Henry Ford, the American Experience, and Why and How the Distribution of Income Affects Growth in the Modern Economy

Posted: January 29, 2013 Filed under: Columns, Economic Growth and Productivity, Income and Wealth 3 Comments »One hundred years ago Henry Ford dropped the price of his Model T to $550. Having adopted new and successful engineering and assembly techniques, the company’s sales expanded exponentially, approximately tripling between 1911 and 1914 alone. Henry Ford bragged that his car would be “so low in price that no man making a good salary will be unable to own one.”

On the American Experience (January 29, 2013) PBS covers the biography of Henry Ford. That story has application to our own time in explaining how the distribution of income affects economic growth.

Ever since the Industrial Revolution, economies of scale—mass production with lower cost for the last items produced than for the first—have been the primary engine of income growth for nations and workers. Ford’s talent at mass production not only made him extraordinarily rich, it helped increase the effective incomes of workers throughout the country since their earnings could go farther. While massive rewards did accrue to entrepreneurs, inventors, and those gaining temporary monopolies, the rising tide lifted all boats; it even leveled out the gains as the forces of competition limited how much leading capitalists could garner for their efforts of yesteryear.

Henry Ford’s fight with unions to the side, he did recognize from the start that workers needed to earn enough to buy his products. I’m not suggesting that the cart of workers’ incomes leads the horse of profits, but rather that they move forward together. Ford at least knew that he and some of the other rich people he tended to detest could use only so many cars themselves; if the everyday citizen couldn’t buy them, he could never get rich.

So how did we move toward a society where today profits seem to be rising but workers’ incomes remain stagnant? The main answer, I believe, is that while economies of scale have expanded extraordinarily since Ford’s day, the necessary purchasers of the new products lie within a global economy. The growth of U.S. workers’ incomes is less necessary for the producers of new goods and services to become wealthy.

Consider how many modern-day Henry Fords produce goods and services with limited physical content: pharmaceutical drugs, electronic software, technology, movies, and other forms of entertainment and information. These “industries” provide much of the growth of the modern U.S. economy.

Many products within these growth industries can be produced at almost no cost for the next or marginal purchaser. How much does it cost Hollywood producers to let one more person watch a movie? For the drug manufacturers to produce one more pill? For Microsoft or Apple to make software available to one more person? Almost nothing in many cases, other than marketing. As economies of scale expanded as we moved through the 20th to the 21st century, so, too, have the possibilities for growth when more people have enough money to buy these new products. If the costs of a pill or movie can be shared among 10 million people, rather than 1 million, then the world economy can expand quickly when 9 million more people can afford to buy the product.

These economies extend beyond production to transportation, storage, and similar costs. It doesn’t cost much to “transport” a movie to Monaco, a pill to Paris, or software to Sofia.

Modern capitalists seek their buyers within a world population of 7 billion, not a U.S. population of 300 million. When creating products with extraordinary economies of scale that are easily transportable, at low weight or even with the click of a mouse button, the new American entrepreneur still wants purchasers whose incomes rise enough to buy these new goods and services. It’s just less necessary that those purchasers reside in the United States.

Does this mean that income becomes increasingly unequal? It depends partly upon whom you count and what type of measure you use. Almost no one could have guessed even a few decades ago the rise of hundreds of millions of middle-class people in China and India. At the same time, it’s also possible that incomes will rise initially for U.S. and Indian entrepreneurs and for workers in Bangalore, but not for large portions of the population in either the United States or India.

I am not arguing that all the consequences of this world order are sanguine. But only by defining its characteristics can we identify our opportunities.

First, consider how substantial economies of scale make higher growth rates possible when incomes rise across the board. Productivity just doesn’t rise as quickly when we build and subsidize McMansions for the few rather than employ workers to provide goods and services with greater economies of scale for the many.

