Did the Financially Insecure Secure Donald Trump’s Victory?

Posted: December 21, 2016 Filed under: Income and Wealth, Job Market and Labor Force 1 Comment »

In a classic case of Monday-morning (or Wednesday-morning) quarterbacking, many of us tend to seek one simple explanation for why Donald Trump won the recent presidential election. New analysis from some of my colleagues at the Urban Institute shows that the real reasons are more complex and transcend sound bites.

As part of our Opportunity and Ownership Initiative, Diana Elliott and Emma Kalish have assessed ongoing election narratives with some on-the-ground facts and an interactive map. They compare county-by-county elections results with various financial and demographic characteristics of voters. Interestingly, Diana and Emma conclude that financial insecurity did not drive voting preferences.

In fact, Hillary Clinton won just 4 of the 55 counties (or county equivalents) whose residents had the highest average credit scores (720 and above). High credit scores imply bills paid promptly and the type of financial stability that comes with paying off a mortgage over time. Clinton did win the 11 counties with the lowest scores.

Race and education were strong factors: generally speaking, white consumers were more likely to vote for Trump, those with bachelors’ degrees or higher to vote for Clinton.

These results provide information not only about voting patterns but about whether different policy initiatives would help those who feel ignored or left out by government, another part of the post-election debate. Further research might also reveal whether Trump appealed to people living in regions that had suffered some decline in security or population, even if voters’ relative financial standing in November 2016 was average or better.

If you access the interactive map yourself, you can do your own analysis of many interesting—and sometimes surprising—factors and see results for particular counties and regions.

Finding an Opportune Way to Expand the Earned Income Tax Credit

Posted: January 30, 2014 Filed under: Columns, Income and Wealth, Job Market and Labor Force, Taxes and Budget 5 Comments »President Obama announced only one major new proposal during last night’s State of the Union address. Here’s what he said:

I agree with Republicans like Senator Rubio that it [the EITC] doesn’t do enough for single workers who don’t have kids. So let’s work together to strengthen the credit, reward work, and help more Americans get ahead.

Having worked on the EITC and other wage subsidies for a long time (and having introduced them at a crucial stage of tax reform efforts in the 1980s), I say it’s about time they were back on the table. Particularly since the onset of the Great Recession, policy discussions around helping those with lower incomes have focused on unemployment insurance, food stamps, and government-subsidized health insurance. Employment needs to move toward the front of our public policy agenda.

As necessary as these other social safety net programs might be—and am not trying to assess their merit here—they generally do not encourage people to stay in the workforce. Like the welfare of old, before the onset of reform of what then was Aid to Families with Dependent Children (AFDC), they provide the greatest benefit to those who do not work at all. While it’s debatable whether a simple EITC expansion increases total labor supply, there is almost no doubt that per dollar of cost it increases employment more than many other social welfare provisions.

Employment has been a vexing and growing challenge for the American economy. The share of all adults who work—also called the employment rate— was declining even before the Great Recession, particularly among the young and the near-elderly. Indeed, a declining employment rate represents a far bigger and longer-term issue than unemployment, since the NON-employment rate includes both those who are unemployed and those who drop out of or never join the labor force.

Concern over employment makes wage subsidies fertile ground for bipartisan consensus, if—and this is a big “if” in these partisan times—both sides can claim victory from the deal.

Consider the history the EITC. Almost every president since Richard Nixon has signed legislation establishing the EITC, expanding it, or making some provisions permanent. And it’s been bipartisan. The initial enactment and the largest increases all occurred under Republicans—Ford, Reagan, and George H.W. Bush, while the expansion during the Democratic Clinton administration was also quite significant.

Many who backed these legislative changes did not view the credit in isolation. They often favored it over some alternative—welfare for Senator Russell Long (the EITC’s first champion) and a minimum wage increase for President George H.W. Bush. Or they accepted the EITC as part of a broader tax or budget package. The EITC was never the subject of stand-alone legislative action.

That leads us to today, and what compromises might be supported by both political parties. I suggest two possibilities.

