How Government Tax And Transfer Policy Promotes Wealth Inequality

Posted: February 8, 2019 Filed under: Columns, Income and Wealth, Taxes and Budget Comments Off on How Government Tax And Transfer Policy Promotes Wealth InequalityFederal tax and spending policies are worsening the problem of economic inequality. But the tax breaks that overwhelmingly benefit the wealthy are only part of the challenge. The increasing diversion of government spending toward income supports and away from opportunity-building programs also is undermining social comity and, ironically, locking in wealth inequality.

Many flawed tax policies are rooted in the ability of affluent households to delay or even avoid tax on the returns from their wealth. By putting off the sale of assets, wealth holders can avoid tax on capital gains that are accrued but not realized. At death, deferred and unrecognized capital gains are exempted from income tax altogether because heirs reset the basis of the assets to their value on the date of death.

While individuals and corporations recognize taxable gains only when they sell assets, they may immediately deduct interest and other expenses. This tax arbitrage makes possible everything from tax shelters to the low taxation of the earnings of multinational companies.

Recent changes in the law have further eroded taxes on wealth. Once, the US taxed capital income at higher rates than labor income, today it does the reverse. For instance, the 2017 tax law sharply lowered the top corporate rate from 35 percent to 21 percent, but trimmed the top individual statutory rate on labor earnings only from 39.6 percent to 37 percent.

In theory, low- and middle-income taxpayers could use these wealth building tools as well. But the data suggest that the path to wealth accumulation eludes most of them, partly because they save only a small share of their income. Even those who do save $100,000 or $200,000 in home equity or in a retirement account earning, say, 5 percent per year may never reap more than $1,000 or so in tax savings annually.

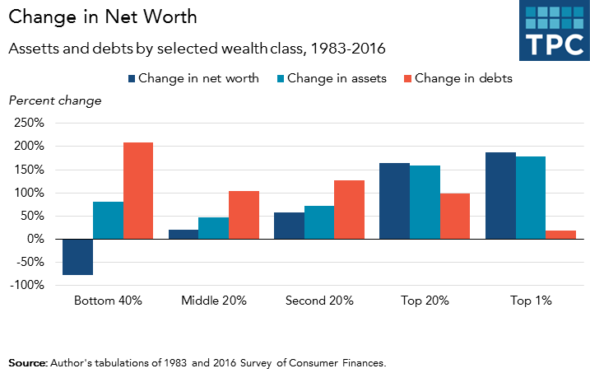

To understand what has been happening to the relative position of the non-wealthy, we need to dig a little into the numbers. Economics professor Edward Wolff of New York University discovered that in 2016 the poorest two-fifths of households had, on average, accumulated less than $3,000 and the middle fifth only $101,000. Trends in debt tell part of the story. From 1983 to 2016, debt grew faster than gross assets for most households–except for those near the top of the wealth pyramid.

It’s not that the government doesn’t aid those with less means. But almost government transfers support consumption, and only indirectly promote opportunity.

Consider the extent to which the largest of these programs, Social Security, has encouraged people to retire while they could still work.

Because of longer life expectancy and, until recently, earlier retirement, a typical American now lives in retirement for 13 more years than when Social Security first started paying benefits in 1940.That’s a lot fewer years of earning and saving, and a lot more years of receiving benefits and drawing down whatever personal wealth they hold.

Annual federal, state, and local government spending from all sources, including tax subsidies, now totals more than $60,000 per household—about $35,000 in direct support for individuals.Yet, increasingly, less and less of it comes in the form of investment or help when people are young. Thus, assuming modest growth in the economy and those supports over time, a typical child born today can expect to receive about $2 million in direct assistance from government. In the meantime, however, government has (a) scheduled smaller shares of national income to assist people when young and in prime ages for learning and developing their human capital, (b) reduced support for their higher education in ways that has now led to $1.4 trillion of student debt being borne by young adults without a corresponding increase in their earning power, and (c) offered little to bolster the productivity of workers.

Any number of programs could have a place in encouraging economic mobility, among them beefed-up access to job training and apprenticeships for non-college goers; wage subsidies that reward work; subsidies for first-time homebuyers in lieu of subsidies for borrowing; a mortgage policy aimed more at wealth building; and promotion of a few thousand dollars of liquid assets in lieu of high-cost borrowing as a source of emergency funds — you get the point. However, in one recent study, I found that federal initiatives to promote opportunity—many in the tax code—have never been a large fraction of government spending or tax programs and are scheduled to decline as a share of GDP.

