One Avenue to Bipartisan Tax Reform: Simplification and Improved Tax Administration

Posted: April 8, 2015 Filed under: Columns, Taxes and Budget 1 Comment »There are many ways to restructure the tax code. Elected officials often fail to detect opportunity when they adhere in a path-dependent way to one past model of success, such the 1986 tax reform. An alternative approach where even the acclaimed 1986 effort made at best modest progress would focus on making tax code simpler for taxpayers and improving compliance without adding to IRS costs. This reframing of reform stands a chance of stepping around the partisan wrangling that deters progress on so many other policy fronts.

In recent weeks, IRS Commissioner John Koskinen has been lamenting the Service’s inability to perform its functions well, mostly recently at today’s Tax Policy Center event on the impact of IRS budget cuts. It not only continues to lose staff, but less experienced staff quickly must replace a large fraction of senior employees who are leaving.

At the same time, congressional Republicans have been finding fault with much of what the IRS does, from its inability to regulate the activities of social welfare 501(c)(4) organizations to its implementation of the Affordable Care Act. Democrats say the solution is a bigger IRS budget. Republicans say it is a smaller one. But there is an alternative choice.

Focus tax reform on an objective almost never before given priority: developing a system that is less costly for taxpayers to comply with, mostly through simplification of existing laws. Simultaneously modify laws where IRS enforcement is difficult or impossible or too costly ever to do well. Such an effort would not necessarily require base broadening, though that often would be consistent. For instance, rather than engaging in a non-productive debate over whether to eliminate or expand refundable tax credits for low-income households, Congress could simply replace the existing credits with versions that are easier for taxpayers to understand and for the IRS to administer.

Put everything on the table, ranging from business deductions to multiple capital gains tax rates to complexity of retirement plan options to refundable credits that go mainly to the poor. Include many of the small items like mileage deductions that can be vastly simplified.

The first step in such an effort would be for the IRS to better understand known error rates for each preference and “program” based partly upon the audit data it keeps. Believe it or not, the agency has never done any good comprehensive study on this, though on occasion it has tried to measure the extent of noncompliance in rough terms.

And the IRS has never conducted this type of research to inform policy, as opposed to allocating internal audit functions. IRS should study taxpayer time costs, error rates, causes of error, costs of auditing, and administrative aspects of every program put into the tax code. For instance, although relatively easy to do, it has never really distinguished in its studies what it can’t know or can’t enforce well from the error rates that it can find under some audit technique.

The second step would be for the IRS and its colleagues at the Treasury’s Office of Tax Policy to be prepared, at least in a tax reform setting, to acknowledge what provisions it cannot monitor at a reasonable cost. For instance, it can estimate compliance with wages reported to the IRS on W-2 forms, but it seems fairly certain that it has little idea of how much charitable contributions of clothing are overvalued. Even if it did, it has no way to efficiently allocate resources to monitor such deductions.

I recognize that a balancing act is required, since IRS doesn’t want to encourage even more noncompliance. But an agency can’t engage in continuous improvement if it doesn’t study and acknowledge its problems in the first place. Indeed, some of IRS’s recent public conflicts, such as over the tax-exempt status of Tea Party and other social welfare organizations, stemmed from what every tax policy analyst has always known: that limited resources devoted to vague or hard-to-enforce law eventually can lead to disaster.

With attention to individual simplification, along with the improved compliance that comes from removal of laws that can’t be enforced, both parties could claim a victory. A simpler and more efficient tax system conforms to both progressive and conservative principles.

Unlike more money for audit, moreover, making the system more administrable and simpler modestly increases national well-being.

In a fairly comprehensive study I undertook for the American Bar Association and the American Institute of Certified Accountants many years ago, I found that expanding IRS audit resources was likely to raise more than was spent, ranging from $2 to $7, depending upon type of return, for every dollar spent. I doubt the conclusion has changed greatly since then. But while more auditors would help redistribute the tax burden in favor of compliant taxpayers, there’s no gain and a likely loss in output by taking workers away from more productive activities.

Administrative reform and simplification, on the other hand, can reduce noncompliance while increasing the time that taxpayers can devote to more productive pursuits. Of course, to achieve this goal, leaders of both parties have to cooperate to make changes that benefit the public, even when it gives them no partisan advantage.

This column originally appeared on TaxVox.

