Six bipartisan opportunities for president-elect Trump

Posted: November 21, 2016 Filed under: Shorts 1 Comment »This post originally appeared on TaxVox.

I have never believed that candidates should lay out detailed policy agendas in their campaigns. While broad outlines are helpful, the specifics are too complex for the stump and often unappealing to voters. So to move beyond campaign promises that seldom add up for any candidate, here is how President-elect Trump could move forward in six policy areas even while facing extraordinary budget constraints. Each issue has a framing that gives it a better chance of garnering bipartisan support.

Workers. Many workers made it clear in this election that they feel forgotten by government. While the left and right disagree over how well our government promotes opportunity for workers, they generally agree it could do better. Trump tapped into workers’ frustrations but hasn’t yet identified how to significantly help them. How about this as a start? Simply ask agencies to assess the extent to which their programs could better promote work, even when that is not their primary mission. This applies to a wide range of programs, from wage, housing, health, and food supports to how well the military helps veterans get a job.

Budget Reform. Even if some adviser tells the President-elect that there is magic money to be had through extraordinary economic growth, tackling budget shortfalls will soon become unavoidable. Never before have so many promises been made for the future, both for unsustainable rates of spending growth and lower taxes. Indeed, all future revenue growth and then some have already been committed for health, retirement, and the interest costs alone. Engaging in more giveaways only exacerbates this problem. One way to cut the Gordian knot and convince the public to buy into longer-run budget goals is to show how interest savings generated by long-run fiscal prudence eventually allows both more program spending and lower taxes than do big deficits.

International Tax Reform. If the US is going to collect tax revenue from US-based multinationals, it will need to get a handle on this issue. It makes no sense administratively to tax these firms based on the geographical location of headquarters, researchers, patents, borrowing, or salespeople. The solution involves taxing corporations less but individual shareholders more, while still engaging corporations to withhold those taxes. Any reform must limit the firms’ ability to shift income and deductions to the most tax-advantageous locations.

Individual Tax Reform. Trump could accomplish some individual tax reform by focusing less on reducing the existing $1 trillion-plus level of tax subsidies and more on limiting their automatically-increasing growth rates. He could use the revenue to either reform the tax code or better target the subsidies. For example, he could redesign housing-related tax preferences so they truly promote homeownership.

Health Reform. Conservative and progressive health experts agree that the Affordable Care Act suffers from at least two problems: It did not sufficiently tackle the issue of rising medical costs, and many people remain uninsured. Trump could generate more bipartisan support if he aims to reform the system to cover more people while generating enough cost saving to make that goal attainable in a fiscally sustainable way.

Retirement and Social Security. President-elect Trump promised to not cut Social Security benefits while Secretary Clinton said she would raise them. But raised or cut relative to what? An average-income millennial couple is scheduled to receive about $2 million in Social Security and Medicare benefits versus $1 million for a typical couple retiring today. Younger people, who often expect no Social Security benefits, seem willing to accept changes that would slow the program’s rate of growth. That’s an opening for Trump to sell the reform as a long-term effort that opens up the budget to some of their needs, such as reducing student debt, while still protecting the current elderly. For many elderly, benefits can even be enhanced through private pension reform to increase individual retirement savings and enhancing Social Security benefits for low-income retirees.

Paraphrasing Herb Stein, who was President Nixon’s chief economic adviser, “what can’t continue won’t.” And that’s true with the nation’s unsustainable fiscal path. Eventually, we will need to take the types of steps that I’ve outlined. With some creative thinking about how to newly frame important issues, President Trump could advance some real possibilities of reform despite a season of ugly campaigning.

Photo courtesy of Gage Skidmore/via Flickr Creative Commons.

An Ideal Presidential Candidate

Posted: August 26, 2015 Filed under: Shorts Leave a comment »After weeks of hearing the presidential candidates pander to your interests and mine, asking us to give up nothing or do nothing to create a better nation—after all, the responsibility for our problems always lies with immigrants, or government workers, or the rich, or business executives, or stupid liberals or conservatives, or some other group that we don’t belong to, right?—I happened to listen again to Gene Scheer’s “American Anthem,” which was featured in Ken Burns’ documentary The War. I realized my ideal candidate would inspire with this song’s type of message.

American Anthem (first two verses)

All we’ve been given by those who came before

The dream of a nation where freedom would endure

The work and prayers of centuries have brought us to this day

What shall be our legacy? What will our children say?