It would be naïve to assume that fixing any of this will be easy. Republicans seem committed to reducing (not increasing) taxes on the wealthy, while Democrats reflexively support redistribution to those less well off, even when their proposals reduce incentives to save and work. But until we fix both sides of this equation, don’t expect government policy to succeed in distributing wealth more equally. After all, simply leveling wealth from the top still will leave the large number of households holding zero wealth with zero percent of all societal wealth.

This blog also appears on TaxVox. A longer version of this blog can be found in The Milken Institute Review, 21 (1): 16-27.

My New Year’s Greeting: Thanks for Being You

Posted: January 2, 2019 Filed under: Columns Comments Off on My New Year’s Greeting: Thanks for Being YouUpon you rest many of my hopes for 2019 and beyond.

Your better instincts and willingness to pitch in, help and serve others, whether in your home, community or job, counts—and counts a lot—especially in these uncertain times. Why? Because it is always the combined efforts of the many that make up a viable society, provide its main resources and produce its primary outputs, both spiritual and material. When we act with virtue and integrity, no cabal of individual actors, no matter how powerful or bad, can long exert control over the people we want to be.

Still, as 2018 began heading toward the holidays, I must confess that sullenness—not good cheer—gripped me. My wife once defined me as a short-run pessimist and a long-run optimist. The latter attitude was missing more than usual. My feelings stretched from guilt to despair.

The guilt came from recognizing that I was shielded from much of the pain being imposed on others. I’m not struggling daily for survival in Syria nor trapped in the endless fighting in Afghanistan or Iraq. In this country, I don’t live in an area with limited opportunity and am not prevented, as are many civil servants and private-sector workers, from speaking truth to power or simply doing my job.

Many people close to me are threatened. If not physically, then with having their efforts disdained, their legacies thrust aside. Despite this, they soldier on. One good friend, Sakena Yacoobi, has now spent decades supporting schools, clinics and other institutions for girls in Afghanistan. Friends in Turkey have devoted their lives to teaching students how to thrive in what they believed was an increasingly modern democracy. My colleagues in government, where I spent much of my career, continue to push for policy based on principle, not whim or special interests.

When you care about others, you want to support their efforts and carry some of their pain.

Here I sit, though, separated from attacks and asked to sacrifice little or nothing by my elected representatives. I’m pampered with unneeded tax cuts and ever-rising health and retirement benefits, even as government invests an ever-smaller share of our growing resources in the future of our children. These elected officials dodge a basic rule most of us teach to our children: that with opportunity, whether earned or unearned, comes responsibility. The more demagogic of this elected base further tell me that solving any and all of our problems will come only from attacking immigrants, the rich, foreigners, or anyone who represents “other.”

Despair then arises from seeing no immediate end to this nastiness, and to the costs imposed on those still working to build a successful society abroad or a more unified one at home.

More recently, a new season of hope has begun to surround me, as it often does this time of year. People have extra energy in their gait; strangers greet me with a nod and a smile. Wonderful friends, both near and far, regale me with stories of their own journeys, and I bask in the love of family.

I see how you continue to dedicate yourself to doing the right thing, to sharing your resources, and maintaining your integrity in efforts large and small. When I once expressed my despair for Afghanistan to my friend Sakena, she told me that her people couldn’t go back to where they were 17 years ago. She felt that too many additional women, as well as men, have been educated in the interim, and, whatever else happens, they cannot unlearn what they have learned. Now, that’s hope.

So, Happy New Year to all of you. And thanks, once again, for renewing my hope in our future.

Come The Flood, Who Should Pay To Help?

Posted: September 6, 2017 Filed under: Columns, Income and Wealth, Taxes and Budget 1 Comment »This post originally appeared on TaxVox.

Hurricane Harvey’s historic flooding has brought out the best in many people. They have put their lives in danger to save strangers, shared their food, and offered their homes. Citizens across the country are contributing to the United Way, Red Cross, community foundations, and churches. Race, creed, and social status seem to make little difference, and the political issues that divide us suddenly seem petty, almost separated from the real world in which we live, suffer, or thrive.