Assessing “Wrongs,” Mainly on the Young, to Pay for “Rights”

Posted: March 26, 2015 Filed under: Aging, Columns, Income and Wealth, Taxes and Budget Leave a comment »What happens when the claim to some financial right from the government creates some financial “wrong” somewhere else?

That is, when the government’s balance sheets don’t balance, and there aren’t enough assets to pay for claims on them, someone must get short-changed. If that “someone” must accept unequal treatment under the law, has the right been matched by a “wrong?” These issues have now arisen for underfunded state pension plans, but they continue to apply in other arenas, such as the unequal assessment of property taxes in states like California. In these and other cases, the young often end up paying the piper.

Protecting rights has long been crucial to maintaining a democratic order. The United States has a long history of protecting citizens’ rights, embedded from the beginning of the nation in the Bill of Rights and, since then, in many legal and constitutional clauses. These aim largely to establish liberty and require equal treatment under the law. When it comes more narrowly to most disputes over private property and assets, there are no “unfunded” government promises; contestants simply dispute over who gets the private funds. The court effectively fills out the balance sheet when it resolves those private disputes. A higher inheritance to one party out of a known amount of estate assets, for example, means a lower amount for another. There’s no third party or unidentified taxpayer who must to contribute or add to the estate so all potential inheritors can walk away happy.

When it comes to financial “rights” established by law, the issue becomes more complicated. The latest cases getting much attention revolve around the rights of state and local public employees to the benefits promised by their pension plans, even when those plans do not have the assets to cover the claims. Some courts have determined that the promised benefits are inviolable under state constitutions, regardless of available assets; other courts have recently interpreted state laws differently, led by the bankruptcy and financial distress of state pension plans.

As another example, some states give longer-term homeowners rights to lower taxation rates than newer homeowners. Proposition 13 of the California Constitution requires that property taxes cannot be increased by more than a certain rate, effectively granting existing homeowners lower tax rates than new homeowners receiving the same services for their tax dollars.

So where does the money come from? Saying that it can be the future taxpayer still dodges the issue of whether the allocation of benefits and costs meets a standard of equal justice.

Thus, when people lay claim to nonexistent government assets, “rights” can’t be totally separated from the “accounting” system under which they are assessed. I’m not a lawyer, but I believe courts and legislators do not do their job completely if they don’t admit to and address the following questions in any disputes on such matters:

- How can we judge anyone’s right to some financial compensation, pension benefit, or lower tax rate without at least knowing where and how the balance sheet is or might be filled out?

- How does the claim to a right by one set of citizens affect the rights of other citizens?

Even when courts determine that any resulting injustice is constitutional or the prerogative of the legislature, they still should do their balance-sheet homework.

In some arenas, the courts have made clear that the lack of underlying funds limits the rights of people to some promised benefit. The United States Supreme Court has stated, for instance, that Social Security benefits can be changed regardless of past legislative promises. This system is largely pay-as-you-go: benefits for the elderly come almost entirely from the taxes of the nonelderly. Because promised cash benefits now increasingly exceed taxes scheduled to be collected, even the pay-as-you-go balance sheet has not been filled out: some past Congress promised that benefits would grow over time without figuring out who would pay for that growth. Legislators can rebalance those sheets constitutionally without violating the rights of a current or future beneficiary. Whether they do so fairly is another matter.

When the courts have leaned toward treating as unalterable the rights of some citizens to unfunded promises made in the past, however, they have directly or indirectly required some unequal treatment under the law, with the young often paying the piper.

Our Urban Institute study of pension reforms in many states reveals that efforts to protect existing but not new state pensions almost always requires the young to receive significantly lower rates of total compensation than older workers doing the same work. Worse yet, we have determined that to cover unfunded liabilities from the past, some states are adopting pension plans that grant NEGATIVE employer pension or retirement plan benefits to new workers, essentially by requiring them to contribute more to the plan than most can expect to get back in future benefits.

In the case of California’s limited property tax increases, new, younger homeowners are required to pay much higher taxes than wealthier, older, and longer-term homeowners.

In these cases, it seems fairly clear that the “rights” of existing state workers or homeowners leads to an assessment of “wrongs”—unequal taxation of unequal pay for equal work—on others, mainly the young, to fill out the balance sheets.

