2013 Update on Lifetime Social Security and Medicare Benefits and Taxes

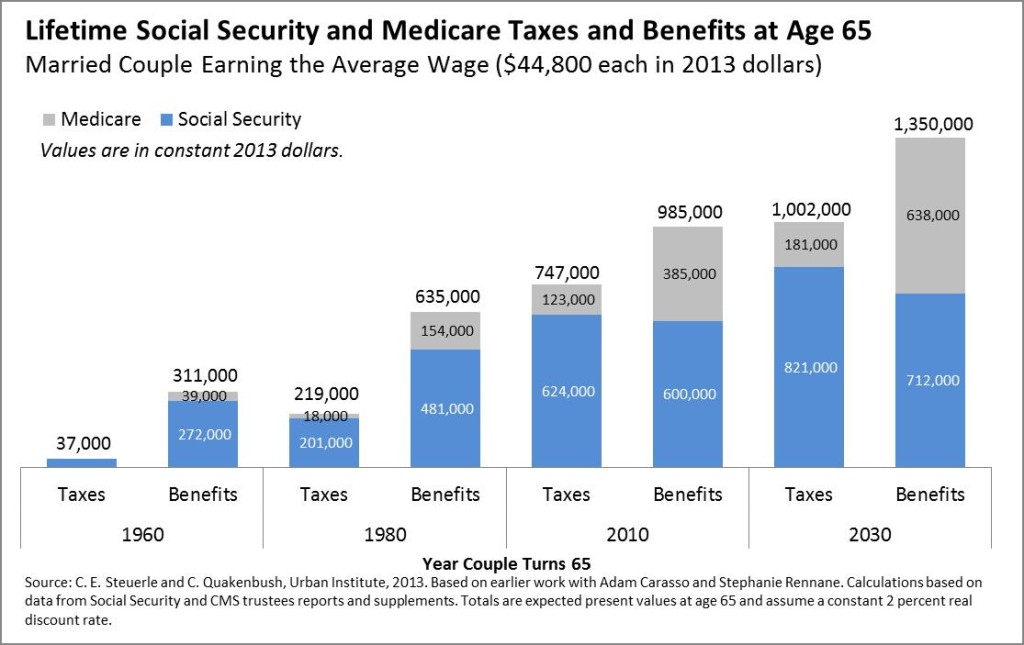

Posted: November 12, 2013 Filed under: Aging, Health and Health Policy, Income and Wealth, Shorts, Taxes and Budget 3 Comments »Our updated numbers for lifetime Social Security and Medicare benefits and taxes are now available, based on the latest projections from the Social Security and CMS actuaries for the 2013 trustees’ reports for OASDI and Medicare. Couples retiring today, with roughly the average earnings of workers in general, as well as average life expectancies, still receive about $1 million in lifetime benefits. This number is scheduled to increase significantly for future retirees and is higher for those with above-average incomes and longer life expectancies.

Little has changed on the Social Security side from our previous estimates, as the program has undergone no significant reform in recent years. Our estimates of present values of Medicare benefits for future retirees have decreased slightly from last year as slower health care cost growth has made its way into projections. By 2030, Medicare benefits (net of any premiums paid) are about 90 percent of last year’s estimates, still a significant multiple of Medicare taxes paid. (As in 2012, our numbers incorporate a Medicare cost scenario that assumes the “doc fix” and other adjustments will be extended, not the “current law” scenario in the trustees report.)

We have been publishing these numbers for a long time—and not without controversy over our intent. Our hope is simply that better and more complete information will help elected officials decide whether Social Security and Medicare are distributing taxes and benefits in the fairest and most efficient way possible, a decision we do not believe possible by looking only at annual numbers or how current, not future, retirees and taxpayers might fare. Therefore, we are delighted that in its most recent Long-Term Budget Outlook, the Congressional Budget Office for the first time also published estimates for lifetime Medicare benefits and taxes, as well as Medicare and Social Security combined. Using a slightly different methodology, CBO produces very complementary results. Differences derive from it using median-wage (rather than average-wage) workers, a 3 percent (rather than a 2 percent) real discount rate, and an assumption of Social Security claiming at 62 (rather than 65). As CBO also notes, expected benefits (and taxes, to a more limited extent) have grown over time for a number of reasons, including longer life expectancies, higher incomes, and rising health spending per person.

[…] Posted at The Government We Deserve on […]

[…] Steurle and Caleb Quackenbush of the Urban Institute have updated their figures showing the lifetime Social Security and Medicare taxes people pay, based on when they’re born, […]

[…] The American Enterprise Institute’s Jim Pethokoukis found this great chart above by the Urban Institute’s Eugene Steuerl. It shows the lifetime Social Security and Medicare taxes and benefits. […]