But because charities and individuals can do only so much, we have turned to government to act on our behalf. But even as we ask government to coordinate efforts and bear a large share of the cost of repair and rejuvenation, a question lingers: Who should pay for those costs? Or to ask another way, who should feel entitled to claim they are exempt from the social compact that says we should use our tax dollars to assist victims of an historic flood they could not predict or plan for? Once one broadens this question to include helping victims of poverty or poor health, or paying some share of the cost of our national defense, it lays bare the issue of who should pay taxes.

Join me, therefore, in speculating about who should be exempt from sharing in the tax burden for helping victims of Hurricane Harvey.

How about owners of capital? They claim they benefit society by building and holding onto wealth and promoting growth by investing that wealth. Though often exaggerated, their case has enough merit to support economic and legal arguments for converting the income tax to a tax on consumption. Indeed, our current tax system combines features of both and reflects the divisions over the role of savings and investment in enhancing our well-being.

Many owners of capital even claim they should pay “negative” tax rates, at least on returns from new investments through generous tax depreciation or expensing of debt-financed physical assets. Should the tax system exempt owners of capital who consume only modest portions of their income from helping to finance assistance for the victims of Harvey?

How about the poor? We exempt low-income households from income tax (though the poor often pay sales, excise, and payroll taxes), a choice that also has some merit. After all, how can one expect the poor to pay taxes when they can’t afford adequate food or housing? Of course, that issue is complicated because low-income people often receive more in government support than they pay in taxes.

How about the middle class? We’re running huge federal deficits today largely because no one wants to raise their taxes or cut their benefits. Democrats are willing to tax the rich and Republicans will take away benefits from the poor, but both parties appear to coddle the (very large) middle class. It is true that middle-income workers have seen little wage growth or upward mobility in recent years, but does that mean they should not do their part to help government cover the costs of floods or other public goods and services that otherwise would add to deficits?

How about the elderly? Yes, many are retired and on fixed incomes. But many are reasonably well off and enjoy a permanent tax exemption on income from sources such as Roth retirement accounts. Can we as a nation go back on that deal? How about those who die with large estates? They could have realized income by selling assets and consumed that wealth when alive. But if they did not, should they be subject to an estate tax upon death? How about companies that get special business tax breaks? Don’t they need tax help to ensure their competitiveness with firms in other countries?

And, finally, how about you and me? Why should we have to pay taxes when it appears almost nobody else does? But then there are those people suffering in the wake of Hurricane Harvey.

Tax Reform Isn’t Just About Revenue but Health Insurance, Housing, and More

Posted: July 21, 2017 Filed under: Columns, Health and Health Policy, Taxes and Budget 1 Comment »This post originally appeared on TaxVox.

Taxes aren’t just about raising money for government. Policymakers engaging in tax reform must recognize how their decisions can disrupt markets for a wide range of economic activity, including healthcare, housing, and charitable giving. Some of those behavioral reactions may be secondary and unintended, but they can’t be ignored.

The Tax Policy Center has described some of the potential impacts of President Trump’s tax ideas on charitable giving and in the way businesses organize themselves. But it’s worth looking at two other examples—health insurance and homeownership—to see how tax changes can affect economic behavior. In both examples, tax reform can improve efficiency and equity, but only if it is well designed.

Employer-provided Health Insurance.

In a recent press conference, Treasury Secretary Steven Mnunchin and Director of the National Economic Council Gary Cohn implied that Trump’s tax plan could limit existing tax breaks for employer-sponsored health insurance (ESI). It would be one of a long list of tax preferences that Administration may target.

But any significant cut in subsidies for ESI could lead employers to reduce or even eliminate health insurance as part of employee compensation. The effects of such a decision could be substantial and most likely change the way people get health insurance. Tax reform must be designed with regard to its effects on subsidies offered through the Affordable Care Act or the House’s recently passed replacement.

For many years, health policy experts have suggested replacing the ESI exclusion with a tax credit. But the ACA and the House bill, and their related costs, largely depend upon retaining the ESI exclusion while adding subsides for those who buy outside the employer market.

The ACA’s exchange subsidy is larger for many employees than the value of their exclusion. Thus, employers already have some incentive to drop ESI coverage, send employees to an exchange, and share the net savings. Yet, so far, few have done so in part due to uncertainty about the future of the ACA and the reluctance of managers to give up their existing coverage. It is not clear how employers would respond to tax reform under the ACA or the House’s credits, which are less generous but in some cases more flexible.

