High-Income Charitable Giving and Higher Education

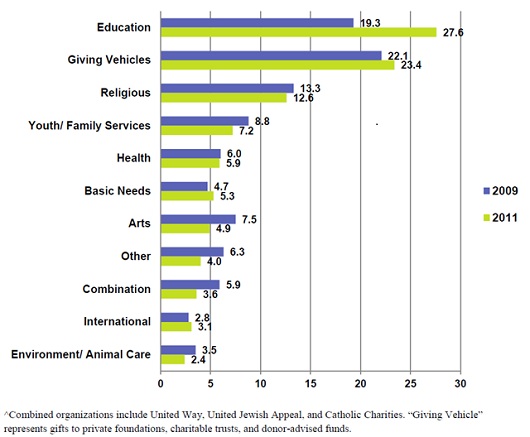

Posted: January 17, 2013 Filed under: Nonprofits and Philanthropy, Shorts 2 Comments »If reforms to the charitable deduction decrease giving among high-income donors, certain types of charities will be affected more than others. As the graph below from a 2012 Bank of America Study indicates, high-income donors give mostly to education, followed by organizations such as trusts and foundations that primarily support other nonprofits (referred to as giving vehicles). Thus, changes to tax law affecting only high-income taxpayers would disproportionately affect donations to educational institutions. However, the relationship isn’t as linear as this figure suggests. Take international organizations, for instance. They receive fewer donations from high-income givers than health organizations, but they rely on those donations more; many health organizations, such as hospitals, receive substantial amounts in fees for service. International organizations also may be among the primary recipients of grants from giving vehicles.

Distribution of High Net Worth Giving: More to Education

Source: 2012 Bank of America Study of High Net Worth Philanthropy.

Note: High net worth includes households with incomes greater than $200,000 and/or net worth more than $1,000,000 excluding the monetary value of their home.

For more interesting data, visit the Tax Policy and Charities project.

Sadly, much of this donation money is tied to the sports program.

Good site you have here.. It’s hard to find high-quality writing like yours nowadays. I seriously appreciate individuals like you! Take care!!