As I say, I’m not a lawyer, but I do know that 2 + 2 does not equal 3. When the courts say that you are entitled to $2 and I’m entitled to $2, they can eventually defy the laws of mathematics if only $3 is available. It’s not that the declining availability of pension benefits to many workers and rapidly rising taxes are problems to be ignored. It’s just that assessing wrongs or liabilities on unrelated parties to a dispute is unlikely to represent equal justice under the law or an efficient way to resolve public finance issues.

A Better Alternative to Taxing Those Without Health Insurance

Posted: March 6, 2015 Filed under: Columns, Health and Health Policy, Taxes and Budget Leave a comment »Although the public debate on health insurance coverage centers on a thumbs-up, thumbs-down fight over the Accountable Care Act (ACA, also called Obamacare), our national system needs a lot of smaller fixes. Many items on this long list of fixes make sense under either a Republican alternative to Obamacare (like the one recently but only partially laid out by Representative Paul Ryan) or Democratic amendments to the existing plan. One example: rethinking the tax penalty on people who do not buy insurance, an issue receiving increased attention as the IRS assesses its first penalties. We can achieve the same end much more effectively by requiring households to purchase health insurance if they want to receive the other government benefits to which they are entitled. No separate tax is required.

The history of the tax penalty

A system of near-universal insurance—where most people of the same age, regardless of their health conditions, can buy insurance at approximately the same price—needs a backup. This need became clear when health reform proposals were first introduced in 2009. Without a backup, individuals have a strong incentive to avoid buying insurance until they are sick, thus effectively getting someone else to pay for their health care. This incentive exists regardless of income level: even a wealthy person who buys health insurance only after becoming sick could hoist his bills on those with lesser incomes who pay for insurance year-round and every year.

The ACA’s partial response to this incentive is to tax those who fail to buy health insurance. The tax for failure in 2014 was either 1 percent of income or $95 per person; it rises to 2.5 percent of income or $695 (adjusted for inflation) after 2015. At the beginning of 2015, millions of people discovered that they owed this tax as they started filing their federal tax returns for 2014.

Practical considerations have always led toward some individual requirement to buy insurance, simply because there are limits on how much government can spend on subsidizing everyone. Our very expensive health care system now entails average health costs per household of about $24,000. The federal government would have to spend just about all its revenues trying to cover all those costs. A mandate to purchase insurance is a partial alternative to ever-more subsidies—as Governor Romney knew when he implemented a related mandate in Massachusetts. At one point, the mandate idea was favored by conservatives even more than liberals as a way to avoid an even more expensive government-controlled system, such as Medicare for all.

What might work better

The problem with the Obamacare tax penalty isn’t the idea; it’s the design. This problem, in various forms, occupied the federal courts needlessly. The central dilemma that pre-occupied an earlier Supreme Court decision was whether government could mandate that we had to buy some particular product (maybe not, it said, but, at least in Chief Justice Roberts’ opinion, it could impose a tax).

Another type of requirement avoids many past and current issues surrounding the Obamacare tax penalty. Simply deny to taxpayers other government benefits if they do not obtain insurance for themselves and their families. There has been no debate over whether government can—indeed, at some level administratively must—set conditions for determining who receives benefits.

This type of requirement could be implemented in various ways. The personal exemption or the child credit or home mortgage subsidies could be limited; some portion of low interest rates for student loans could be denied. This approach entails no new “tax” for not buying insurance; it simply adds to the conditions for receipt of other government benefits.

Designed well, the denial of any tax benefit could easily be reflected in withholding, so there are fewer end-of-year surprises. Employers, for instance, could adjust withholding for months in which employees did not declare insurance for themselves. As for the many poor receiving benefits like SNAP, most tend to be eligible for Medicaid, so the requirement than they sign up could be handled better by the related administrative offices that deal with them than by the IRS imposing some surprise penalty at the end of the year.

For both administrative and political reasons, this type of requirement can also be made stricter than the current extra tax. The IRS has always had trouble collecting money at the end of the year, and people react more negatively to an additional tax than to a requirement that they shouldn’t shift health costs onto others if they want to receive some other government benefit.

The road ahead

I doubt that any future government, Democratic or Republican, is going to deny people the ability to buy health insurance at a common community rate, even if they are sick or have failed to purchase health insurance previously. The world has already changed too much. Insurance companies have adapted, and so have hospitals. Before health reform, uninsured people could generate partial benefits or coverage by receiving treatment in emergency rooms (where such care is often required by law), and then not paying their bills. With some major exceptions, that practice has declined since the ACA was implemented. No one wants to go back to the old ways.

