How Earnings Affect Benefits for Households with Children: The More Universal Case

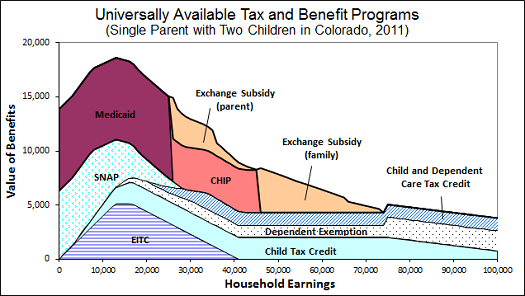

Posted: October 31, 2012 Filed under: Children, Income and Wealth, Shorts, Taxes and Budget 5 Comments »Many government programs automatically grant eligibility to all families with children, depending only on their income. As their incomes increase, however, these families often, but not always, receive fewer benefits. Some restrictions operate on a schedule: earn $1 more, get 30 cents less in benefits. Medicaid provides eligibility up to a given income level, then denies eligibility when one more dollar is earned (though usually with a delay). The dependent exemption only is available to those owing taxes, and only at high income levels is removed by the alternative minimum tax.

How do these programs interact?

The figure below considers a single parent household with children and shows how these various benefits vary as the earnings of the household increase. Because every household with children, including you and me if we are raising children, is eligible for these programs if our income falls in the right ranges, we can be said to belong to this benefit and benefit reduction system. For instance, as income increases from $10,000 to $40,000, our household would lose most earned income tax credits, SNAP (formerly known as food stamps), and much Medicaid, though under health reform other health subsidies would still be available. Note that in addition to these losses of benefits, direct tax rates from income and Social Security taxes would apply, though they are not shown here. For further detail see my testimony before the House Subcommittees on Human Resources and Select Revenue Measures on June 27, 2012, “Marginal Tax Rates, Work, and the Nation’s Real Tax System.” My next short describes the extreme welfare case.

I’d find the chart much more informative if it were accompanied by a second chart, derived from the first but changed from it in three ways:

(1) Make the vertical scale commensurate with the horizontal scale. I understand that the given chart’s approach makes it easier to see and identify the effect of the various programs. But in so doing, it makes it harder to evaluate the effect of (for instance) a $10000 increase in salary.

(2) Show income on the derived chart both vertically and horizontally. This would make it easier to see the net impact on a family as their income increases.

(3) Improve the completeness involved in doing (2) by showing the impact of income and social security taxes as well.

[…] Post navigation ← Previous […]

This argues for the kind of simplification I advocate, namely converting categorical programs to a larger child tax credit that never sunsets and is paid by the employer, along with mandatory coverage of beneficiaries under the plan of whomever administers their benefits, whether this is state government or a Catholic Charities agency running a literacy program. I would also pay illiterate workers or beneficiaries to achieve literacy rather than train them for dead end jobs, with a larger minimum wage of about $12 per hour (with an automatic COLA for both) and coverage of trainees under a refundable Child Tax Credit as well. All of this would be financed by a VAT-like Net Business Receipts Tax which allow businesses the opportunity to let the government run training programs or to fund alternative private programs (or even run their own), according to the wishes of their employees. This would truly be a libertarian socialist alternative, which likely means no one would like it, even though it will would work.

Mr. Bindner I disagree with the idea of paying illiterate workers to become literate. There are many reasons someone doesn’t attain a high school diploma. My son, for instance, was a poor fit in the education system and has since been afraid to step into any iteration of it in order to earn a GED.

However, he is not illiterate: he can read and understand as well as any other average American; he can perform the math needed for everyday purposes; he is aware of history and his rights as a citizen as much as anyone else. He can assess a situation with a directness to be envied. Will paying someone like my son to get a GED inspire him to do so or make him any more “literate?” No. Classes are not conveniently available except in challenged neighborhoods (we are quite middle class) and my son still fears the vagaries of the world of education. He’s not well-read but compared to many average Americans, he isn’t any less literate.

As for increasing the minimum wage to $12 an hour, that’s a nice idea except for the notching-up effect it would have on other wages and then prices. Perhaps it’s more complex than that, but I don’t see it. A skilled craftsman or the holder of a bachelor’s degree feels demotivation if their wage is only a small margin above the minimum and pressures their employer for adjustment. That can be done if there’s enough revenue. How do we increase revenue? Sell more or raise prices. Which is easier? You know…

I did digress quite a bit for illustrative purposes! Another point

[…] Posted at The Government We Deserve on […]