Tax Subsidies for Housing

Although Cohn insists that “homeownership would be protected” under Trump’s tax plan, the Administration is considering several proposals that would significantly reduce incentives to buy housing.

Here are just three examples: Lowering tax rates would make the mortgage interest deduction less valuable. Eliminating property tax deductions as part of a repeal of the state and local tax deduction could raise taxes for homeowners who itemize. And doubling the standard deduction would significantly reduce the number of taxpayers taking deductions for mortgage interest.

In this new world, renters would increase in numbers and the number of homeowners would decline.

Like the exclusion for employer-provided health insurance, the tax subsidies for homeownership are both inefficient and inequitable. They provide an incentive mainly to those who need it least because the benefits are concentrated among those with higher incomes.

While it might make sense as a matter of tax policy to give middle-income individuals a higher standard deduction in lieu of the opportunity to itemize expenses, does it make sense as a matter of housing policy to leave a mortgage interest deduction concentrated on a select few taxpayers, largely with incomes well above average? And to what extent should equity owners, who still maintain an incentive to own homes, as opposed to taking out their equity and putting it into a saving account, be favored relative to borrowers? After all, younger and wealth-constrained, households are the ones most in need of borrowed funds to own their first homes, and they already have a far smaller share of total societal wealth than they did a generation ago

Providing some alternative incentive, such as to new homeowners, might help address some of these housing policy issues.

My concerns are not intended to throw cold water on tax reform. But they are a warning about the importance of doing it right.

Tax subsidies for health insurance and homeownership do need reform, but policymakers must ask themselves whether their new tax system creates the right set of incentives for the right people and integrates well with spending programs aimed at the some of the same objectives. They must also be sure to adjust as necessary to avoid undesirable behavioral responses. If they don’t, they may weaken or even destroy the benefits of reform.

Replacing the Individual Mandate to Buy Health Insurance: A First Step to Compromise

Posted: July 14, 2017 Filed under: Columns, Health and Health Policy 1 Comment »This post originally appeared in TaxVox.

The Trump Administration and congressional Republicans remain stalemated over how to “repeal and replace” the 2010 Affordable Care Act (ACA). One major problem: The House approach in the American Health Care Act (AHCA) is highly unlikely to pass Congress when it increases the number of uninsured by 23 million, as estimated by the Congressional Budget Office. Real reform needs a better set of building blocks. Here I address one of those building blocks: how to replace the ACA’s individual mandate in a way that satisfies both Democratic goals for coverage and Republican concerns that government shouldn’t mandate what citizens must buy. What is the alternative? Simply make some existing government benefits, particularly tax benefits, conditional upon buying health insurance.

Such a step could also be made at least as progressive as the ACA’s mandate, which would please Democrats. And it would replace the use of a whole new penalty tax structure surrounding the ACA’s mandate, a step that should please Republicans.

Fair and efficient reform of ACA requires recognizing the logic behind individual responsibility to purchase insurance, an idea long favored by many researchers and public officials across the ideological spectrum. If government is going to support those in need, whether through Medicaid, uncompensated care, or, under some new government subsidy, how should it treat those who don’t buy health insurance even if they have the financial resources to do so? Equal justice suggests that a household making, say, $50,000 but effectively paying $10,000 to buy insurance—for instance, through lower cash compensation when receiving employer-provided insurance—shouldn’t have to subsidize other households with the same income but who don’t buy insurance.

That problem arises whenever government safety nets protect those who don’t insure against future needs but becomes particularly acute in health care when, as both Democrats and Republicans have now accepted, health insurance companies cannot exclude people with “pre-existing” conditions. Without some individual responsibility requirement, what is there to prevent people from going without insurance until they turn ill?

Democrats want to keep some requirement for individual responsibility to maintain the ACA’s coverage expansion. But why can’t Republicans find an acceptable alternative?

It’s simple math. Since adding millions to the roles of the uninsured seems politically unacceptable, the alternatives are to increase government benefits and the taxes needed to support them, or impose an even higher unfunded mandate on providers to care for the uninsured. Some commentators already believe that enactment of a House-like bill would eventually result in a universal system like Medicare for all, an unsatisfactory outcome for Republicans.