Similar calculations can affect welfare policy. It may not cost us very much directly to give lower-income people the ability to buy goods and services with large economies of scale. For instance, if we give a household $1,000 that it uses to buy a television subscription that at the margin costs a cable company only an additional $100 to provide, then the net cost to the non-welfare part of society may also be only $100 despite the transfer of $1,000. At the same time, if the $1,000 subsidy at a $100 marginal cost of production results in plus $900 to a monopoly cable company and minus $1,000 to the taxpayer, then both the welfare recipient and the taxpayer may have reduced incentive to work. Private income (before welfare) also becomes more unequal.

Or consider antitrust policy. Tying it to its 19th century moorings may be inadequate for a 21st century economy. International competition may lessen any concern over having only four major American automobile manufacturers, but what about the concentration of accounting practices among the Big Four? Did the breakup of Arthur Andersen for its accounting indiscretions promote or reduce competition?

What about our current multi-tiered pricing of drugs, higher at home and lower abroad? Without any compensating mechanism, does this increase net output from the United States but at an unfair cost to U.S. consumers?

To answer all these questions, we need to concentrate correctly on causes, not inveigh interminably on impressions. One conclusion from Henry Ford’s day still stands out in my mind: promoting greater growth means both a favorable climate for entrepreneurship and a sharing of its rewards broadly with workers.

The Case for Optimism in the New Year: Still Standing on the Shoulders of our Forebears

Posted: January 3, 2013 Filed under: Columns, Economic Growth and Productivity, Taxes and Budget 2 Comments »With all the silliness going on in Washington these days, and with recovery from recession slow here and halting in many other developed nations, we could easily adopt a pessimistic attitude that obscures the prospects lying right at our feet. At the beginning of a new year, I think we instead need to pause and reflect on our graces and blessings, even as we confront the obstacles we have placed in the way of realizing our potential.

First, let’s not translate politicians’ largely self-imposed requirement to make some tough economic choices into the false premise that we lack resources to do anything new, much less better. Are we poor? Hardly. We’re richer than almost any country anywhere and anytime. If we’re growing more slowly than we expect, that only means we’re getting richer more moderately. With average gross domestic product per household now exceeding $125,000, we can easily get misled by focusing on gloomy statistics that exclude or don’t count for improvements.

Here are some among the many pieces of evidence that we often ignore: the ever-better health care that we receive annually through almost any insurance plan, whether employer- or government-provided; the steady increase in life expectancy; and the improvement in the quality of our computers, telecommunications, automobiles, and other durable goods.

Is the public sector in decline? Well, it might be dysfunctional, and it might not be growing as fast as it did in recent decades, but consider: federal and state government spending, including tax subsidies, exceeds $50,000 per household. That amount is greater than the average real income of households from all sources, public and private, in the early 1960s. Transfer programs are more than 50 percent larger than when Ronald Reagan became president. Look closely at every proposed budget, Democratic or Republican, and you will see that they project incomes will increase by about 30 percent—or $5 trillion in today’s dollars—in about a decade. Meanwhile, government spending and revenues will grow by a similar share, perhaps a bit less under one political party than the other. (I hesitate to say that it will grow more slowly under Republicans, since history often belies that conventional wisdom.)

Compare what is required to get the budget in order with what economic growth normally makes possible. Want to reduce budget deficits by, say, 5 percentage points of GDP or about $1 trillion annually in another decade? That’s just a fraction of the rise in incomes that we expect and hope to achieve, yet it’s far more than either political party has come close to suggesting, and probably more than necessary. To top it off, deficit reduction does not mean reduced wealth any more than paying off a credit card does. It merely means that we accept paying more of our bills now rather than passing the liabilities onto our children.

Why the optimism surrounding economic growth? We stand on the shoulders of those who have gone before us. They passed onto us all their knowledge and left us with a country rich in citizens and communities, institutions and inventions, rights and resources. We have a long-established history of entrepreneurial ingenuity; a flexible labor force; the world’s most thriving set of charities, associations, and universities; and, for all our petty bickering, a people united by belief in our republic, and not, as in so many countries, divided by clan or tribe or religion. Even our barriers of race and gender have been falling away, much to the benefit of everyone, not just those who suffer from discrimination.

