Has Social Security Redistributed to Whites from People of Color?

Posted: November 8, 2013 Filed under: Columns, Income and Wealth, Race, Ethnicity, and Gender 6 Comments »In a new brief, my colleagues and I examine how many features of Social Security combine to redistribute money among racial and ethnic groups over long periods of time, combining together generations. We find that the program as a whole, and especially its retirement portion, has likely redistributed from blacks, Hispanics, and other racial minorities to whites.

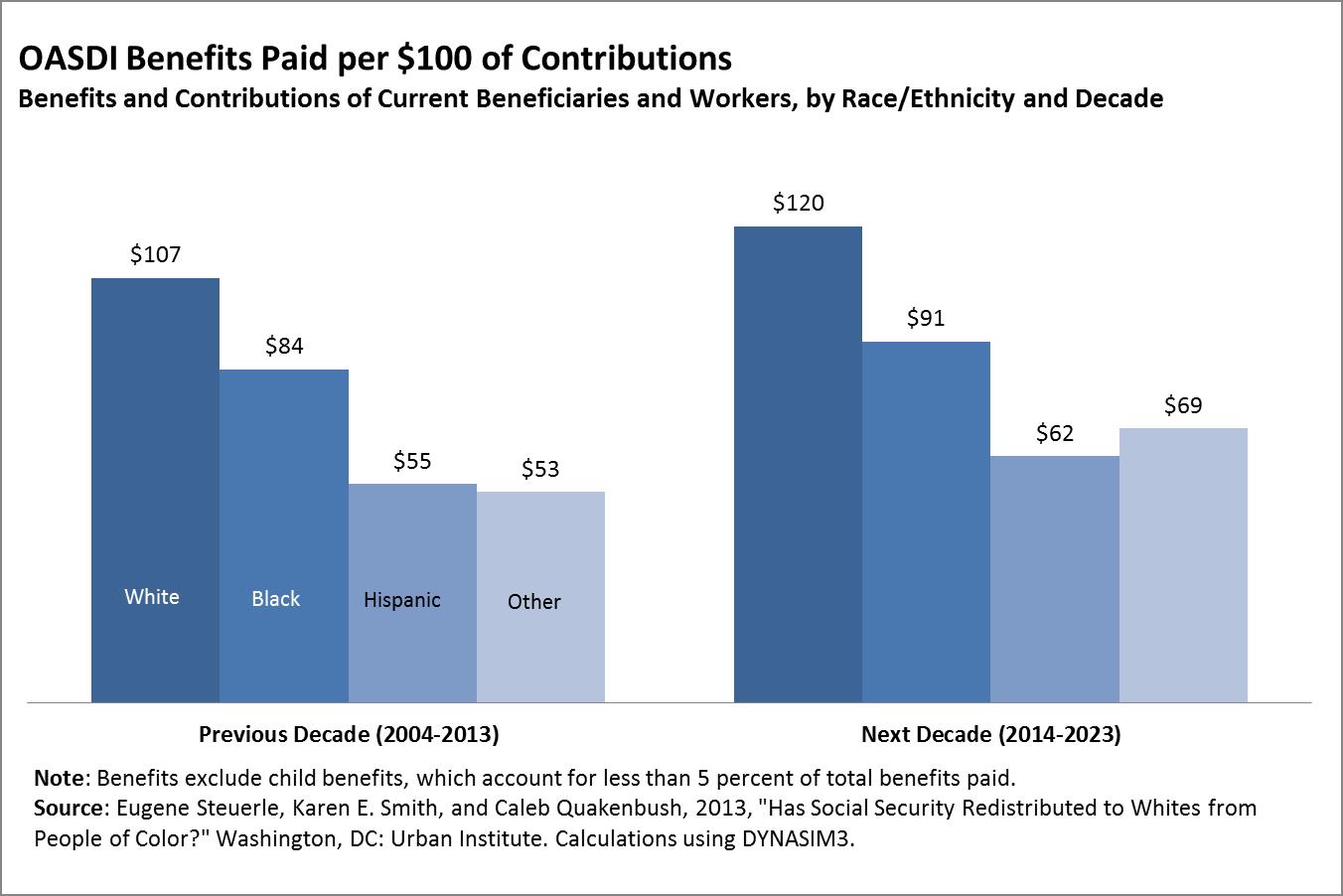

The major cause? When taxes are compared to benefits for each generation, the early generations of retirees got large windfalls, those retiring today come closer to breaking even, and tomorrow’s retirees on average will get back less than they pay in, assuming some modest interest rate could have been earned on their contributions or taxes. This phenomenon by itself wouldn’t cause interracial redistribution, but whites disproportionately occupy the high-return generations, while Hispanics, more recently immigrated groups, and blacks increasingly occupy the lower return generations.

The immigration part of the story is easy to understand. Hispanics and other recent immigrants weren’t around to receive the windfalls that came about as the system expanded over its early decades. Whenever Congress increased lifetime benefits for retirees and near-retirees, younger workers would be required to contribute for decades to support those higher benefits. Older workers would get those higher benefits with fewer years of additional contributions or, at times, none at all.

As for the redistribution from blacks, they disproportionately occupy the lower-return generations because of their larger family sizes. A simple analogy might be made with a two-family world where one couple has three kids and the second has one, but the kids all contribute the same $1,000 each to support the four parents, who all get the same benefit of $1,000 each. The larger family contributes $3,000 and gets back $2,000. The effect will be permanent unless some other redistributions over time offset this windfall gain for the smaller family.

Of course, these simple stories ignore Social Security’s other moving parts. Its progressive benefit formula, which I consider in many ways brilliant because it is based on lifetime rather than annual earnings, redistributes to those with lower lifetime earnings. At the same time, Social Security contains many regressive features. For instance, as a protection for old age it appropriately requires that payments be made in the form of annuities, but that ends up redistributing to those with higher incomes because they have higher-than-average life expectancies. Also, unlike private pensions where it would be illegal, single heads of household, often lower-income women, are required to contribute for spousal and survivor benefits they can’t receive.

