How Earnings Affect Benefits for Households with Children: The Extreme Welfare Case

Posted: November 1, 2012 Filed under: Children, Income and Wealth, Shorts, Taxes and Budget 4 Comments »In theory, a household may be eligible for a broad range of government supports. Some are universally available, such as earned income tax credits and SNAP (formerly called food stamps) to a household with children if earnings are low enough. (See a previous short on this subject.) Others are only available to some people. For instance, government establishes waiting lists for programs like rental housing subsidies and limits number of years of participation in the traditional welfare program, now called Temporary Assistance to Needy Families or TANF.

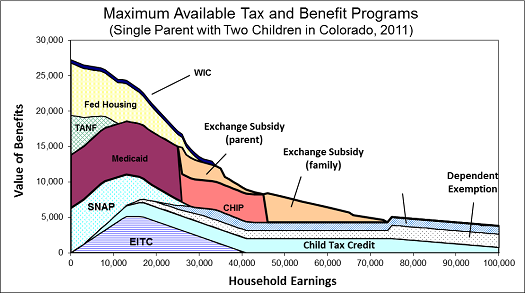

The figure below assumes a single parent with two children is receiving almost all these benefits, an extreme case. It includes the more universally available programs, like SNAP. It also assumes the availability of the new Exchange subsidy provided by health reform. Benefits add up to close to $27,000 when this household fails to work and fall to about $8,000 as earnings increase to $40,000. Note that the graph does not take into account free child care support or income and Social Security taxes. When these are added to other benefit reductions, the household can sometimes even lose net income by earning more.

For further detail see my testimony before the House Subcommittees on Human Resources and Select Revenue Measures on June 27, 2012, “Marginal Tax Rates, Work, and the Nation’s Real Tax System.”

[…] Post navigation ← Previous Next → […]

[…] Posted at The Government We Deserve on 11/1/2012 Gene Steuerle, Host of “The Government We […]

Very interesting. Today’s WaPo Fact Checker blog post sent me here. I’d be very interested to see this same graph with the y-axis as “Value of Benefits + Income” to show the real value of working a little harder or getting paid a higher wage for this worst case scenario. It appears that at no point is there a drop in benefits+income for making more money, but it does seem quite unmotivating between $20,000-$30,000.

What is the light blue section with the missing label above Dependent Exemption that starts at about 20K and extends past 100,000? Maybe mortgage deduction?