Not that countries can’t go into decline. Argentina early in the 20th century, Bosnia more recently, and Yemen today provide warnings. The overpromised political systems of Japan, Western Europe, and the United States provide new threats, as does population and labor force decline in some countries. The young are falling behind previous generations in their accumulation of wealth, many people of color have stopped catching up as they did in the past, and our educational systems are showing few gains. Too unequal a distribution of income and wealth also threatens growth for both social and economic reasons (on which I will elaborate little here other than to note how much modern growth everywhere has been correlated with a thriving middle class).

Yes, all these problems threaten us at a time when our political institutions appear to have languished and gone into decline. Yet, even that problem, I believe, reflects a search for a fundamental government transformation that has occurred only a few times in our vibrant, yet still young and ever-challenging, democratic experiment.

At the beginning of another year, therefore, let’s resolve to recognize within our challenges the extraordinary opportunities we, too, possess for bequeathing a better world to our children.

Testimony on Marginal Tax Rates and Work Incentives

Posted: July 9, 2012 Filed under: Economic Growth and Productivity, Income and Wealth, Shorts, Taxes and Budget 2 Comments »On June 27, 2012 I testified before the House Subcommittees on Human Resources and Select Revenue Measures on the interaction of various welfare and tax credit programs and work incentives. My full testimony, “Marginal Tax Rates, Work, and the Nation’s Real Tax System” can be found here, and the entire hearing can be watched online here. Below is a shorter summary of my remarks.

The nation’s real tax system includes not just the direct statutory rates explicit in such taxes as the income tax and the Social Security tax, but the implicit taxes that derive from phasing out of various benefits in both expenditure and tax programs. These “expenditure taxes,” as I call them, derive largely from a liberal-conservative compromise that emphasizes means testing as a way of both increasing progressivity and saving on direct taxes needed to support various programs. Although low- and moderate-income households are especially affected, you can’t turn around today without spotting these hidden taxes in Pell grants, the AMT, and in dozens, if not hundreds, of programs.

At the Urban Institute we have done quite a bit of work on calculating these rates. One case study we examined was a single parent with two children in Colorado in 2011, to find the maximum benefits for which such a person may be eligible and how they phase out as income increases. (Our net income change calculator (NICC) is now available on the WEB site and can demonstrate tax rates for families in a variety of circumstances in every state.) Rates are low or negative up to about $10,000 to $15,000 of income. Thereafter, they rise quickly. We also looked at the effective tax rate for a household whose income rises from $10,000 to $40,000, and found that income and payroll taxes take away about 30 percent of earnings. The phase out of universally available benefits such as EITC and SNAP or food stamps raises the rate to about 55 percent, and the household getting maximum subsidies, such as welfare and housing, sees a rate of about 82 percent. What used to be called a poverty trap has now moved out to what Linda Giannarelli and I have labeled the “twice poverty trap.” That is, the high rates especially hit households that earn more than poverty level incomes.

Many studies have attempted to show that the effect of these rates on work, and the results are mixed. Work subsidies such as the EITC generally encourage labor force participation but may tend to discourage work at higher income levels, particularly for second jobs in a family or moving to full time work. Design matters greatly. For instance, Medicaid will discourage work among the disabled more than a subsidy system such as the exchange subsidy adopted in health reform; on the other hand, health reform will probably encourage more people to retire early. For the same amount of cost, a program that requires work will indeed lead to more work than one that does not. EITC and welfare reform have done better on the work front than did AFDC.

Other consequences must be examined. Means testing and joint filing have resulted in hundreds of billions of dollars of marriage penalties for low and middle income households. Not marrying is the tax shelter for the poor. Many programs do help those with special needs, although they vary widely in their efficiency and effectiveness. There is some evidence that well-developed programs can improve behaviors such as school attendance and maternal health. At the same time, long-run consequences are often hard to estimate.

Just as a classic liberal-conservative compromise got us to this situation, so might it require a liberal-conservative consensus get us out of it. Among the many approaches to reform are (a) seeking broad-based social welfare reform rather than adopting programs one-by-one with multiple phase-outs, (b) starting to emphasize opportunity and education over adequacy and consumption; (c) putting tax rates directly in the tax code to replace implicit tax rates, (d) making work an even stronger requirement for receipt of various benefits, (e) adopting a maximum marginal tax rate for programs combined, and (f) letting child benefits go with the child and wage subsidies go with low-income workers rather than combining the two.