We are left with this: The federal government now spends about three-tenths of its entire non-interest budget on health care, and the share is increasing rapidly. In this expensive healthcare world, government supports should be targeted toward those who need help the most.

While the ACA’s mandate moves in the direction of establishing equal treatment of those with equal ability to buy insurance, it levies a penalty for most people that is far lower than the cost of insurance. According to a calculator provided by the Tax Policy Center, the 2016 penalty was $991 for a single person making $50,000 or $2,085 for a family of four. By contrast, the IRS indicates that an average “bronze” premium insurance policy would cost several times more: for an individual, about $2,700, and for a family of four, $10,700.

Making purchase of health insurance a condition for receiving other government benefits removes the philosophical and, for some, constitutional hang-up over whether government should mandate that we buy something. Instead, Congress could simply make health insurance a condition for opting to take some other benefits such as standard deduction, itemized deductions, or child credit. If we can get some more permanent agreement on some individual responsibility payment, the IRS can start to adjust withholding by employers for employees who don’t have employer insurance or declare otherwise that they have insurance. This would reduce end-of-the-year problems in collecting money from people who may not have any easy way to pay a penalty.

While some also suggest allowing insurance companies to charge higher premiums for those who buy insurance only when they get sick, that penalty is likely to be either too low to be effective or too high to be affordable by those who only seek insurance once sick.

In sum, any replacement structure for the ACA requires solid building blocks. Repealing and replacing the individual mandate with a conditional limit on the receipt of other government tax benefits offers one possibly bipartisan way to expand coverage, save government costs, and improve tax administration. To it, of course, must be added a subsidy system for those with too little income to afford insurance. The combination can be made as progressive or more progressive than the ACA. As noted, however, inattention to a requirement for individual responsibility will in the long run probably only add to the load that must be supported by the building block of government subsidies.

How Both Public Tax Reform and Private Sector Initiatives Can Strengthen Charities

Posted: April 27, 2017 Filed under: Columns, Nonprofits and Philanthropy, Taxes and Budget 2 Comments »This post originally appeared in TaxVox.

In the March and April 2017 print editions of the Chronicle of Philanthropy, I proposed both a public and a private sector initiative for strengthening charities. These included improved tax policies as well as steps charities could take independently of any legislation. These initiatives aim to increase charitable giving of income, wealth, and time.

My organizing principle was simple: First, make tax subsidies more effective and efficient. Second, improve the way charities market themselves. Neither Congress nor the charitable sector has ever approached either task in a comprehensive way. The articles are here and here, with permission of the Chronicle.

Here, briefly, are my suggestions:

What government can do:

- Allow all taxpayers—even current non-itemizers—to claim a deduction for contributions above some minimum amount.

- Extend the deduction to gifts made by April 15 or filing of one’s tax return—similar to the extended contribution date for Individual Retirement Account contributions– rather than December 31 of the previous calendar year.

- Create a better donation-reporting system to IRS to reduce tax non-compliance, with a reward of an extra deduction for those donations; the improved tax compliance should more than pay for the extra reward.

- Make it easier for individuals to make donations from their IRA accounts.

- Reduce and simplify the excise tax on foundations.

- Encourage charitable bequests, especially if the estate tax is cut or repealed.

What charities can do, independently from government:

- Create a national campaign to promote giving, such as:

- Tell simple but powerful human-interest stories extolling generous people.

- Help donors identify worthy programs by promoting access to useful sources of information on each charity.

- Encourage people to give to charity when they settle disputes.

- Help people understand better their potential to give out of wealth, not just income, and to leave lasting legacies:

- Run endowment campaigns.

- Encourage wealth advisers to promote charitable giving.

Today charities feel under siege. They fear they are about to lose direct government support if Congress cuts domestic spending that funds the specific programs they run. And they worry that lawmakers will trim tax benefits for charitable giving by individuals and firms. Their concerns are legitimate but, in truth, over the many decades I have worked with charities on public policy issues, their advocacy has nearly always felt defensive.

Charities can easily become collateral damage from policies that are not aimed directly at them. Congress won’t decide broad issues such as size of government, tax rates, limits on tax incentives, or the share of revenues that should come from income taxes (the only tax where there is a charitable deduction) solely or primarily based on their effect on the charitable sector.

