternatively, governments and firms should make their projections assuming a less risky but lower rate of return. If the risk-taking strategy works, then future (not current) funding payments can be lowered.

When the firm or government declares bankruptcy, many bondholders, pensioners, and remaining workers deserve sympathy. Certainly the retiree who might have to rely on less than expected, the bondholder who accepted a lower rate of return in exchange for what she thought was a less risky investment, and the taxpayer who often gets caught covering everyone else’s problems. Sometimes these are the same people who benefited from the excessive payments (made possible, first, when inadequate funds were put into the pension plan, and then, during the delay between recognizing the problem and taking some later action such as bankruptcy). But often they are not.

While these claimants may battle each other, they almost always collude against the young. The use of unreasonable actuarial assumptions establishes this pattern by forcing future workers and taxpayers to cover shortfalls. In addition to covering some of those losses, new workers for the state or the firm, if it survives, will be granted far fewer pension or retirement plan benefits than even current workers, not merely those already retired.

Unequal pay for equal work becomes the new standard. Age discrimination against the old is illegal, but not the young. State pension plans now typically provide tiered benefits, with successively lower benefits for newer workers. In fact, states are now starting to provide negative employer benefits to the young by giving them back less in benefits than their contributions plus some modest rate of return.

The same holds in different ways in private industry. We are all familiar with the higher cash and pension benefits being paid to older airline pilots and automobile workers, among others. Almost no one addresses the consequences for wealth-building, including retirement adequacy, for today’s young. That’s tomorrow’s problem.

Or is it? Seems like we’ve heard that claim before.