Declines in Wealth and Declines in Income

Posted: June 26, 2012 Filed under: Economic Growth and Productivity, Income and Wealth, Shorts 1 Comment »The press recently had a field day reporting the decline in wealth from 2007 to 2010, as measured by a recently released Survey of Consumer Finances. Be careful interpreting those results. A decline in the valuation of wealth does not necessarily mean any decline in collective well-being or consumption in a society.

Think of a decline in the price of gold. Society doesn’t necessarily consume any less of anything, and the loss for the gold seller is a gain for the gold buyer. More relevant to the current crisis, take the value of a house. It doesn’t produce any fewer services just because it sells for less. And the buyer gains what the seller loses. A retiree’s hope for selling and then spending down those assets in retirement may be reduced, but his children’s earnings go a lot further if they decide to buy a house.

There are, of course, real and agonizing losses from a recession. They largely come from the decline in output of society and of the corresponding income of its citizens. There are too many unemployed and underemployed resources, both people and capital. When a decline in society’s aggregate wealth reflects a reduction in the collective value of all the future things it can produce or buy—for instance, because factories produce less—then there are total net losses that are never recovered. Even here, however, one must distinguish between when the decline in wealth valuation occurs and when the losses to society really take place. Greece’s economy, for example, was long on a downhill curve, which the markets finally realized. In fact, if the reform effort succeeds, Greek citizens may end up with a more, not less, wealthy economy than they had when stocks and bonds started tumbling downward.

Are French and Greek Election Results That Surprising?

Posted: May 9, 2012 Filed under: Economic Growth and Productivity, Shorts Leave a comment »I’m fascinated by articles finding any mystery in the recent French and Greek elections. Do the results prove or disprove the sagacity of recent austerity drives in European budgets? Do they presage the resurgence of socialist initiatives in France? Do they sound the death knell for established political parties in Greece?

Hardly. The French and Greek governments were only the latest two of perhaps a dozen to fall in the past few years. Some count Barack Obama’s election as president of the United States in 2008 and the Republican Party’s recapture of the House of Representatives a mere two years later as similar political upheavals.

Throughout the developed world we are seeing the electorate respond to two powerful forces. The first: the Great Recession and its aftermath. In the wake of this severe economic downturn, no political party is safe, and public opinion bounces from left to right to everywhere in between. Voters are mainly rejecting whoever is in power, with the source of popular frustration switching from the recession to the lack of a better recovery.

The second, less obvious force: a new fiscal era whose details have yet to be resolved. Since World War II, politicians have been able to operate mostly on the give-away side of the budget, with legislation dominated by tax cuts and spending increases. Now these generous governments have shot their wads, giving away not just current resources but any that ever will be available—and then some. That’s tough. Politicians usually do not run on what they are going to ask for from us, as opposed to what they are going to give us. And we voters punish politicians when they try to either pay for all those past give-aways or pare them back.

These problems are not the left-right issues of the 20th century. Political parties themselves must redefine themselves for this new era, and, since they haven’t figured that out, their internal upheavals match their external ones in dealing with the voter.

Expect the political turmoil to continue.

How Social Security Can Costlessly Offset Declines in Private Pension Protection

Posted: June 30, 2010 Filed under: Columns, Economic Growth and Productivity, Income and Wealth, Race, Ethnicity, and Gender Leave a comment »Here’s a well-kept secret: the Social Security Administration today offers one of the best investment options anywhere. This great deal allows individuals to add to the Social Security annuities that they already qualify for at age 62. Since the classic pension plans that used to provide workers with private annuity payments until death are fast disappearing, this option gets more valuable by the day.

This add-on, like the basic Social Security annuity, is as insured as an investment can get, doesn’t fluctuate with the stock market or economic downturns, and rises in value along with inflation. The rate of return is decent too.