Because of these various offsetting features, the retirement or old-age part of the system exhibits little net progressivity even before adding on this new multigenerational consequence of making each successive generation pay more for each dollar of benefit it receives.

When disability insurance is considered, it adds to significantly to progressivity in the sense of redistributing to those with lower incomes. From a broader perspective, of course, one can hardly consider it a plus that some racial and ethnic groups incur higher levels of disability, along with the huge losses of private income that Social Security does not replace.

The study does not contain policy prescriptions, though my own separate work has for very long time suggested the merits of substantively (not just symbolically) higher levels of minimum benefits and other progressive adjustments. Nor does the study contradict the success of Social Security in reducing poverty dramatically among the elderly, particularly in its early decades. It does suggest that as reform is being considered, we give serious attention to whether the system achieves its stated objectives, including the extent to which it really provides better protection for those individuals and classes who are less well off.

Both the left and right, I think it fair to say, have presumed that the system is far more progressive than it turns out to be—a more recent literature finding to which this study adds. Unfortunately, the Social Security debate, like so many we have today, tends to be argued on a thumbs-up or thumbs-down basis, rather than on how it might be better designed to meet society’s objectives.

Read more on Economix and Wonkblog.

[…] Posted at The Government We Deserve on […]

Hello to every body, it’s my first pay a visit of this blog; this blog contains remarkable and genuinely fine stuff for readers.

always i used to read smaller content that also clear their motive,

and that is also happening with this piece of writing

which I am reading here.

If you are going for most excellent contents like myself, simply go to see this site every day

for the reason that it gives quality contents, thanks

Hmm it appears like your blog ate my first comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I too am an aspiring blog writer but I’m still new to

everything. Do you have any helpful hints for newbie blog writers?

I’d genuinely appreciate it.

I don’t know if it’s just me or if everybody else experiencing

problems with your blog. It appears like some of the text within your posts are running off the screen.

Can someone else please comment and let me know if this

is happening to them too? This might be a problem with my

web browser because I’ve had this happen before.

Thanks