In a partisan world, of course, a fix of almost any type becomes difficult. Republicans are afraid to fix almost any aspect of Obamacare for fear it would involve a buy-in to the plan’s success; Democrats dread amending Obamacare because it might hint at some degree of failure. Watching the current Supreme Court battle, you sense that many enjoy the fight more than anything else. Still, this simple fix should be added to the list of reforms for consideration when and if we decide we want something better.

Addressing income inequality first requires knowing what we’re measuring

Posted: February 18, 2015 Filed under: Columns, Economic Growth and Productivity, Income and Wealth, Taxes and Budget 1 Comment »Politicians, researchers, and the media have given a good deal of attention recently to widening income inequality. Yet very few have paid attention to how—and how well—we measure income. Different measures of income show very different results on whether and how much inequality has risen. Without clarity, even honest and non-ideological public and private efforts to address inequality will fall short of their mark—and, in some cases, exacerbate inequality further.

How we typically measure income

Income measures tell different stories about opportunity and can be useful for different purposes. Some studies on income inequality measure income before government transfers and taxes—for instance, studies that compare workers’ earnings over time. Studies of the distribution of wealth or capital income, too, typically exclude any entitlement to government benefits. These “market” measures capture how much individuals have gained or lost in their returns from work and saving.

More comprehensive measures examine income after transfers and taxes. Transfers include Social Security, SNAP (formerly food stamps), cash welfare, and the earned income tax credit. Taxes include income and Social Security taxes. These measures best capture individuals’ net income and what living standards they can maintain, but not their financial independence or how much they are sharing directly in the rewards of the market.

Within both sets of measures (pre-tax, pre-transfer and post-tax, post-transfer), most studies still exclude a great deal. Health care often fails to be counted, even though increases in real health costs and benefits now take up about one-third of all per-capita income growth. Most of these health benefits come from government health plans (like Medicare and Medicaid) or employer-provided health insurance. Households pay directly for only a minor share of health costs, so they often don’t think about improved health care as a source of income growth.

How improving our definition of income—and using alternative measures—sharpens our view of income inequality

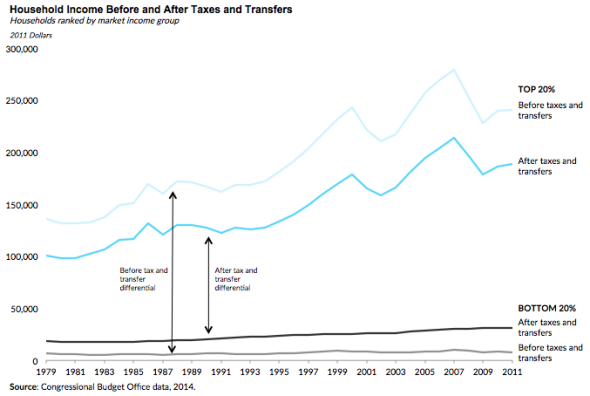

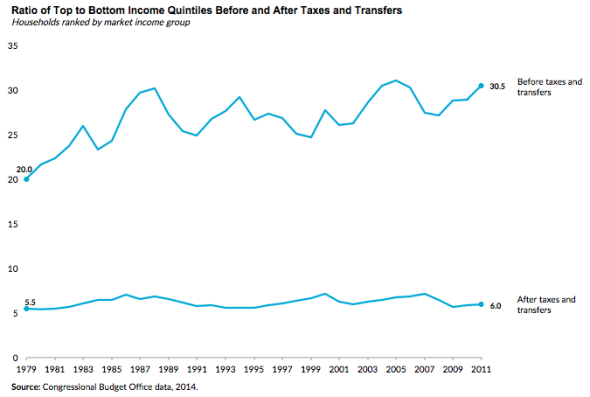

Starting with a more comprehensive measure of income, and then breaking out components, can improve our understanding of income inequality and its sources. As an example, let’s use some recent Congressional Budget Office (CBO) estimates, which provide perhaps the most comprehensive measure of household market incomes (consisting of labor, business, capital, and retirement income), then add the value of government transfers and subtract the value of federal taxes.

Between 1979 and 2011, the average market incomes—that is, incomes before taxes and transfers—of the richest 20 percent of the population (or the top income quintile) grew from 20 times to 30 times the incomes of the poorest 20 percent (the bottom income quintile).

When examining income after taxes and transfers, however, the relationship between the top and bottom income quintiles is more stable. It starts at a ratio of about 5.5:1 in 1979 and increases very slightly to 6:1 by 2011.