So where’s the rub? This option is buried in Social Security’s overlapping and confusing provisions. That’s why so few people who could really use this extra protection end up understanding, much less buying, it.

My suggested reform: daylight this hidden concoction of provisions and convert it into an open, understandable, and far more flexible option. Doing so would favor saving and reward work while better preparing elderly people for their very high likelihood of living to age 80 and beyond. And it needn’t cost anything.

How? As part of a broader Social Security reform of the retirement age. Instead of confusing notions of early retirement at 62 and normal retirement at 66, surrounded by formal “earnings tests” and “delayed retirement credits,” adopt a simpler annuity option. (Stay tuned for some definitions of terms, but keep in mind that the very fact that most people misunderstand how all these provisions interact proves the need for reform.)

Under my plan, the Social Security Administration would simply tell people their benefit at a specific retirement age (either an earliest age or a “normal” age). Then it would show a simple set of penalties or bonuses for withdrawing money or depositing it with Social Security. It could fit on a postcard.

Although not essential, I would sweeten the deal for people who not only delay benefits but also work longer and pay extra taxes. With this additional option, the penalties would be higher and the bonuses greater for workers than nonworkers. For instance, the employee portion of Social Security tax could be credited as buying a higher annuity. These extra bonuses could be financed by making the up-front benefit available at the earliest retirement age a bit lower for higher-income beneficiaries who stop working as soon as possible. This combined strategy backloads benefits more to later years when people are older and frailer, and it encourages work—an approach I have advocated, as does Jed Graham in his recent book, A Well-Tailored Safety Net.

The simple, easily understood bonuses would basically be annuities with higher payouts than standard Social Security benefits. They could be purchased whether a worker quit work or not. As people can today, many would purchase these fortified annuities by forgoing all their Social Security checks for a while. But, unlike today, they could also specify how much of their Social Security check they would forgo or send a separate check to Social Security.

How would the poor fare under this new approach? To protect them, let’s increase minimum benefits under Social Security so most lower-income households end up with higher lifetime Social Security benefits—regardless of what other reforms may be undertaken. Say, for example, we accept the additional option of lowering the up-front benefit for those who totally stop work as soon as possible in their 60s by 10 percent but bump up a minimum benefit to $900. Then someone who used to get more than $1,000 could get less in those early years but has a great option for beefing up the annuity in later years. Someone formerly getting $1,000 or less would not lose out at all, even in early years of retirement.

Helpful employers (or 401(k) account managers, financial planners, or banks) could help workers take advantage of this great annuity option. As one example, they could easily map out a range of schedules for drawing down private assets or taking partial Social Security checks for a couple of years in exchange for better old-age protection—higher annual, inflation-adjusted payments—in later years.

Setting up a similar payout trade off today is sometimes possible if you’re not easily discouraged, but you wouldn’t get much credit for additional taxes. In fact, you can even send back Social Security money received in the past to boost future benefits. (Who knew?)

Too bad most people believe that if they hit age 62 in 2010, the “earnings test” they face is a “tax” up to the age 66 that reduces benefits by 50 cents for every extra dollar they earn between $14,160 and $37,680. But that’s what they think, and they calculate this “tax,” add it to their other tax burdens, and quickly decide that they’re better off retiring. Yet, that’s not really right. In truth, if they forgo some benefits now, they have just bought an additional annuity, and their future annual Social Security benefits go up permanently by roughly $67 for every $1,000 in Social Security benefits they temporarily forgo for one year.

Today, those age 66 to 70 have different options than when they were younger than 66. This only adds to the confusion. They no longer must purchase the annuity (face the earnings test) if they work, but they are free to take a delayed retirement credit—this time, $80 in every future year of retirement for each $1,000 of Social Security benefit forgone for one year . But they often don’t realize that they don’t need to start benefits at retirement. By living off other assets awhile, even a month or more, they can convert some of their riskier assets into a higher Social Security annuity asset.

Just to further complicate things, Social Security administrators often tell people to “get your money while the getting is good” when, in fact, it’s risky to draw down benefits too soon when one member of a typical couple is likely to live for 25 or 30 years after age 62.