One, following our historical pattern, is to expand the EITC as an alternative to other efforts. At some point, recession-led unemployment insurance expansions will end. A bill to increase the minimum wage might go nowhere. Might an expanded wage subsidy be a compromise? A broader tax or budget bill always presents possibilities. The EITC offers one way to mitigate the net impact on lower-income populations, whether offsetting losses from new deficit reduction efforts, or ongoing cutbacks due to sequestration or dwindling appropriations.

The other is to tweak the EITC so it interacts better with other policy goals, such as reductions in marriage penalties—a cause often advocated by Republicans. The childless single workers identified by the president are not the only ones left out of any significant wage support. So also are many low-income married workers. Despite recent changes, the EITC still creates marriage penalties, particularly if a low-wage worker marries into a household already receiving the maximum credit. Such a low-wage worker often fares worse than a single person who gets nothing or almost nothing: once added to the household, the additional worker’s income can phase out his partner’s’ EITC benefits and reduce or eliminate any previous eligibility for other public benefits. Current government policy announces that it is more advantageous to stay unmarried.

Simply expand the current, very small, credit for childless single people, and marriage penalties would multiply in spades. I suggest including in any expansion low-wage workers who decide to marry or stay married, not only those single persons left out. Such an expansion would proceed largely along the same lines as the president’s, but also reduce marriage penalties .

In sum, the president’s best path to bipartisan support for the EITC is to stress more policies that favor employment, offer the expansion as a compromise from other efforts less favored by his opposition, and reduce marriage penalties.

How Tax and Transfer Policies Affect Work Incentives

Posted: February 14, 2013 Filed under: Economic Growth and Productivity, Income and Wealth, Job Market and Labor Force, Shorts, Taxes and Budget 1 Comment »When the design of safety net programs is considered alongside that of our tax code, it is easy to see that our tax and transfer systems need to focus less on increasing consumption and more on promoting opportunity, work, saving, and education.

The government doesn’t affect work incentives just through direct taxes. Implicit taxes—that is, penalties for earning additional income—are everywhere, whether in TANF or SNAP, Medicaid or the new health exchange subsidy, PEP or Pease (reductions in tax allowances for personal exemptions and itemized deductions), Pell grants or student loans, child tax credits or earned income tax credits, unemployment compensation or workers compensation, or dozens of other programs. These implicit taxes combine with explicit taxes to create inefficient and often inequitable, certainly strange and anomalous, incentives for many households.

At some income levels, families face prohibitively high penalties for moving off assistance. Accepting a higher paying job could mean a steep cut in child care assistance for a single worker with children, for instance. For some, the rapid phaseout of benefits can offset or even more than offset additional take-home pay. Asset tests in means-tested programs create similar barriers to saving.

Not getting married is one way that people avoid some of these penalties or taxes and is the major tax shelter for low- and moderate-income households with children. Our tax and welfare system thus favors those who consider marriage an option—to be avoided when there are penalties and engaged when there are bonuses. The losers tend to be those who consider marriage a social or religious necessity.

The high rates and marriage penalties arising in these systems occur partly because of the piecemeal fashion in which they are considered. Efforts to design benefit packages more comprehensively could greatly improve both the incentives families face and the quality and choice of benefits they receive.

For more details, see my congressional testimony for today’s hearing on “Unintended Consequences: Is Government Effectively Addressing the Unemployment Crisis?” before the Committee on Oversight and Government Reform.

Allocating Monies Where Unemployment Is Highest

Posted: November 15, 2012 Filed under: Job Market and Labor Force, Shorts 1 Comment »As Congress debates how to unwind from all the debt it is accumulating, it continues to face high unemployment around the nation. One possible deficit-reducing approach is to provide greater assistance or revenue sharing to those regions, or people in the regions, most suffering from high unemployment, while reducing some across-the-board supports.

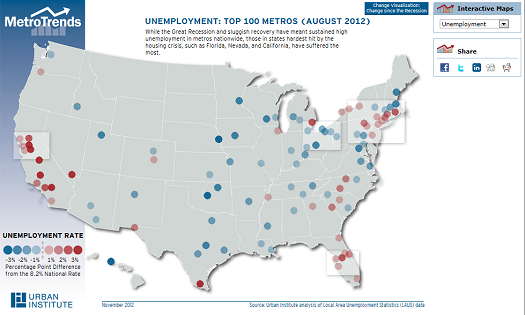

To examine variation in unemployment, I would like to draw attention to some of the interesting interactive graphs available from Urban Institute’s MetroTrends web site. The graph below looks at unemployment in the top 100 metro areas in the United States. By clicking on a city, you can look at the unemployment rate going back to 2000 or compare unemployment between two cities.