We find somewhat similar trends when comparing the fourth quintile with the second quintile. After taxes and transfers, income ratios don’t change much over this period, though the market-based measures of income show increased inequality. Of course, the very top 1 percent still has gained significantly; in 2011 it had nearly 33 times the income of the bottom 20 percent, compared with about 19 times in 1979.

What’s still missing

Even the CBO measures, however, are far from comprehensive. They exclude many benefits that are harder to measure or distribute, such as the returns from homeownership and the value of public goods like highways, parks, and fire protection. As Steve Rose points out, even more elusive are the broadly shared gains in living standards brought by improved technology and new inventions.

Why getting it right matters

Though defining income may seem like merely a technical exercise, it has huge consequences. Inequality has always been a political football: all sides tend to quote statistics that support their policy stances while ignoring the statistics refuting them. Yet if we want good policy, we’ve got to be open to how well any particular policy might improve income equality by one measure or make it worse by another, often at the same time. This is not a new story: bad or misleading information almost inevitably leads to bad policy.

This column first appeared on MetroTrends.

The President’s Capital Gains Proposals: An Opening for Business Tax Reform?

Posted: February 6, 2015 Filed under: Columns, Taxes and Budget Leave a comment »In his budget proposal, President Obama would raise capital gains taxes as a way to finance middle class tax relief. Along with many Republicans, he also supports tax rate cuts for business and efforts to prevent multinational corporations from avoiding U. S. taxation.

This raises an intriguing possibility. Why not pay for at least some corporate tax cuts with higher taxes on individuals on their receipts of capital gains or similar returns? In effect, as it becomes increasingly difficult to find a workable way to tax profits of the largest businesses, largely multinational companies, why not tax shareholders directly?

Most proposals to deal with the complexities of international taxation wrestle with how to tax corporations based on their geographical location. But as Martin Sullivan of Tax Notes said years ago, what does it mean to base taxes on a company’s easily-reassigned mailing address when its products are produced, consumed, researched, and administered in many places?

By contrast, individuals usually do maintain residence primarily in one country. Thus, reducing corporate taxes while increasing shareholder taxes on U.S. residents largely avoids this residence problem. Indeed, many proposals, such as a recent one by Eric Toder and Alan Viard, move in this direction. While such a tradeoff is not a perfect solution, it makes the taxation of the wealthy easier to administer and less prone to today’s corporate shelter games.

Many have made the case for why cutting corporate rates is sound policy. On what policy grounds can Obama’s plan for raising taxes on capital gains fit into this story?

Much of the publicity about taxing the rich focuses on their individual tax rate. But many very wealthy people avoid paying individual taxes on their capital income simply by never selling stock, real estate, or other assets on which they have accrued gains. That’s because, at death, the law forgives all capital gains taxes on unsold assets.

The very wealthy, moreover, tend to realize a fairly small share of their accrued gains and an even smaller share than those who are merely wealthy. It makes sense: the nouveaux riche seldom become wealthy unless they continually reinvest their earnings. And when they want to consume more, they can do so through means other than selling assets, such as borrowing.

Warren Buffett was famous for claiming that he paid lower tax rates than his secretary, alluding in part to his capital gains rate versus her ordinary tax rate on salary. But Buffett doesn’t just pay a modest capital gains tax rate (it was 15 percent when he made his claim and about 25 percent now). On his total economic income, including unrealized gains, it’s doubtful that his personal taxes add up to more than 5 percent.

At the same time, many of the wealthy do pay significant tax in other ways. If they own stock, they effectively bear some share of the burden of the corporate tax. Real estate taxes can also be significant and not merely reflect services received by local governments. Decades ago I found that more tax was collected on capital income through the corporate tax than the personal tax. Today, the story is more complicated, since many domestic businesses have converted to partnerships and Subchapter S corporations, where partners and shareholders pay individual income tax on profits.

The President would raise the capital gains rate and tax accrued gains at death. This would encourage taxpayers to recognize gains earlier, since waiting until death would no longer eliminate taxation on gains unrealized until then. The proposal would effectively capture hundreds of billions of dollars of untaxed gains that forever escape taxation under current law.