The type of reform I’m proposing could never be timelier. Had more older individuals taken advantage of this simplified option before the stock market crashed, they’d be a lot more secure today. Similarly, folks retiring today with many of their assets tied up in either risky or very low return investments could sleep better if they take this option.

Why wait? Let’s redesign and simplify the Social Security super-structure surrounding retirement ages, related earnings tests, and delayed retirement credits. Let’s help more retirees build up additional annuity protection in old age, make more transparent the advantages of delaying benefits, reward better those who work longer and pay more taxes, and create simpler and more flexible options for depositing different sums of money to purchase larger annuities in Social Security.

Why Economic Growth Isn’t Enough

Posted: May 12, 2010 Filed under: Columns, Economic Growth and Productivity, Taxes and Budget Leave a comment »Today’s budget problems aren’t America’s first. High debt levels accompanied our major wars, but they were quickly reduced soon after. “Deficits as far as the eye can see” in the mid-1980s were followed briefly by surpluses in the late 1990s. In all these cases, economic growth helped solve the problem. Today, that’s no longer possible.

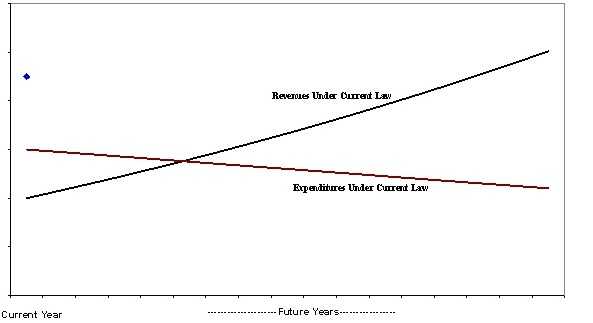

Failure to understand the causes of today’s historic impasse will stymie those budget reformers tempted to believe we can use the traditional pro-growth strategy to get our fiscal house in order. Most of history is on their side: in almost all past U.S. budgets—indeed, the budgets of most nations—revenues were scheduled to grow automatically along with the economy, and expenditures were scheduled to grow only if there was new legislation. Thus, revenues in some future year would always exceed that past expense, no matter how high any current deficit. But under the laws now dominating the budget, expenditures essentially are or will be growing faster than both revenues and the rest of the economy. In fact, we’re now locked into automatic expenditure hikes that will outstrip revenues under almost any conceivable rate of economic growth.

In the many budget policy reform discussions I’ve been part of, this disconnect from the past blocks understanding of our present fiscal situation. Thus, both liberals who want to maintain spending programs and conservatives seeking to keep taxes low seem to think—or, at least, want to think—that economic growth can once again solve our problems.

Just what is different now? Today, we are facing two fiscal problems, while before we had just one. In the past, fiscal imbalance was mainly a temporary, current issue only. Yes, Congresses would occasionally spend much more than they collected in taxes, sometimes heedlessly. But as long as revenues over time rose with economic growth and most spending was discretionary, push never came to shove as long as the next Congresses weren’t too profligate

In effect, during the nation’s first two centuries, all that was required to get the nation’s house in order was for future Congresses to limit new spending increases or tax cuts. Since future surpluses were always built into the established law at any one point in time, sound fiscal policy meant not turning those surpluses into unmanageably high deficits year after year.

Take the case of World War II, when our national debt ballooned. It’s usually cited as the great example of successful fiscal policy overcoming a depression. If in 1942 Congress had developed ten-year estimates of the deficit under “current law” on the books, the estimates would have shown massive surpluses. Spending was scheduled to drop dramatically in absolute terms and as a percentage of the economy or GDP once the war was over. Meanwhile, higher tax rates imposed to support war spending would stay in place until future Congresses saw fit to reduce them.

Jump ahead to today. Now, so much spending growth is built into law in permanent or mandatory programs that these programs essentially absorb all future revenues. Meanwhile, we’ve also cut taxes—widening the gap between available revenues and growing spending levels.