Below is a screenshot; the interactive graph can be found at http://datatools.metrotrends.org/charts/metrodata/LAUSMap_files/LAUSMap.cfm.

And Now Something for Our Most Recession-Weary Workers

Posted: April 1, 2010 Filed under: Aging, Columns, Income and Wealth, Job Market and Labor Force, Taxes and Budget Leave a comment »With economic recovery from the deep recession in view, a double-headed challenge remains. Reducing the deficit requires cutting back government spending, but we still need to promote employment and work, and that won’t come free. Given this administration’s progressive leanings, its attention to low- and moderate-income workers is surprisingly modest.

So how hard is it to spend less overall but more on lower-income workers? Presidents George H.W. Bush, Bill Clinton, and Ronald Reagan all expanded wage subsidies for some low-wage workers through the earned income tax credit (EITC) while and reforming taxes and significantly lowering the deficit.

Shifting policy toward low-income workers brings other benefits, too.

It increases employment more per dollar spent than many current subsidies that go to higher-income individuals and to those who do not work at all.

It helps reduce the long-term costs of added crime and depression borne of long spells of unemployment.

Done right, it can reduce the marriage penalties in many wage subsidies and welfare programs.

This administration and Congress have hoped that their biggest initiative—saving and subsidizing Wall Street and lowering borrowing costs—would trickle down benefits for everyone else. Maybe so, but more money for low-income workers can also trickle up. And it costs far less to subsidize a low-wage job than a high-wage job.

The biggest direct wage subsidy enacted so far has been the Making Work Pay tax credit. For most eligible working households, however, it’s just a $400 credit ($800 for married couples). It’s really not a jobs subsidy so much as an across-the-board tax cut to spur consumption.

The Obama administration’s latest ventures include such items as a $5,000 tax credit for small businesses for each new employee hired this year. Puny relative to the economy’s size, this incentive also gets mired in all sorts of definitional issues. What is a small business? (Your maid service? Your friendly billionaire’s 20th venture?) Who’s new? (Your kid? Someone already on your to-hire list?). Why discriminate against struggling businesses? And why not count the worker they would otherwise let go?

Wage subsidies for low- and moderate-income earners, by contrast, traditionally have fans on both the left and the right. More progressive than most other subsidies, they also offer an alternative to welfare and unemployment insurance, which can discourage work. Indeed, past EITC increases helped give low-income households a foothold that allowed President Clinton and the Republican Congress to reform and deemphasize welfare in 1996.

The Obama administration does support expanding EITC for families with three or more children a bit. And, arguably, its proposed extension of the child credit to include some very low earning households who generally don’t owe taxes subsidizes part-time or part-year work. Nonetheless, most moderate-income workers are excluded from these expansions, which send money mainly to one-parent households and only to households with children.

What’s the most sensible approach? For my money, it’s concentrating additional work support to the largest groups now left out: low-wage single workers and many married, two-earner, low-wage families. Especially key is an EITC-like subsidy for the low-wage worker based mainly on his or her earnings.

That way, we reach single people with no kids, including many of the males hardest hit during this recession and still ineligible for most government programs. And we reach many households who marry or contemplate marriage, only to realize that tying the knot means losing or jeopardizing thousands of dollars worth of EITC, Medicaid, welfare, and housing subsidies annually. Better to stay unmarried, even if living together.

And if we don’t take these steps? For starters, we ignore the fundamental policy lessons that leaving millions of productive people jobless has long-lasting costs. Unemployed people are more depressed, less entrepreneurial, more risk averse, more bored, more inclined toward substance abuse, and more likely (especially if they are young men) to turn to crime. Just as failing to create jobs for more Iraqis right after Saddam Hussein’s fall was a big foreign policy mistake because many turned to more violent pursuits, neglecting job creation now could be a colossal domestic policy mistake that plays out long after our economy is back on its feet.

Our national sense of fair play is at stake here too. The recession hurt low-income workers most, but they were largely left out of most stimulus programs.