Trading a lower corporate tax rate for higher taxes on capital gains could also result in a more progressive tax system since many corporate shares sit in retirement plans and charitable endowments. It would reduce to hold onto assets—in tax parlance, lock-in—and the incentive to engage in tax sheltering. There’s also a potential one-time gain in productivity, to the extent that the proposal taxes some past gains earned but untaxed, as such taxes would have less effect on future behavior than the taxation of current and future returns from business.

Tough issues would remain. Real reform almost always means winners and losers. For instance, how would a proposal deal with higher capital gains taxes for non-corporate partners and owners of real estate? Toder and Viard, for instance, would apply higher individual taxes only on owners of publicly-traded companies.

Still, some increase in capital gains taxes could help finance corporate tax reform without reducing the net taxes on the wealthy. It is exactly the type of real world trade-off that both Democrats and Republicans must consider if they are serious about corporate tax reform.

This column originally appeared on TaxVox.

President Obama’s Middle-Class Tax Message in the State of the Union

Posted: January 21, 2015 Filed under: Columns, Taxes and Budget 1 Comment »President Obama’s tax proposals for the middle class were a key element of his State of the Union address. But they represent only relatively modest efforts to create subsidies through the tax code rather than through other departments of government. Looked at broadly, many only tinker around the edges of tax policy and count on an overloaded and troubled agency, the IRS, to administer them.

Will $320 billion of tax increases finance very much?

The President proposes $320 billion in tax increases on the wealthy. It sounds like a lot. But how much would it finance in expenditures and additional tax breaks, assuming it is all spent rather than used to reduce the deficit? Well, there are approximately 320 million Americans, so the proposal would garner about $1,000 per person. But, then again, the $320 billion would be raised over ten years, so that’s about $100 per person per year that could be financed.

Now compare the $100 per year with what we already spend. Add together federal, state, and local spending plus tax subsidies (and the President would “spend” a good deal of his additional revenue on new tax subsidies), and the figure comes out to more than $20,000 per person. And that spending is scheduled to rise by an average of several thousand dollars per year over the same ten year period, due more to (hoped for) economic growth than anything else.

None of these observations speaks for or against the proposals. I like some of them, don’t like others. But if you want to have a significant impact on the budget and on the well-being of citizens, concentrate on where the money is.

Should we throw even more subsidies into the tax code?

Like almost all his recent predecessors, the President talks in his State of the Union address about tax simplification, but in almost the same breath he proposes a range of new tax subsidies. It’s an old story. Tax cuts show up as “smaller” government to those who simply count up net government revenue as a measure of government size. According to that theory, we could achieve dramatically limited government or no government at all if we put all expenditures into the tax code, thereby collecting negative taxes on people, at least as long as we run deficits.

Huge jurisdictional problems also lead to more and more being put into the tax code. Discretionary spending is capped; tax subsidies are not. Congressional tax committees can use increased revenues to pay for increased tax subsidies, but they do not have the jurisdictional authority to spend additional tax revenues on higher levels of spending, or, on the flip side, to reduce many items of direct spending to pay for lower tax rates.

Now I’m not suggesting that a new tax subsidy is necessarily more complex than a new expenditure. But it does raise the issue of whether the IRS is the right agency to administer the subsidy. All of this is coming at a time when the IRS has lost significant resources, the Taxpayer Advocate suggests we should be ready for a horrible filing season in which taxpayers will have difficulty getting ahold of someone in IRS to advise them, and many in the IRS remain disheartened and have been pushed into a bunker mentality that fears bad publicity more than bad administration.

This column originally appeared on TaxVox.

America’s Can-Do New Year’s Resolution

Posted: January 6, 2015 Filed under: Columns, Economic Growth and Productivity, Income and Wealth Leave a comment »How about a national new year’s resolution for 2015? Here’s my suggestion: let’s resolve to restore our can-do spirit, sense of destiny, and vision of frontiers as challenges rather than barriers. Let’s remember that fear and pessimism multiply the negative impact of bad events, whereas optimism reinforces positive outcomes. Think of Louis Howe, who added “the only thing we have to fear is fear itself” to Franklin Delano Roosevelt’s first inaugural address, or Henry David Thoreau, who wrote that “nothing is so much to be feared as fear.”

Now, seven years after the start of the Great Recession, it’s a good time to reflect on just how lucky we are as a nation and on the vast ocean of possibilities that lie before us. If we don’t see those possibilities, we’ve simply turned our back to them—and forgotten how America became America in the first place. In Dead Men Ruling, I attack viciously both the notion that we live in a time of austerity and the politics that sells pessimism as a way of clutching onto our piece of the national pie.