Thus charities must think longer-term as the nation is struggles to define a modern set of public policies and societal goals relevant to 21st century needs and opportunities. My suggestions are intended to extend well beyond any current political battle, no matter which party controls government at any point. Their goal is to strengthen the charitable sector, by improving both government incentives and the outreach and self-examination by non-profits themselves.

Fighting to maintain the status quo is not a strategic option. Nor should every charity expect to come out unscathed in this rapidly changing environment. But the US is facing important choices as it decides the direction and size of government in the Trump era. That debate ought to include a broad look at charities in this new environment and whether that includes strengthening, though reforming, the role of charities in American life.

How the Fight over Symbols Prevents Health, Trade, Immigration and Tax Reform

Posted: April 25, 2017 Filed under: Columns, Health and Health Policy, Taxes and Budget 2 Comments »This post originally appeared on TaxVox.

President Trump came into office promising to repeal the Affordable Care Act, abandon key multinational trade agreements, build a wall and send immigrants home, and reform the tax code. Many Democrats have sworn to oppose him at every turn. On the first three items, he has already faced obstacles or stalemate and even temporarily left the battleground. But are these debates really about substantive reform that improves people’s lives? Or mainly over capturing symbols that appeal to each party’s base? Those goals aren’t the same.

Reform defies easy party or ideological labels because it often focuses not on bigger or smaller government but fixing poorly-functioning operations, establishing greater equity among households, or adapting to new circumstances. With health, immigration, trade, and tax policy the need for constant real improvement conflicts with important, but often-counterproductive, fights over political symbolism.

Health Reform. When the Affordable Care Act (ACA or Obamacare) passed the Senate, backers knew it had flaws. They hoped to fix them later in the legislative process, but the death of Sen. Ted Kennedy cost Democrats their filibuster-proof majority in the Senate and made the fixes or amendments requiring a new Senate vote virtually impossible. As a result, the healthcare community and households continue to grapple with an imperfect environment: Gains from expanded insurance coverage have been offset by slower than expected take-up rates, especially among young adults, for ACA marketplace policies, ongoing uncertainty about Medicaid expansions, and failure to come to grips with the full impact of health cost growth, often outside of Obamacare, on the federal budget.

Congress and President Trump have a chance to repair those problems, but both parties find themselves in a box. Republicans can’t accept any reforms that allow Democrats to claim “Obamacare” is being preserved, while many Democrats can’t swallow changes that acknowledge the ACA’s failures.

Trade Reform. Trade is another case where political symbolism impedes needed change. No doubt, our trading partners at times violate the spirit and even treaty letter of “fair” trade (so does the US), but trade agreements are the very vehicle for limiting such violations. Rather than repairing these understandings, political symbolism demands they be torn up or abandoned. Thus, instead of reviving and revising the Transpacific Partnership, which might have enhanced US trade in Asia, the Trump Administration has scrapped it.

Any successful trade agreement must strengthen rather than weaken international commerce if it is to promote economic growth without raising consumer prices. But trade debates occur on treacherous political ground. Any shift in trade, no matter how good or bad, almost inevitably reduces demand for some US-made products and hurts the workers producing those goods, thereby creating a new group of populists who will cry “foul” that the President and Congress have once again abandoned workers.

Immigration Reform. People suffering from persecution, hunger, or lack of human rights will try to escape those horrors and find new opportunity. So it has always been and will always be. Borders are porous enough that there are tens of millions of immigrants, legal and illegal, in the United States and much of Europe. Meanwhile, immigrants grow as a share of developed nations’ total populations, partly due to relatively low-birthrates in the existing populations. We can reduce opportunities for legal entry, step up border patrols, build walls, and send even more people back to their prior country of residence. But none of those actions really address the basic economic and social forces at play, while temporary symbolic political victories leave millions of families fearful of breakup, reduce domestic output by immigrant workers, and hurt America’s image as the home of freedom for people around the globe.

Tax Reform. In taxation, the symbolic fights almost always center on the size of government and progressivity. Yet many of the tax code’s real problems are that it is inefficient, complex, and treats those with equal incomes unequally and inequitably. The Tax Reform Act of 1986 neatly focused on the latter issues by making no significant change in either revenues or progressivity. But even in its early stages, the debate over a 2017 tax reform has already been muddled by a cacophony of mutually inconsistent goals: Reduce tax rates for multinational corporations and cut taxes for the middle class while not increasing the deficit or raising anyone’s taxes.