Policy two-fers are often rare. But this policy shift is a five-fer that appeals to both liberal and conservative principles: reduced spending, greater progressivity, higher employment per dollar spent, reduced crime and depression, and fewer penalties for marriage. And with predictions of only slow employment growth ahead, the timing is right for confronting unemployment more strategically.

Modernizing Social Security

Posted: September 19, 2008 Filed under: Columns, Income and Wealth, Job Market and Labor Force Leave a comment »Certainly one important question raised about Social Security today is how to balance its finances. But it’s only one question. Social Security exists-or should exist-to serve people, and lately it’s been doing only a so-so job on that front.

Many of Social Security’s features were designed around a view of the economy and the family that is at least three-quarters of a century old. Congress spends tens of billions more every single year for the program, but few of those extra dollars address the needs of the poor or very old. Meanwhile, the program discourages work at a time when the labor force is growing at a slower pace, and it discriminates strongly against single parents, usually women.

Three major reforms are required to modernize Social Security: better poverty reduction, less discouragement of work, and fairer treatment of the family.

Poverty reduction. Consider: early in its history, Social Security brought many of the old out of poverty; today, its additional spending does little to help the poor and nearly poor. Instead, higher benefits every year are allocated across the board to all future retirees, and because we’re living longer, smaller shares go to those who really are old.

Establishing a decent minimum benefit would help address this problem, as it would set a base to which other amounts could be added if desired. Before tackling issues such as middle- and upper-class benefits and individual accounts, reformers from across the ideological spectrum ought first to set a base that would improve the quality of life for the bottom third or bottom half.

Higher benefits in older age and lower benefits at the earliest ages of eligibility are another way to address the poverty problems of the very old. Your 85-year-old neighbor is more likely than your 62-year-old neighbor to be unhealthy, vulnerable, and without a spouse to help with impairments.

Additional work. Consider: Social Security, like the rest of government, is largely funded by taxes paid by workers. Encouraging more work is the one reform alternative that is almost a magic elixir. At any given tax rate, it would allow:

- higher Social Security lifetime benefits for everyone (because of more Social Security revenues);

- much higher annual Social Security benefits (because lifetime benefits are withdrawn over fewer years);

- higher personal income (because of a higher GDP);

- and, significant income tax revenues for the rest of government, hence reducing the squeeze of retirement on other essential domestic programs.

Social Security’s early retirement age sends a signal to people that they are old (and elgible for “Old” Age Insurance) at age 62. Today, however, many people retiring at that age still have close to two decades, or around one-third of their adult lives, left to live. Many of your moms and dads have liveor are living a lot longer than your grandparents, and you are going to live, on average, a lot longer than they are.

Raising the early retirement age by itself doesn’t actually save Social Security any money, but people who wo onal income, pay additional taxes, and significantly increase their own living standards in retirement. Other changes in the retirement age can bein a way that, on average, increases lifetime benefits of the most vulnerable-the poor, the disabled, and the very old.

Social Security can also stop discriminating against-as a hypothetical-your fellow worker who works 40 years for an much lower benefits than someone who works 30 years for $40,000. Congress should also recognize that the current program discourages work because of its confusing rules on “earnings tests” (between age 62-66) and “delayed retirement credits” (age 66-70).

Fairer treatment of the family. Consider all of the following examples of the unfair treatment of families:

- A single head of household paying taxes and supporting children often recieves tens or hundreds of thousands of dollars less in lifetime benefits than spouses who do not work, do not raise children, and do not pay any taxes.

- A husband and wife who each earn $40,000 will receive tens of thousands of dollars fewer in lifetime benefits than a husband who earns $80,000 and a wife who earns nothing.

- A divorced spouse with nine years and 11 months of marriage gets nothing out of spousal and survivor benefits, while a divorced spouse with 10 years and one month of marriage gets expected benefits worth hundreds of thousands of dollars.

- Widows who dare to remarry can lose tens of thousands of dollars of benefits by remarrying someone who earns less than their late spouse did.

- Individuals (mainly men, for biological reasons) can generate tens of thousands of dollars of benefits by having children later in life (generally after age 40)–benefits not available to most people who raise children.