No one knows the future, of course. But the evidence points strongly toward the potential of a people whose can-do spirit helped it establish the first and now longest-lasting modern democracy, conquer frontiers of land and space alike, enhance freedom at home and abroad, and lead in the industrial, technological, and information revolutions.

Though income tracks only some of our general gains in well-being, we’re hardly poor. Our GDP per household is about $145,000, and real income per person is more than 75 percent higher than when Ronald Reagan was first elected president. We are richer than before the Great Recession. And, even projections of slower growth imply that average household income will rise by around $24,000 within roughly a decade.

We have available goods and services of which kings and queens of old could not have dreamt: not just the very visible gains in ways of communicating and entertaining ourselves, but fresh fruit and vegetables year round, life expectancies and health care far beyond those of our parents and grandparents, and continually improving automobiles, shelter, clothing, travel options, plumbing, and building architecture. And much more to come.

Of course, it’s part of our human condition to focus on the next problems, the ones we haven’t solved. Such striving provides the very basis for continued growth. Your hard labors, your dedication and sacrifices, and your everyday efforts to care for older and younger living generations may not make news. But they do make the world go around.

Our mistake comes from paying attention to those in politics, the media, or our own community who turn our mutual problems into excuses for personal attacks or a sense of helplessness rather than calls for further joint and individual efforts. We know the temptations: for the media, if it bleeds, it leads; for the politician, if it smells, it sells; for the business, if it deceives, it succeeds. But there’s no reason that either they or we need fall prey to such tricks.

If some current debates aren’t as enlightened as they might be, we can still sense progress from where they might have been a generation ago. We don’t debate whether cops should discriminate against different groups—an issue my brother-in-law confronted while working for the FBI in Little Rock, Arkansas in 1957—but instead how to pay proper respect to each person, civilian and cop alike. We don’t debate whether people should have enough food to eat but whether graduate students should collect food stamps. We don’t debate whether to help the disabled but how to extend efforts toward the mentally ill, the autistic, and those who are too old to be treated in school settings. We don’t debate whether to protect the old but whether our old age programs emphasize too much middle-age retirement rather than the needs of the old. When we engage these debates, whether on the same or different sides, most of us concentrate on how to do better, how much government efforts help or hinder progress, and how to shift our resources toward more effective or productive efforts.

In the end, the case for progress rests not on some wild-eyed dream but on the simple notion that we stand on the backs of those who went before us. Available knowledge expands. It doesn’t recede—even if at times we let our minds recede through laziness, prejudice, and fear of the new, or we reinforce political institutions that protect their power or status by blocking advancement.

That’s where we Americans are especially lucky. The can-do spirit, the entrepreneurial urge, and the freedom to try new things have been among the greatest strengths of our people, who continually find new paths forward and ever-broader vistas.

So my optimism is easy to explain: I trust in you. Happy New Year.

An April 15 Deadline for Charitable Giving Would Be a Boon to Nonprofits

Posted: December 16, 2014 Filed under: Columns, Nonprofits and Philanthropy, Taxes and Budget Leave a comment »Many years ago, I began to suggest that taxpayers should have the opportunity to give to charity all the way until April 15 and then take a deduction against their previous year’s taxable income.

Now the idea is getting attention from lawmakers—but it needs the support of charities to make possible the increase in charitable giving it would foster.

In previous years, Congress approved a post-December adjustment to stimulate certain kinds of behavior: Taxpayers who add to individual retirement accounts have been offered a similar option since the mid-1970s, and Congress has occasionally extended the charitable-giving deadline to April 15 for disaster relief, as in the aftermath of Hurricane Katrina.

A great deal of evidence suggests that simply changing the charitable-deduction deadline could increase giving significantly.

Nonprofits like the Jewish Federations of North America support the option, but some other charities have expressed concern about whether it would harm end-of-year appeals.

I would suggest that these charities avoid thinking of charitable giving as a fixed amount—what I call the “clump of charity” thesis.

All the research, plus some real-life fundraising experience, suggests that the April 15 option would lead to an overall increase in the sums Americans give annually.

Just for a minute, however, let’s suppose that the clump-of-charity thesis is right and that the amount of charitable giving nationwide is the same every year. If that’s the case, then it’s unwise to add this new wrinkle to the tax system. But consider the corollaries: If giving is immune to incentives or circumstances, then both the charitable deduction and fundraising more broadly are superfluous, if not wasteful.