As long as lawmakers fight mainly over symbols rather than substance, they are unlikely to achieve many real improvements in policy. And tax reform will follow along the path down which health, immigration, and trade reform already seem headed.

The ‘Save Our Social Security Act of 2016’: A Major Step Toward Reform

Posted: July 29, 2016 Filed under: Aging, Columns 7 Comments »Without fanfare, a bipartisan group of Representatives has introduced a bill that could bring Social Security’s finances close to long-term balance. Labeled the “Save Our Social Security Act of 2016,” the proposal also recognizes an important fact: that the longer we delay reform, the more it will cost post-babyboom generations.

Gen X and Y and Millennials are already scheduled to pay more for their benefits than boomers and older generations no matter what path we take to reform. Whether we raise payroll taxes, use more income taxes to pay off Social Security obligations, or cut benefits, someone must pay. Delaying reform only increases the burden on the young.

The “SOS Act,” as it is called, was introduced by five Republicans and one Democratic member of the House. Co-sponsors Reid Ribble (R–WI) and Dan Benishek (R–MI) were joined by Jim Cooper (D–TN), Cynthia Lummis (R–WY), Scott Rigell (R–VA), and Todd Rokita (R–IN). They pieced together the proposal using an interactive tool offered by the Committee for a Responsible Federal Budget. (Disclosure: I serve on the committee’s board of directors).

The bill contains these primary features (listed in order of their ability to shrink Social Security deficits; the last two would raise deficits):

- Increase the “normal retirement age” (NRA) by two months per year until it reaches 69 for those turning 62 in 2034. Thereafter, it indexes the NRA to increases in longevity, so that the fraction of a lifetime spent in retirement stops growing.

- Levy the OASDI tax on 90% of covered earnings.

- Use a more accurate measure of inflation to determine Social Security’s cost-of-living adjustment (COLA), so that benefits fall by about one-third of one percent per year.

- When calculating average Social Security earnings, count a few more years than the 35 top-earning years, thereby creating a more accurate (and usually lower) measure of the share of a worker’s average lifetime earnings that will be replaced under the Social Security benefit formula.

- Under Social Security’s current design, the first dollars of average lifetime earnings are replaced at a 90% rate, the next dollars at a 32% rate, and the last dollars at a 15% rate; under the new proposal, the 15% rate would drop to 5% for those in that top earnings bracket.

- Raise annual benefits by roughly $1,000 a year for those with more than 20 years of coverage, and let that amount grow at the average wage growth rate.

- Set a special minimum benefit so that, for instance, workers with 20 years of coverage would receive a benefit no lower than the poverty level, and increase the minimum benefit by the average wage growth rate instead of the inflation rate.

These changes would bring the Social Security system close to long-term solvency. Enough taxes would accrue to pay full benefits not only for 75 years, but also to roughly cover benefits in the 75th and later years. By contrast, the last major reform (in 1983) didn’t close the long-term gap.

Almost as soon as that Reagan-era bill was passed and signed, its failure to cover the period after 75 years led Social Security actuaries to declare the system’s finances out of balance. The solvency issue would pop up again under subsequent presidents. The SOS Act, however, would restore balance, and do so equitably: by closing one-third of the funding gap through tax increases, one-third through progressive rate changes, and one-third through adjustments in the retirement age.

The bill can still be improved. It could do more, at a fairly moderate cost, to help those with below-median lifetime incomes. (As a member of the bipartisan 1999 National Commission on Retirement Policy, I was among the first to propose higher minimum benefits as a way to address distributional issues and improve benefits for low and moderate-income elderly.) The bill could also address the structure of survivor and spousal benefits, which is built on the notion of a stereotypical mid-20th century household with a male breadwinner and a stay-at-home wife. It could also address the negative economic consequences of keeping the early retirement age at 62 no matter how long people live.

For those who are interested, Social Security’s assessment of the bill’s consequences is helpful to read but it can also be misleading. The assessment implies that future retirees’ income replacement rates will fall relative to those of current retirees. That’s true only if Americans keep retiring as early as they currently do. In fact, many people (except those with the highest incomes) could enjoy an increase in replacement rates simply by working an additional year for every year the average life expectancy improves.

A version of this post originally appeared on the Retirement Income Journal.