Most of these problems derive from a stereotypical view of the family that was never accurate and is increasingly out of date. The courts would dethis design discriminatory if private plans tried to adopt it.

Modernizing Social Security requires addressing these three basic issues of fairness and efficiency. Otherwise, Social Security reform will fail no matter what level of solvency it attains.

Employment and That Magical Year, 2008

Posted: December 12, 2007 Filed under: Columns, Economic Growth and Productivity, Job Market and Labor Force Leave a comment »Everyone knows that 2008 promises to be a bellwether year, rife with dramatic changes already glimpsed. Some harbingers of change are obvious. A new president will be elected—though campaigns hide as much as reveal what that president will choose or be forced to do. The subprime mortgage market also portends dramatic changes in the financial markets in 2008 and beyond. But perhaps the biggest change of all is a sleeper so far—the first year of a scheduled drop-off in employment growth that will last for some 30 years running. If this decline is left unchecked, the net impact on employment will be far greater and longer lasting than the temporary employment dip during the Great Depression.

Suppose that the economy was about to suffer the equivalent of an increase in the unemployment rate of about 3/10 of 1 percent every year for the next 30 years. Further suppose that in many of those years, the number of workers declined rather than rose. Meanwhile, suppose that the rate of revenue growth declined along with employment growth—at the very same time that the rate of government spending starting rising rapidly because more and more people qualified for “elderly” benefits.

If you were an official in charge of economic policy, would you be worried? If you’re an investor in stocks and bonds, should you be concerned?

Well, you should be. These ominous trends and more are now at the starting gate. The unprecedented mega-transition scheduled for the U.S. economy stems from both demographics and public policy. The rise and coming fall in employment of the baby boom generation—those born between 1946 and 1965—provides much of the demographic impetus.

Tracing the impact of the baby boomers on the economy over the years has often been likened to following a pig swallowed by a python. First, the boomers affected their parents’ demand for post-World War II housing. Then their ranks swelled enrollment in primary and secondary schools. From the mid-1960s to the mid-1980s, college enrollment ballooned. Lately, the baby boomers have been stocking away retirement assets, adding to the national total, and, through increased demand, driving up the prices for second and vacation homes.

So how does the swallowed pig affect the national employment picture? When the Reaganites and the Clintonites brag about job growth during the 1980s or 1990s, they are mainly trying to claim personal credit for the number of human eggs fertilized from 1946 through 1965. Those embryos became babies who became workers and swelled the labor markets a few decades later.

Two other demographic factors added to labor market buoyancy and lack of fiscal pressure during the period that boomers stocked the workforce. First, these boomers came on the heels of a baby bust population born during the Depression and World War II, so growth in the ranks of the elderly was restrained. Also, women entered the labor market in droves, eventually reaching employment levels close to men’s.

One net result was that U.S. employment grew 12 percent in the 1950s, 20 percent in the 1960s, 26 percent in the 1970s, 20 percent in the 1980s, and 15 percent in the 1990s. From 2000 to 2007, the growth was roughly 7 percent.

Public policy adjusted to the pig in the belly of the snake partly by taking advantage of the additional revenues provided by the new workers. Occasionally, elected officials increased subsidies for housing, education, and retirement saving to accommodate this generation. They also offered more and more years of retirement support and higher annual benefits to each succeeding generation of retirees.

But that was then. If higher employment growth spurred economic demand and growth, as well as government revenues and spending, in the past, what is lower employment growth likely to mean for the future?

We often read statistics about when Social Security funds will become inadequate to pay promised benefits. But the current system’s obligations aren’t confined to giving bigger benefits to more people. Besides that tall order, policymakers will have to deal with the projected decline in revenue growth rates as close to one-third of the adult population moves onto Social Security.

We can hold off on the hand-wringing only if we believe that demand for older workers will swell and that many boomers will stay in the workforce. I, for one, think that can happen and that many of the doomsday scenarios for this new labor market are wrong. Yet, the supply of older workers will be crimped as long as public and private employment policies stay rooted in the 1970s—or even the 1990s. How fast and well employers and government officials adjust will determine whether demographic changes poised to unfold starting in 2008 bolster or drag down the economy. Among the tallest of orders is to move away from private and public policies that now encourage retirement in middle age—a subject for another time.