I doubt that most fundraisers believe the clump-of-charity thesis, so the real question is whether an April option would increase giving. Here are six pieces of evidence suggesting it would be a wise policy:

Taxpayers tend to underestimate the incentive to give. Several scholarly papers, including by researchers associated with the Federal Reserve Board and the National Bureau of Economic Research, have examined how well taxpayers understand and respond to tax provisions.

It turns out that many taxpayers, particularly middle-class ones, possess only a limited idea of their marginal tax rate—that is, the rate of subsidy they would get for additional charitable gifts if they itemized. They tend to equate the marginal rate with the average rate of tax they pay on all income, not recognizing that tax law looks differently at the first dollar and the average dollar earned than at the last one.

For example, a taxpayer who earns $50,000 might owe $5,000, or 10 percent of income on average. So she might imagine at year’s end, without formally doing her taxes, that donating $100 more before April 15 would save her that average percentage, or just $10 in taxes. But if she prepared her taxes under an April 15 option, she would get a formal notice from her tax software or tax preparer telling her such a gift would save her $25 and cost just $75 out of pocket.

If people saw this information laid out clearly with a first draft of their tax return, they would quickly grasp the real benefits of an increase in giving.

Few people know their tax and income circumstances until they get that information in January and beyond. Many Americans reconcile their books when preparing their tax returns. At this time, they see whether they’ve met goals and what options they’ve passed up but should have considered. That’s why the April 15 proposal should appeal to organizations that are working to attract gifts of all sizes, not just those that get more modest contributions from the broad middle class.

Advertising works best when it is closely timed to the activity you want to promote. Marketers understand this: That is why grocery stores send flyers out near weekend shopping time, not months in advance.

There is absolutely no time like tax time, not even the end of the year, when people are so tuned into taxation after toting up their annual income and charitable gifts. What better time to promote an opportunity to them?

Charities would get tons of free marketing from influential players. Hundreds of thousands of tax preparers and tax-software designers would promote the idea of charitable giving to their clients. Tax software already walks people through ways to reduce their taxes, and my discussions with people who deal with the interaction between technology and fundraising indicate that people preparing their tax returns could easily be encouraged to make a gift with just a few clicks of a mouse while filling out their returns.

Many trained tax preparers, in turn, would give special attention to the April 15 option for reducing taxes. They want to make clients happy, and they, too, want to improve their communities and the nation.

The April 15 option would be an even better deal for the federal treasury than the basic charitable deduction.

While the charitable deduction on average increases giving by 50 cents to $1 or a bit more for every dollar of revenue lost to the government, the April 15 option would provide $3 to $5 on average to charity for every dollar of revenue loss.

Why? Much of the existing deduction subsidizes giving that would occur anyway, but the additional cost with the April 15 idea applies only to added giving. For a taxpayer in a 25-percent marginal tax bracket, for instance, each additional $100 of giving costs the Treasury just $25.

People don’t like paying taxes. Alex Rees-Jones, an assistant professor at the University of Pennsylvania’s Wharton School, has found that taxpayers seek to minimize the amount they owe when they file.

The April 15 option would allow them to pay less to Uncle Sam when they haven’t withheld enough money over the year, and it would be a good way to use some of their refund when they have. They could also avoid penalties at times by simply giving more to charity.

To be sure, people who worry about the April 15 idea do have a legitimate concern: While giving over all would almost assuredly go up, some people would simply change when they give.

Still, while some people might delay one year’s end-of-year giving until the first months of the following year, others might accelerate each year’s end-of-year giving to the beginning of the same year.

This adjustment, I believe, is a small price to pay for the gain to charities over all. And charities can maximize the benefits by promoting giving both at the emotional time when people are thinking about helping others during the holidays and then again at tax time when people are focusing on taxes and how tax incentives help them stretch their own finances to aid those in need.

The debate over the April 15 option reminds me of when I served as a cofounder of a community foundation in Alexandria, Va. Initially, a few charities expressed anxiety about competition, but once they saw how the foundation’s activities raised money for them and helped expand their management capacity, any fear turned to broad-based support.

The April 15 option deserves the full advocacy of all nonprofits. It would be among the most cost-efficient ways possible to increase giving.

At a time when we depend so heavily on nonprofits, that’s exactly what we need.

This post originally appeared in The Chronicle of Philanthropy.