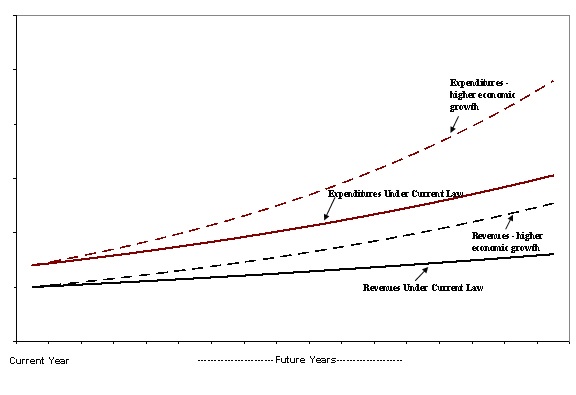

But why won’t even higher economic growth solve the problem? If spending growth were limited so it couldn’t exceed some fixed rate, then higher economic growth might increase the revenue growth rate enough to help restore balance. Unfortunately, spending growth is not set at a fixed rate. Instead, it generally is scheduled to grow faster when the economy grows faster.

Consider government retirement programs, such as Social Security. Most are wage indexed insofar as a 10 percent higher growth rate of wages doesn’t just raise taxes on those wages, it also raises the annual benefits of all future retirees by 10 percent. The same doesn’t hold for discretionary programs such as education, even though we might expect that teachers’ salaries would need to rise with economic growth. Instead, teachers’ raises must be appropriated every year. Meanwhile, in most retirement systems employees stop working at fixed ages, even though for decades Americans have been living longer. When spending rises with both wages and extra years of retirement benefits, extra economic growth just doesn’t provide much if any reprieve from fiscal imbalances.

Health care is a bit more complicated. Health costs tend to rise more than proportionately with incomes. If our incomes rise by 10 percent over the next few years, we tend to demand at least 10 percent more health care. With 20 percent income growth, we want even more than 20 percent increases in health goods and services. Of course, it’s not just a demand phenomenon. The higher economic growth may reflect improvements in health technology, along with its higher costs.

Today, so much of government spending is devoted to health and retirement programs that their growing costs tend to swamp gains we might achieve in holding down the ever-smaller portion of the budget devoted to discretionary spending. Some other programs add to the problem, since they, too, tend to grow with the economy: mortgage interest deductions as we demand more housing, subsidized pension contributions and other employee benefits as our wages go up.

Built-in automatic spending growth like I’ve just described means that balancing the budget today is far harder than simply putting the brakes on new tax cuts and spending increases. A do-little Congress can no longer save the day. Our elected officials are in a bind they hate: they must both say “No” to many new give-aways AND go back on unkeepable spending and tax promises made by past lawmakers…

The thumbnail version: seek economic growth, but don’t expect it to provide the budget slack it did when most spending was discretionary. Congress has already spent the revenues that economic growth will provide, so we need to weed our government’s garden as well as water it.

From Deficit to Surplus: How Budget Projections Used to Look under Current Law

How Budget Projections Look Today under Current Law: With and Without Additional Economic Growth

Lessons Unlearned? Who Pays for the Next Financial Collapse?

Posted: January 11, 2010 Filed under: Columns, Economic Growth and Productivity, Income and Wealth, Taxes and Budget Leave a comment »It’s an old story. Come a financial collapse, somebody’s got to pay to get the nation’s financial house back in order. While many on Wall Street made millions losing money for their companies, every young American is now saddled with tens of thousands of dollars of additional government debt. While buyers walked away from homes when they went underwater, others who had mustered large down payments simply absorbed their losses—in some cases, wiping out years of saving. While speculators who borrowed to buy stock or real estate shrugged off debt by declaring personal or corporate bankruptcy, those who invested in their 401(k)s helplessly watched their retirement savings erode.

Real loss and suffering run through the country’s financial straits, and so does a profound sense of unfairness. Once the downward spiral started, prudent investors, savers, and reasonable risk-takers got little direct government help, mainly because they were still standing. But their losses were no less real. First, the recession hit their pocketbooks and portfolios. Then many of them lost their jobs or watched friends and families lose theirs. Next, interest rates on their bank deposits fell, while fees on credit cards rose.

