COVID-19-Related Policies Can Better Boost the Economy By Targeting Less To Savers

Posted: June 12, 2020 Filed under: Uncategorized Comments Off on COVID-19-Related Policies Can Better Boost the Economy By Targeting Less To SaversCongress has responded to the COVID-19 pandemic-induced economic slowdown by putting hundreds of billions of dollars directly into people’s pockets. Much of this came from the Economic Stimulus Payments ($1,200 per adult/$500 per child) administered by the IRS and expanded unemployment benefits. The evidence so far suggests that many households are saving much of that money, along with higher shares of their private income. And that suggests those payments are having weaker economic benefits than they otherwise could.

A recent report by the Bureau of Economic Analysis (BEA), found that the saving rate of US households rose from about 8 percent in pre-pandemic February to 13 percent in March to 33 percent in April. Annualized, that would be equal to $4.7 trillion in increased savings, far more than the increase in net transfers made so far by government through the various COVID-19 relief bills.

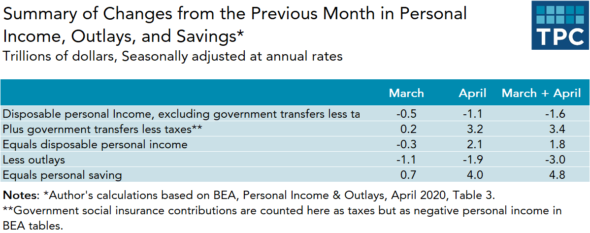

Before taking into account changes in government transfers, disposable personal income (net of taxes and related social insurance contributions) fell across March and April by about $1.6 trillion (all numbers here are at a seasonally adjusted annual rate, so that, roughly speaking, a $100 billion decline in one month, if permanent over the year, would add up to an annual decline of $1.2 trillion). Thanks largely to delaying the income tax filing deadline from April 15 and those COVID-19 relief bills, government transfers less taxes rose by about $3.4 trillion over those two months. Despite the devastating losses in wage and other income suffered by millions, disposable personal income overall rose by about 13 percent or about $1.8 trillion (on an annual basis). Still, outlays (basically all forms of personal spending) fell at an annual rate of about $3 trillion, or nearly double the $1.6 trillion decline in disposable personal income before those net transfers.

There are many reasons why people were not spending in the pandemic months of March and April. At first, in March, people were afraid to travel, shop, or eat out. Then governments closed many businesses and imposed stay-at-home orders, leaving people without places to spend, and often without jobs. Those abnormal pressures weakened the normal recession-fighting ability of fiscal and monetary policy to boost consumer demand.

Even in a classical economic downturn, recovery often takes time simply because people become extra cautious with whatever money they have. Yale economist and Nobel laureate Robert Shiller recently noted how the tendency of some people to embrace austerity may have extended the length of the Great Depression. When people spend less, they save more, and with less spending on goods and services, the demand for workers to produce those goods and services falls as well.

Admittedly, the BEA numbers, which only cover income and items such as checks or refunds paid by the end of April, tell a very incomplete story. The stimulus funds delivered by rebate payments or unemployment benefits no doubt lessened the severity of the downturn. Many households did or eventually will spend their rebate payments and increased unemployment and other benefits, though for some it may take a while. Without a continuation of these transfers, the declines in personal income will soon exceed the net increase in transfers provided by government. The jury, therefore, is still out on just how well these recent congressional actions will stabilize the economy in the short term and stimulate demand over the medium term.

Still, the data raise important policy questions. My colleague Howard Gleckman has questioned the value of government distributing payments to almost everyone, not just those who are most in need. As he notes, many types of consumer spending (e.g., travel, entertainment) are just not available at the current time.

Low-income households and the unemployed probably will spend funds quickly, if for no other reason than to pay for rent, food, and utility bills. Many people, however, suffered little or no decrease in income and have reduced their consumption for reasons other than immediate financial shortfalls. Even after months pass, they are unlikely to take two cruises at the end of the year to make up for the one they gave up this spring. These households may simply deposit those government payments and save them for the longer-term.

Congress should study both the successes and failures of the early government payments to boost demand as it considers the next round. It needs to carefully consider how well each dollar of spending or tax reduction meets the two primary objectives of the day: caring for those who are hurting and stimulating the economy.

Here are four rules that should guide these deliberations:

- Government purchases likely stimulate the economy more than many forms of transfers and tax reductions;

- Almost any speed-up of test and vaccine production and delivery leads to faster economic recovery;

- Reinforcing a normal tendency for consumption rates to rise as income and wealth falls, government spending on households whose incomes have declined and whose bills are due will be more effective than providing windfalls for those who have not lost income and already are saving more than usual; and

- Not every cause, no matter how worthy for other purposes, deserves equal attention as a response to our current health and economic crises.

Using these four guideposts can ensure the effectiveness, efficiency, and equity of future federal responses to the current health and economic crisis.

This column originally appeared on TaxVox on June 8, 2020.