Let them say of me I was one who believed

In sharing the blessings I received

Let me know in my heart when my days are through

America, America, I gave my best to you

Each generation from the plains to distant shore

With the gifts they were given were determined to leave more

Battles fought together, acts of conscience fought alone

These are the seeds from which America has grown

Let them say of me I was one who believed

In sharing the blessings I received

Let me know in my heart when my days are through

America, America, I gave my best to you

Dead Men Ruling

Posted: May 14, 2014 Filed under: Shorts, Taxes and Budget Leave a comment »A personal note to you, my readers and friends.

My latest book, Dead Men Ruling, is in many ways the most important that I have ever written. I try not only to diagnose the disease that underlies so many of our economic and political problems today, but also to attack the wrong-headed notion that we live in an age of austerity and limited possibility.

Consider: the gross domestic product per household is $141,000 today and is projected, even with slower growth, to reach $168,000 in 10 years. Over that same period under Republican and Democratic budgets alike, government at all levels is likely to increase spending and tax subsidies from $55,000 to around $65,000 per household. Our budget may be terribly allocated, and the way we tax and spend can be quite inequitable, but do these numbers suggest a nation that must continue to turn its back to the ocean of possibilities that lie right at our feet?

I hope you will read Dead Men Ruling. Even more, I hope that you recommend it to friends and elected officials who want to move beyond yesteryear’s stale debates toward a 21st-century agenda—particularly when it comes to promoting opportunity and mobility, prioritizing children and their future, and creating a government that can be both effective and lean.

If you cover the news, are organizing an event, or have a group interested in the book, I can help. Please contact me.

Because I make no money on the book, my motivation is purely aspirational. I strongly believe that the country is at an inevitable turning point, requiring honest leadership. Though it will take time, together we can make that turn well.

At DeadMenRuling.com, you can order copies directly and find many related recommendations, videos, and interviews. As a Government We Deserve reader, you can use discount code KCD4. Or you can use various book venders (including Amazon).

To tease your interest a bit further, I include the preface below.

PREFACE

Low or zero growth in employment… inadequate funds to pay future Social Security and Medicare bills…declining rates of investment… cuts in funding for education and children’s programs…arbitrary sequesters or cutbacks in good and bad programs alike… underfunded pension plans…bankrupt cities…threats not to pay our nation’s debts… inability to reach political compromise…political parties with no real vision for 21st century government.

I’ve come to a strong belief that these and a whole host of seemingly separable economic and political problems are symptoms of a common disease, one unique to our time and shared widely throughout the developed world. Unless that disease and the history of how it spread over time is understood, it’s easy to fall prey to believing in simple but ineffective nostrums, hoping that a cure lies merely in switching political parties or reducing the deficit, expanding our favorite program, or hunkering down to protect it. My first purpose in writing this book is to accurately diagnose that disease so we can attack it at its roots

But my fonder hope is that we reawaken to the extraordinary possibilities that lay right at our feet and restore the American can-do spirit that has prevailed over most of our history. Despite the despairing claims of many, we no more live in an age of austerity than did Americans at the turn into the 20th century with the demise of the frontier. Conditions are ripe to advance opportunity in ways never before possible, including doing for children and the young in this century what the 20th did for senior citizens, yet without abandoning those earlier gains. Recognizing this extraordinary but checked potential is also the secret to breaking the political logjam that, as I will show, was created largely by now dead (and retired) men.

On the Progressivity of Obamacare

Posted: January 31, 2014 Filed under: Health and Health Policy, Shorts 3 Comments »Is the Affordable Care Act progressive in the most effective way?

In a very fine study, Henry Aaron and Gary Burtless at Brookings have looked at the ACA’s potential effects on income inequality and have preliminarily concluded that the ACA redistributes income—largely in the form of health benefits fits—to the poorest one-third of Americans. Most of the law’s additional subsidies—the expansion of Medicaid and subsidies for those buying insurance on the exchange—are highest for those with the lowest incomes. Offsets, such as some new taxes, tend to be concentrated less at those lower income levels.

What the Aaron and Burtless’ study was never intended to assess—and a lingering 21st century concern with almost all government health policies—is the ACA’s effectiveness and efficiency, both for the public in general and those with modest means in particular. For instance, many rewards of our government health policy have traditionally been captured by health industry providers, who are able to charge consumers higher prices. A program can be progressive, but still end up charging the public an additional $2 for $1.50 or $1 worth of care.

The ACA does at times attempt to deal with some of these issues and includes several experiments. But it was mainly directed at improving access, not reducing health costs. Reforms beyond the ACA still are required on that front regardless of which political party accedes to power.