The crowning blow, of course, came when these model taxpayers got the honor of subsidizing the big risk-takers who got us into this mess. A Treasury Department watchdog says that taxpayers probably will never recoup tens to hundreds of billions of dollars transferred to failing companies. The Government Accountability Office released a study stating that the federal government is unlikely to recover much of the $81 billion invested in automobile companies and their related financing companies.

The apparent lesson from all of this? Irresponsibility pays. The ironic truth? Building a more vibrant economy requires fewer, not more, people playing by the “heads I win and tails you lose” rule. It means “de-leveraging” the economy: reducing the extent to which some people, through borrowing and similar efforts, can undertake unnecessarily risky gambles with others’ money. This isn’t easy, since at the same time we want more borrowing if it helps stimulate saving flowing to sound investment, we also want investors, financial managers, and financial institutions to exercise due prudence by having more of their own money at risk.

Why de-leverage? Recessions are less severe when more investors, risk-takers, and consumers can stand fast like dominos that don’t fall once a potential crisis gets under way. This helps explain why the burst of the stock bubble in 2000 didn?t lead to nearly so severe a recession: more of the losses were borne directly by those who first incurred the losses.

All this means that some unity exists behind seemingly disparate headlines about financial, corporate, and tax reform. In effect, those fights rage over who bears the costs of the next recession.

One well-publicized battle has been over opening up financial institutions’ books—especially where the government makes explicit or implicit guarantees that these companies won’t go under. While some officers at large financial institutions worry that regulation could stifle innovation and growth, others twist that legitimate fear into an excuse to resist reforms that would expose their freedom to gamble with our money and our guarantees.

Some of the same financial institutions that once ate our lunch also oppose stricter capital standards. But they are wrong. To protect against future collapses, we must demand that lenders keep greater reserves on hand relative to the size and riskiness of their portfolios. Similarly, we need greater ownership of banks by stockholders who would bear a larger share of the cost of failure.

Paul Krugman, among others (“Bubbles and the Banks,” http://www.nytimes.com/2010/01/08/opinion/08krugman.html) looks to reforming banks to help deter future financial collapses. But the implications of financial reform extend far beyond the banks.

Across the board, individual and corporate borrowers must also put more of their own skin in the game. This means higher down payments for homes and greater collateral and equity stakes for those who flip real estate or whole corporations for quick profit. If the government continues offering new homebuyers’ credits, it needs to ensure that they get added to minimum down payments, thus reducing risks of default later. And the auto industry must dump lending strategies that turn their financial arms’ IOUs into public obligations whenever the economy slows and throngs of car-buyers can’t pay off their loans.

Meanwhile, corporate and financial managers—just like the rest of us—need to experience risk’s perils, not just its rewards. While Kenneth Feinberg, Washington’s pay czar” for bailed-out corporations, may have trouble enforcing cuts in the compensation packages of top managers, he clearly set one right example by requiring that extravagant cash bonuses be converted into incentive pay in company stock that can’t be sold for years. Stockholders and mutual fund managers need to demand similar reform across the entire corporate sector.

Finally, the president and Congress—just barely getting their toes wet on this issue—need to look hard at how our tax code subsidizes borrowing so heavily and then do something about it. Any future tax reform clearly should remove the ingrained bias that favors corporate debt and discourages corporate equity.

Even then, major incentives remain for individuals and partnerships to borrow heavily—deducting interest payments while avoiding tax on gains in the value of their assets. Gaming like this leads to far too many financial transactions that make little or no real economic sense, while once again shackling everyone else with additional risks and tax burdens.

Now that a recovery is under way, some lobbyists probably hope public pressure for financial, corporate, and tax reform will subside or that the confusing technical details behind reform will weaken Congress’s will to act. But, in many ways, reform is needed more than ever during a recovery, when growth requires getting savings into the hands of sound investors who can spur more growth. Without reform, there’s little to prevent losses from the next recession being laid, once again, at the feet of the prudent investors, businesses, and consumers.