The Budget Deal: A Tentative Step Forward

Posted: December 12, 2013 Filed under: Shorts, Taxes and Budget 6 Comments »In a recent Washington Post article, I characterized any forthcoming budget deal as two parties who had dug a hole for themselves deciding to stop throwing shovels at each other. Despite this skepticism, I must admit that this December 2013 agreement is certainly better than throwing shovels—or, more formally, threatening another government shutdown, along with its attendant costs on the workings of government, the well-being of citizens, and economic growth.

This budget agreement also takes a couple of baby steps forward. For the first time in a while, it includes modest reforms to mandatory programs, not just discretionary programs. It cuts back slightly on the silly sequester. Perhaps more important, it gets the two budget committees functioning again. Traditionally, members of these committees have had to fight with the rest of Congress as much, if not more, than with their opponents within the committees—partly because committee members, regardless of affiliation, shared the objective of getting the budget into some sort of order.

If the committee members have really decided to restore their status, and if they are constrained by other congressional leaders from making significant headway on the budget in the months leading to the next election, I hope at least they will start working on bipartisan budget process reforms, such as reducing the game-playing in future budget agreements. One example is greater constraints on future legislation that increases long-term deficits. A trick still possible (but not used in this deal) is to avoid scoring or counting costs against a bill when they fall outside an arbitrary ten-year budget window.

Nelson Mandela and the Formation of a Nation

Posted: December 9, 2013 Filed under: Economic Growth and Productivity, Shorts 3 Comments »A few years ago I visited a history museum in an Eastern European nation that had recently abandoned communism. It was quite depressing. In one room I could read about oppression under ancient royalty, in the next oppression under Hitler, in the next oppression under communism. I became acutely aware of how lucky I was to live in a nation with a positive history and legend about its founding and development, and the related ability to triumph over evils, internal and external, ranging from slavery to fascism.

A person like Nelson Mandela takes his country onto a higher plane. He serves as a beacon and inspiration for new generations. When the South African government falters, as it will over time, Mandela’s legend will continually call the people back to a time when hope for progress drove the nation.

Any country’s story of itself evolves from the actions of its heroes and the mythology (in the most positive sense of that word) that surrounds them. In the United States, our teachers and textbooks teach our schoolchildren to try to emulate our Washingtons, Jeffersons, Lincolns, Roosevelts, and Kings. With their leadership, we—and our nation—seemed to move to a higher and better plane. We don’t have to count on our Millard Fillmores to inspire us, even if plenty of them still seem to be around.

I worry greatly about those countries without heroes to inspire their citizens. People in Russia or Egypt may come to tolerate a Putin or a Mubarak-like successor because many of them haven’t known anything better. Despite the formidable talent of the Chinese people, they still look back to a Mao rather than a Gandhi for thinking about what their nation can become—giving India, in my view, an extraordinary leg up for development in this still-young century. In a country with true national heroes, the citizens come to see themselves as part of an evolving and perfecting culture. Failures aren’t tolerated as the way of the world but seen and actively opposed as obstacles to progress.

In this way, Nelson Mandela lives on—and will do so for centuries to come.

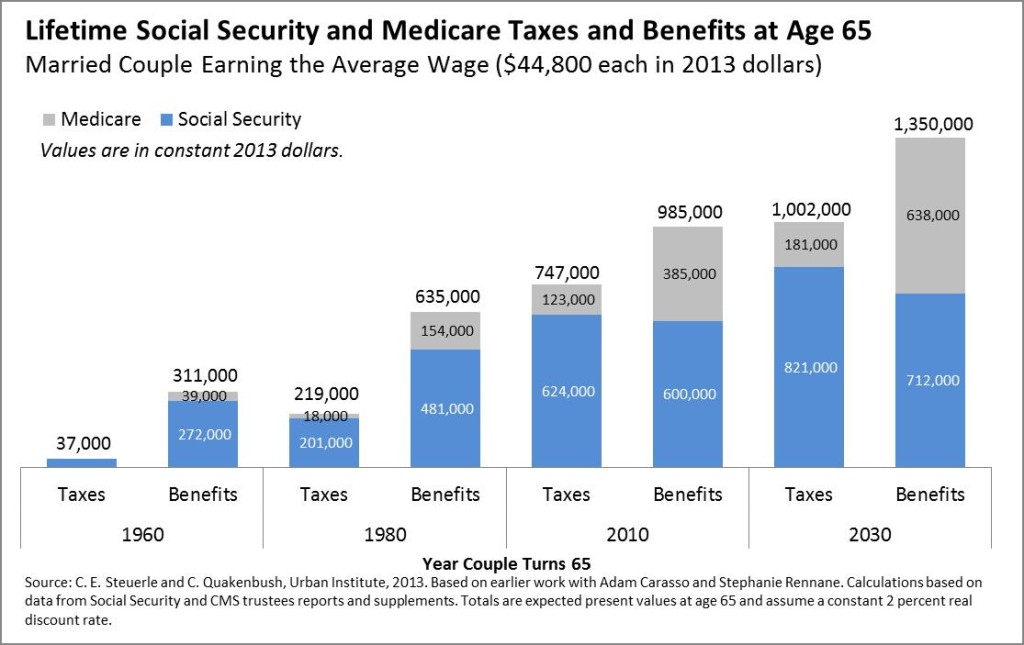

2013 Update on Lifetime Social Security and Medicare Benefits and Taxes

Posted: November 12, 2013 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts, Taxes and Budget 3 Comments »Our updated numbers for lifetime Social Security and Medicare benefits and taxes are now available, based on the latest projections from the Social Security and CMS actuaries for the 2013 trustees’ reports for OASDI and Medicare. Couples retiring today, with roughly the average earnings of workers in general, as well as average life expectancies, still receive about $1 million in lifetime benefits. This number is scheduled to increase significantly for future retirees and is higher for those with above-average incomes and longer life expectancies.

Little has changed on the Social Security side from our previous estimates, as the program has undergone no significant reform in recent years. Our estimates of present values of Medicare benefits for future retirees have decreased slightly from last year as slower health care cost growth has made its way into projections. By 2030, Medicare benefits (net of any premiums paid) are about 90 percent of last year’s estimates, still a significant multiple of Medicare taxes paid. (As in 2012, our numbers incorporate a Medicare cost scenario that assumes the “doc fix” and other adjustments will be extended, not the “current law” scenario in the trustees report.)

We have been publishing these numbers for a long time—and not without controversy over our intent. Our hope is simply that better and more complete information will help elected officials decide whether Social Security and Medicare are distributing taxes and benefits in the fairest and most efficient way possible, a decision we do not believe possible by looking only at annual numbers or how current, not future, retirees and taxpayers might fare. Therefore, we are delighted that in its most recent Long-Term Budget Outlook, the Congressional Budget Office for the first time also published estimates for lifetime Medicare benefits and taxes, as well as Medicare and Social Security combined. Using a slightly different methodology, CBO produces very complementary results. Differences derive from it using median-wage (rather than average-wage) workers, a 3 percent (rather than a 2 percent) real discount rate, and an assumption of Social Security claiming at 62 (rather than 65). As CBO also notes, expected benefits (and taxes, to a more limited extent) have grown over time for a number of reasons, including longer life expectancies, higher incomes, and rising health spending per person.

Five Thoughts after Celebrating Independence Day

Posted: July 8, 2013 Filed under: Race, Ethnicity, and Gender, Shorts 2 Comments »A few years ago I emerged from my July 4 hovel at home and started attending fireworks celebrations again. Sometimes I settle in with the crowds on the National Mall in Washington, DC; other times I crowd at the last minute with the groups that gather on one of the many surrounding hilltops. What strikes me again and again as I merge into and mingle with the crowds is how much the experience unifies us. Here are five related thoughts:

- There’s something very special about July 4 and Thanksgiving Day, national holidays where we all come together to celebrate the many blessings we have received. What other holidays take us so outside ourselves and into the larger whole of our national community?

- Among the most jovial and lively of the participants on July 4 are the new immigrant communities, at least as I infer from their many accents. They cheer the loudest. Many have come far from conditions of poverty and tyranny to know real freedom. I like this. They inspire me.

- Whatever anyone thinks of immigration reform, our immigrant community largely organizes its protests over its desire to work and contribute. I contrast this particularly with those (not all) countries of Europe or Japan, where either immigration is discouraged or significant roadblocks are placed on immigrant work. Such places lose out on the intellectual and even genetic gains from diversity and gain the social problems that derive from keeping the young restless. I also applaud our founding fathers, who ameliorated what will be a perpetual problem in any rich country by having the good sense to attach citizenship to birth in the country. I know it’s arbitrary, but it certainly avoids some of the multigenerational problems and bitterness I’ve seen elsewhere.

- Symbolism and celebration help define who we are. Give John Adams early credit when writing his wife, Abigail, that “the second day of July, 1776 [he was off by two days—for good reason]…will be celebrated by succeeding generations as the great anniversary festival… it ought to be solemnized with pomp and parade…and illuminations, from one end of this continent to the other, from this time forward forever more.”

- I’m one of the luckiest people ever to live in this time and place. Aren’t you?